Burberry (LSE:BRBY) is a famous British luxury fashion house. It produces clothes that most people wouldn’t frown upon wearing, and I think the shares are worth owning, too.

Here are the main reasons I’m considering it for my portfolio right now as an addition to my luxury holdings in LVMH and Ferrari.

Company overview

Burberry’s main segments of revenue include apparel, accessories, cosmetics, and fragrances. It has a global presence and distribution network, including retail stores, wholesale operations, and e-commerce.

In 2024, the company indicated a challenging environment for luxury goods, reporting lower levels of crucial Christmas-time trading.

However, CEO Jonathan Akeroyd has mentioned a positive outlook for the firm’s future, including a transition to a new modern British creative style. He has acknowledged the slowing luxury demand but has given confidence to shareholders with a £4bn revenue ambition.

Crucial financials

The last financial report showed a 7% decrease in retail revenue from the previous year.

However, China had 8%, and Japan had 9% growth in revenue, showing promise for the company’s international operations. Notably there was a 10% decline in revenue in South Korea. The Americas had a 15% decrease in sales, too.

While the concerns regarding the slowdown in luxury are valid and something I am aware of already due to the large section of my portfolio devoted to LVMH, I think can present a buying opportunity for me.

The reason is that the current lower growth period may not last forever. For established brands in luxury, their presence tends to outlast economic cycles.

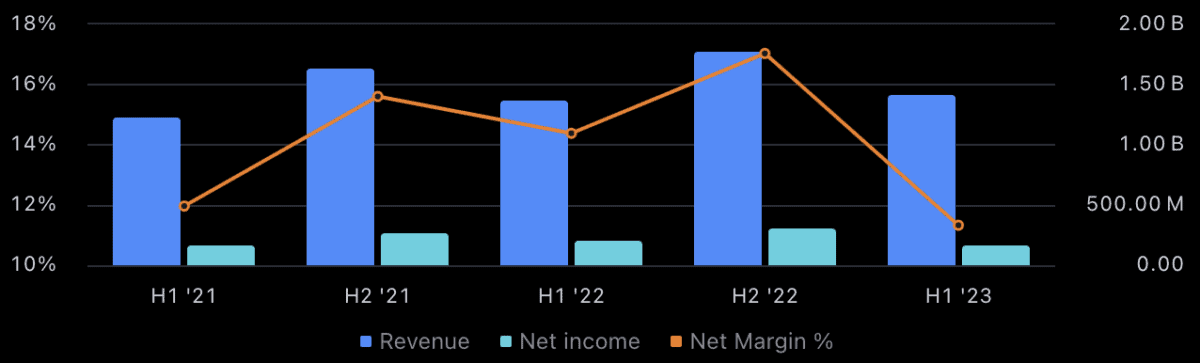

Thankfully, Burberry has some exceptional financials to carry it through. For example, its net margin is 14.5%, which is in the top 10% of companies in its industry.

Value opportunity

With the current price-to-earnings ratio around 11, I think this is one of the best times to buy Burberry shares in history.

The thing is, the company is a bit of a slow grower in terms of its share price. It’s up 760% since it went public in 2002 but actually down 12.5% over 10 years at this point.

That’s why I think if I’m going to buy the shares at the current low price, I also need to be prepared to hold the stock for many decades to reap the full rewards. I think Burberry is definitely worth me holding for this long.

Risks

Other than the general slowdown in the luxury industry at this time, there are also other concerns that could prove challenging if I become a shareholder.

For example, Burberry’s balance sheet is less than ideal at the moment, with only 32% of its assets proportioned by equity. Over the last 10 years, it’s usually been around 60% or so, so this is unusually low.

Additionally, analysts expect its earnings growth over the next three to five years to be around 2.8% on average each year. That’s a lot lower than the 15.9% the company has been used to on average over the last three years.

It’s buy-time for me

I’m adding Burberry to my portfolio when I next add to my luxury holdings. LVMH I already own, but Hermès and Burberry are next.

The current price and powerful brand are too good for me to pass up.