Investing in defence stocks like BAE Systems (LSE:BA.) proved to be a shrewd move last year. The BAE share price marched higher as the ongoing war in Ukraine and tensions in the Middle East fuelled demand for weapons and military equipment.

But, near a 52-week high, are BAE shares now expensive for investors thinking about buying today? Or can the FTSE 100-listed defence giant continue to deliver impressive gains in 2024 and beyond?

Here’s what the charts say.

Paying a premium

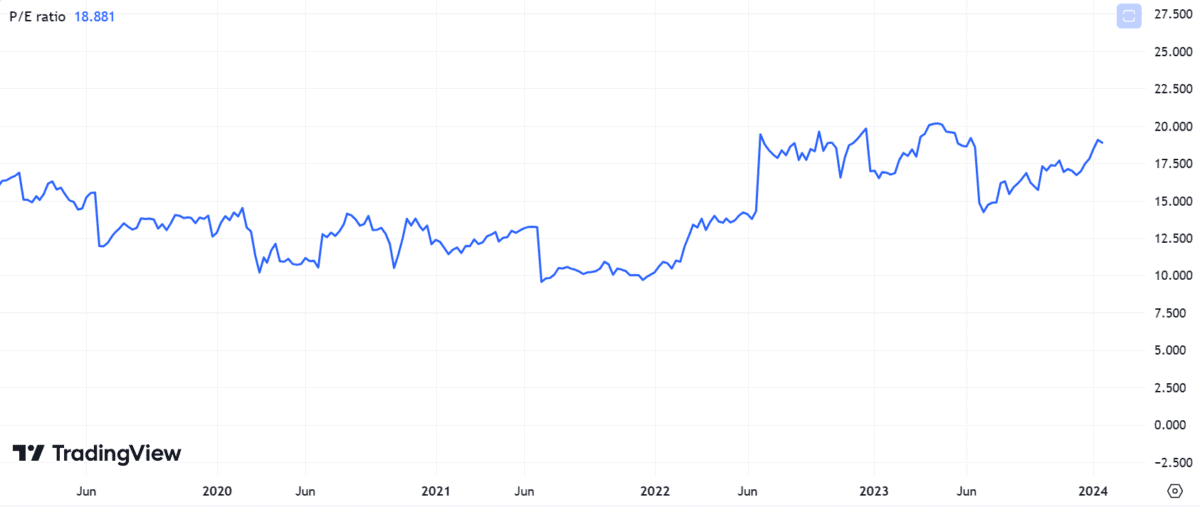

It’s worth acknowledging that recent share price gains have pushed the stock’s price-to-earnings (P/E) ratio above its five-year average.

Before Russia invaded Ukraine, BAE shares had a P/E multiple just above 10. Today, it stands at nearly 19. This suggests the stock isn’t as cheap as it was.

However, this valuation metric only tells part of the story. Future growth prospects show promise. After all, the company currently boasts a record order backlog of £66.2bn.

Nonetheless, it appears tailwinds from elevated geopolitical tensions are reflected in today’s share price, at least to some extent.

Industry valuations

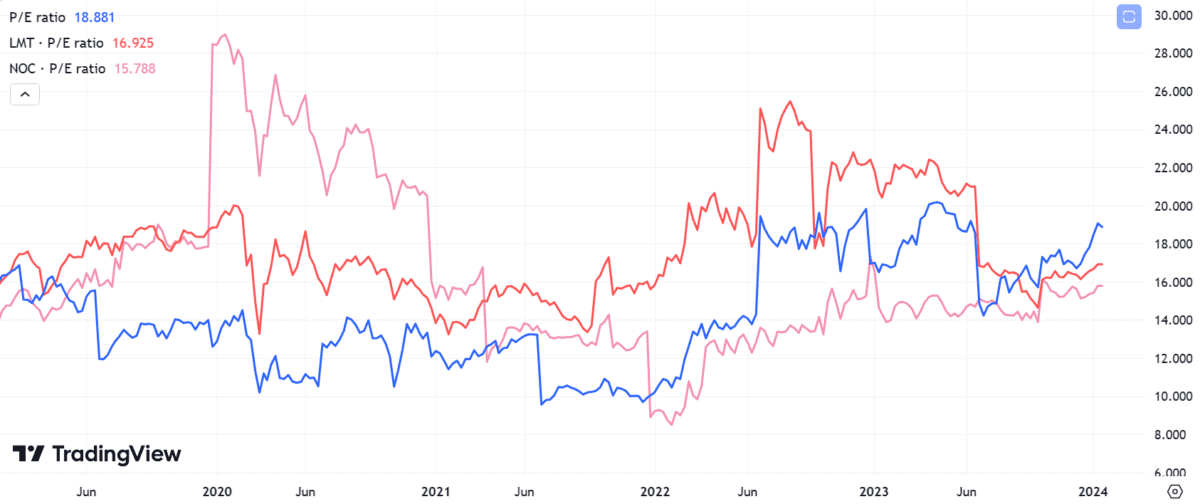

In recent years, BAE’s valuation stacked up favourably compared to those of major US defence contractors such as Lockheed Martin and Northrop Grumman.

But following spectacular growth in the share price, that situation has reversed. For the past few months, the stock’s traded at a higher P/E ratio than its American competitors.

