I believe packing my Stocks and Shares ISA with FTSE 100 shares is a great way to make a second income. The steady stream of juicy dividends I’ve received since I began my investment journey many years ago is a testament to how successful this investing strategy can be.

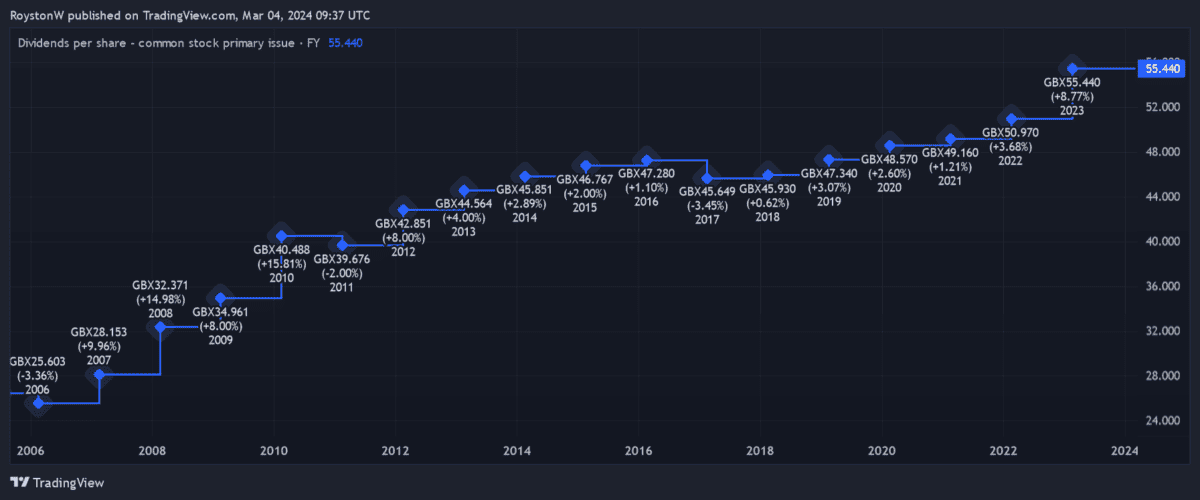

National Grid (LSE:NG.) is one top stock with a strong history of growing shareholder rewards. I need to remember that large capex bills could potentially derail this track record later on. But impressive cash flows and a formidable ‘economic moat’ still mean it could remain one of the Footsie’s greatest income stocks.

A £100 passive income

How many National Grid shares would I need for a three-figure monthly income however? If I targeted a £100 payout each month, I’d need to buy 2,010 shares in the company. This is based on a dividend yield of 5.8% for the financial year to March 2025.

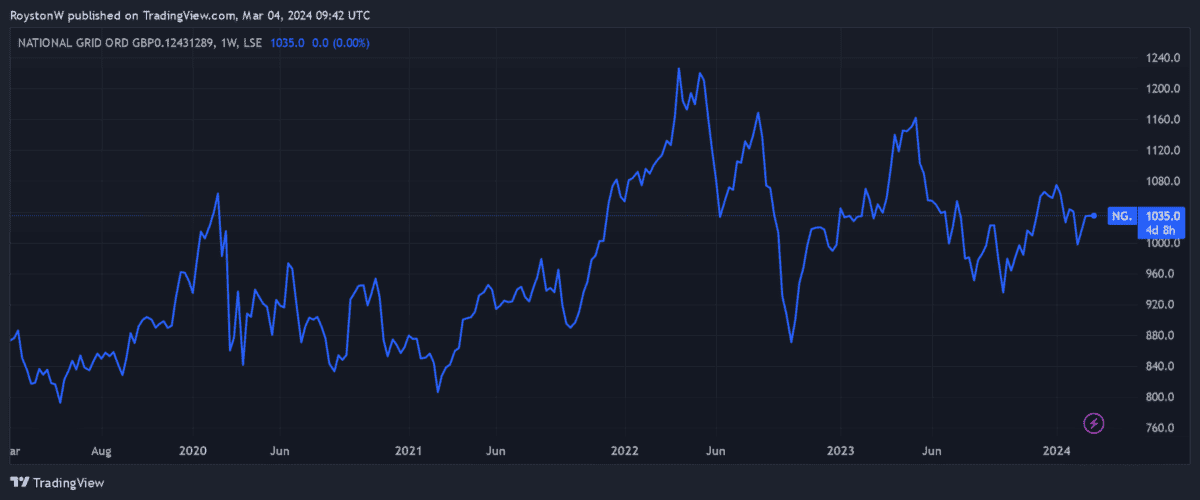

At a current share price of £10.35, I would need to spend £20,803.50 to do this. It’d be a sum worth paying, in my opinion.

As I say, National Grid’s yield sits just below 6%. To put this into context, the average yield for FTSE 100 shares sits way back at 3.8%. The good news is that City analysts expect dividends to keep rising in fiscal 2026, too. So the yield rises up to 5.9%.

A reliable income provider

National Grid’s excellent dividend history can be attributed to its ultra-defensive operations. Profits and cash flows remain stable at all points of the economic cycle. It has the means and the confidence therefore to pay big dividends (almost) year after year.

It’s also down to those economic moats, or competitive advantages, that I mentioned earlier. Regulator Ofgem has given it a monopoly on maintaining the UK’s power grid, meaning it doesn’t suffer from rivals chipping away at it revenues.

Debt threat

Of course dividends are never guaranteed. And as with any UK stock, there are potential problems I need to consider before buying the shares for income.

As I touched upon earlier, the business of keeping Britain’s lights on is enormously expensive. What’s more, National Grid will have to spend lots of money going forwards to decarbonise the country’s electricity network.

This will add further stress to a balance sheet that already has lots of debt. Net debt is tipped to hit £44.5bn in March, up £3.5bn year on year.

Share price spike?

Yet on balance, the firm looks in better shape than many other high-yielding dividend stocks. And the firm is positioning itself for further sustained dividend growth through its strategic investments. Its plan is to expand its asset base by 8% to 10% each year.

I’ll be looking to add the shares to my own portfolio when I have spare cash to invest. Once the Bank of England starts cutting interest rates its share price could take off. In the meantime, I can comfort myself by receiving some pretty big dividends.