The UK stock market underwhelmed in 2023. It lagged behind most of the world’s largest, including those of the US and Japan.

The MSCI World Index, which includes 1,480 of the stocks of the world’s largest companies, gained 23% in 2023. By contrast, the FTSE 100 — which accounts for 70% of the total value of UK-listed companies — increased by ‘only’ 3.8%.

But here are six reasons why I think UK equities will have a much better 2024.

1. Sleeping giants

Although there was a ‘Santa rally’ in the run up to Christmas, some of the stocks of the UK’s largest companies closed 2023 a long way short of their 52-week highs.

Three of the five biggest — AstraZeneca, Unilever and BP — ended the year 17%, 28% and 22%, respectively, below their 2023 peaks.

There are many other examples.

But these three alone account for 17% of the movement in the FTSE 100.

If these stocks recapture former glories, then the principal market indexes will rise.

2. Easing monetary policy

Bloomberg’s latest survey of economists forecasts that the Bank of England will start cutting the base rate from the middle of the year, with four quarter point reductions expected before the end of 2024.

If the experts are correct, this would reduce it to 4.25%.

This should help increase earnings.

It also makes other investments (such as interest-earning deposits and government bonds) less attractive, and could lead to a switch into shares.

3. Taming inflation

A reduction in borrowing costs is only possible because inflation appears to be falling.

It halved during 2023.

And it appears that most economists are expecting it to be close to the government’s target of 2%, by the end of 2024.

A reduction in the rate at which prices are increasing is generally considered a good thing, as it helps disposable incomes and should boost company profits.

4. Global growth

Although the UK economy appears to be bouncing along the bottom, and despite the fact that many countries are still struggling from the effects of the pandemic, all regions of the world are expected to grow in 2024, according to the United Nations.

This should benefit the domestic stock market as approximately 70% of the revenue of the UK’s largest 100 companies is derived from overseas territories.

5. Cheap stocks

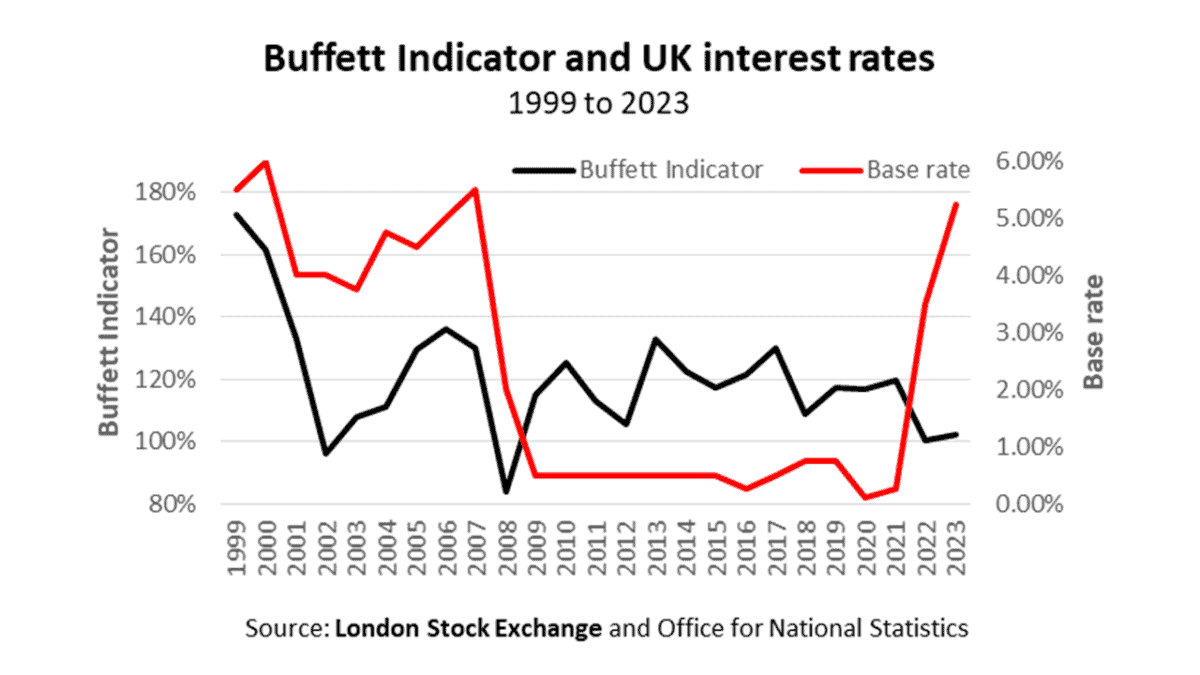

In 2001, Warren Buffett devised a valuation model to measure the attractiveness of US equities.

It assesses value for money by comparing the size of the economy with the market cap of the stock market.

It can be thought of as an economy-wide price-to-earnings ratio.

Applying it to the UK, the indicator suggests domestic shares are currently at historically cheap levels, which should attract investors.

The model is sometimes criticised as national income ignores overseas sales, whereas company valuations reflect them.

But it’s a useful — if a little crude — way of gauging the appeal of a particular stock market.

6. History

My final reason for optimism in 2024, is that the stock market usually does grow.

Of course, history might not be repeated. But it tells us that during its 40 years, the FTSE 100 has recorded annual increases on 29 occasions.

Although it’s been a slow start to the year, I remain hopeful that the stock market will soon pick up.