Granted, its multiple isn’t wildly out of line with the industry standard. Nevertheless, investors should monitor BAE’s relative valuation closely. Should the gap widen, there may be better bargains to be found elsewhere in the defence sector.

Dividend prospects

Despite emerging causes for concern about the valuation, BAE Systems remains a top pick among FTSE 100 stocks for passive income.

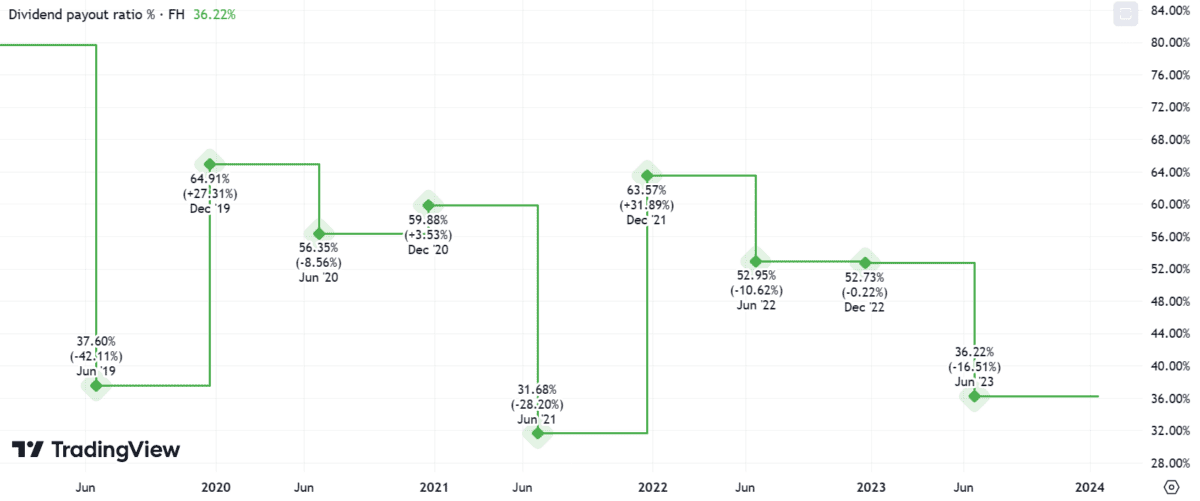

Although the dividend yield of 2.36% may not be the most exciting, the business claims Dividend Aristocrat status. In addition, forecast dividend cover of 2.1 times earnings indicates a wide margin of safety.

Encouragingly, BAE’s dividend payout ratio has been falling since the end of 2021. This means the company has plenty of headroom to invest in further earnings expansion, which bodes well for future dividend hikes.

Balance sheet

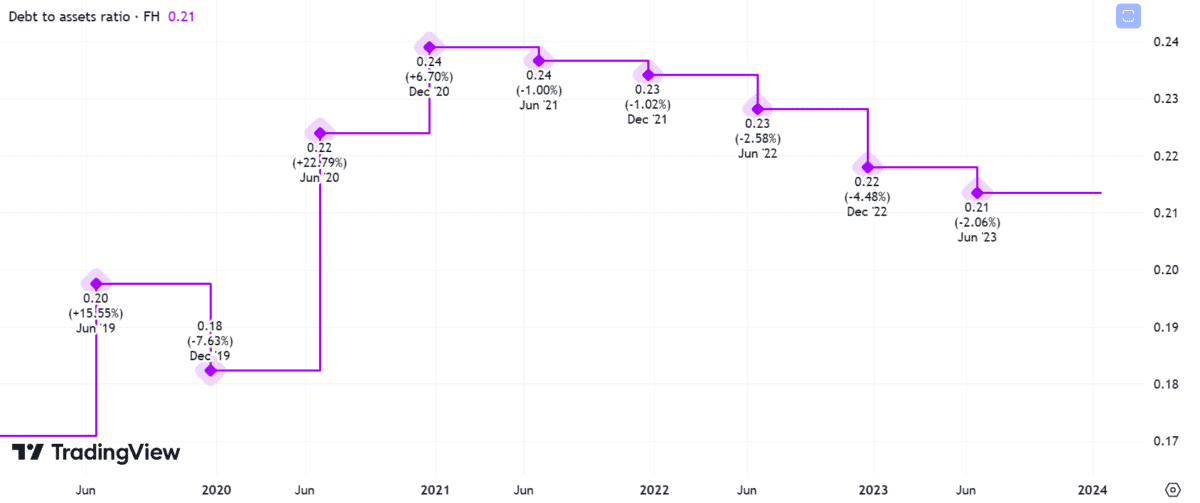

The defence contractor’s also made significant progress in shoring up its balance sheet over the past three years.

The group’s debt-to-assets ratio has shrunk every year since the end of 2020 and it’s worth remembering this hallmark of financial strength isn’t captured by valuation metrics like the P/E ratio.

On this front, BAE Systems looks like a business in excellent financial health today.

A stock to consider?

After two years of stellar growth, the BAE share price isn’t the bargain it once was. But I think there are still reasons for optimism. Indeed, the balance sheet looks robust and shareholder distributions are built on solid foundations.

And recent contract wins, such as the £3.95bn deal to build a new generation of submarines for Australia as part of the AUKUS defence pact, suggest demand for BAE’s services will remain strong in the coming years.

Although the shares might trade at a premium currently, I believe they merit serious consideration from investors. If I had spare cash, I’d buy this stock today.