I reckon it’s possible to build a retirement pot by investing in quality FTSE 100 shares.

Let me explain a method as to how I could do this with an initial £15,000 investment.

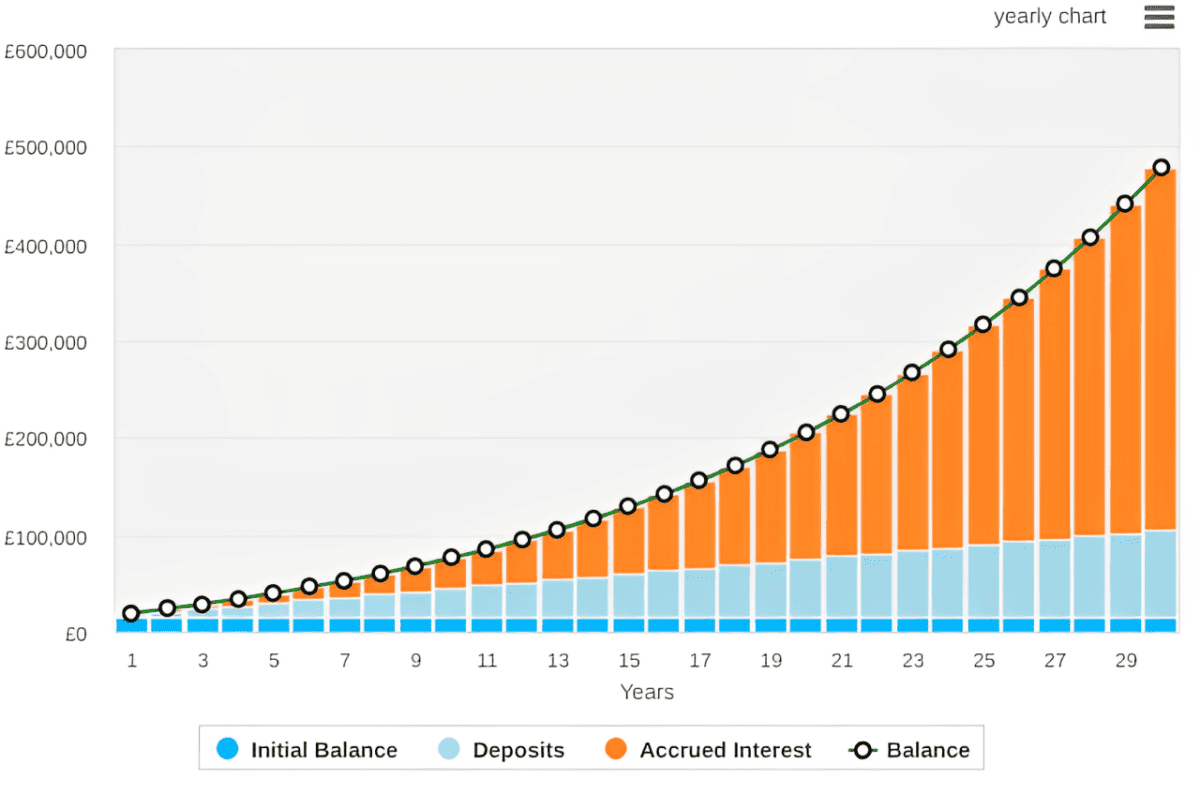

Breaking down the numbers

Since 1984, the UK’s premier index has returned 7.5% annually. This is a pretty good return, in my view. It’s much more than a low-yielding savings account that I could leave my money in. By the time I’m ready to retire, I would have nowhere near having enough money to retire on if I did that!

- The first thing I would do is put £15K into a tax-efficient Stocks and Shares ISA

- Next, I’d invest this amount into quality FTSE 100 shares

- As well as my lump sum, I’m going to add £250 a month for 30 years

- If I were to receive dividends, I would reinvest these too

- I’m going to put a time frame of 30 years on my plan

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The chart below shows how my investment could pan out.

It’s worth mentioning that dividends aren’t guaranteed and I’m conscious that past performance isn’t a guarantee of the future, so a 7.5% return may not come to fruition. Conversely, the rate of return could be higher!

Investing the right stocks is key. I would focus on diversification. So I would buy quality stocks from a number of sectors. For example, some banking and financial stocks, tech stocks, house builders, defence stocks, and more.

One pick I like

BAE Systems (LSE: BA.) is one of the world’s biggest defence businesses.

The shares have been on a great run recently. Over a 12-month period they’re up 38% from 888p at this time last year, to current levels of 1,234p.

I reckon a big reason for the recent rise has been geopolitical tensions across the world pushing up defence spending. I’m wishing for speedy and peaceful resolutions across all conflicts. However, it’s worth mentioning that defence spending covers much more than wars and weapons.

According to Statista, global defence spending is at all-time highs, and could continue on this trajectory. BAE’s excellent track record, reputation, and deep-seated relationships with leading governments puts it in a great position to boost performance and returns for years to come.

Next, the fundamentals at present look good. The shares trade on a price-to-earnings ratio of 19. This isn’t the lowest, but I’m willing to pay a fair price for a wonderful business. In addition to this, a dividend yield of 2.3% would boost my passive income.

All investments come with risks and BAE is no different. There is a chance defence spending could be scaled back if conflicts come to a resolution, impacting performance and BAE’s share price. However, defence covers much more than wars, such as cyber security, so I’m not too worried here. Another risk is if a BAE product were to fail, it could cause financial and reputational damage to the business.

I don’t have £15K right now but using the maths and method above, I could employ this to help me retire comfortably.