2023 was a better year for the Darktrace (LSE: DARK) share price. In 2022, the FTSE 250 stock had lost 38% of its value. Last year, it surged 41%.

This means it’s the best post-IPO performer from the quintet of tech stocks that listed on the London Stock Exchange in 2021.

| Stock | 2023 performance | All-time performance |

| Darktrace | 41% | 5% |

| Deliveroo | 49% | -56% |

| Oxford Nanopore | -15% | -73% |

| THG | 94% | -91% |

| Wise | 55% | -8% |

So what went right in 2023? And is the stock worth me buying now?

A year of progress

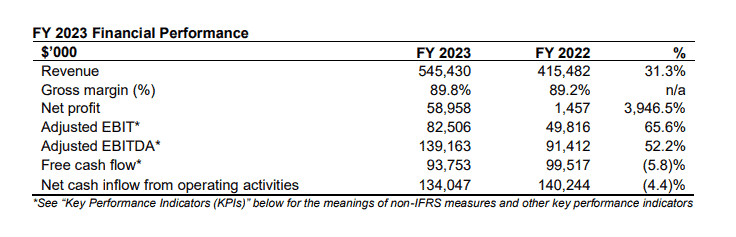

Last year’s strong performance was due to a rebound in tech stocks as well as operational progress at the company. In FY23, it grew revenue and improved profitability.

And this momentum has continued. In H1 of 2024 (covering the six months to the end of December), sales jumped 27.1% year on year to $329.6m while its customer base rose 12.9% to 9,232.

Looking forward, the firm now expects full-year sales (to the end of June) to increase between 23% and 24.5%. That’s up from management’s previous guidance of 22% to 23.5%.

Meanwhile, its adjusted EBITDA margins will be above the top end of its previous guidance range of 17% to 19%.

CFO Cathy Graham touted “the large market opportunity for our AI-powered cyber security products as attackers capitalise on the availability of increasingly sophisticated tools and tactics, including generative AI”.

However, one issue worth highlighting is that the firm said an improvement in annualised recurring revenue (ARR), a key growth metric for software businesses, was coming from its existing customer base. New business ARR “appears to have stabilised but not yet materially improved.”

This does highlight the tough macroeconomic backdrop. Considering this, the firm is doing well to continue growing.

An industry in high demand

I’m incredibly bullish on the cybersecurity sector as hardly a week goes by without another headline-grabbing cyber hack or incident.

Consider this non-exhaustive list of recent events:

- British Library cyber attack

- Ukraine-linked hackers hit Moscow internet provider

- US water utilities targeted by foreign hackers

- Sellafield nuclear site hacked

No wonder research firm McKinsey thinks cybersecurity should eventually be a $1.5trn a year industry!

The best stock?

When it comes to growth investing, I try to identify huge global themes (electronic payments, AI, etc) and invest in the top dog(s) in the spaces (like Visa, Nvidia).

In AI/cybersecurity, my pick last year was CrowdStrike, which is growing much faster than Darktrace.

Looking ahead, the sheer size and importance of the cybersecurity industry should create a few big winners, in my opinion. However, I’m not convinced yet that Darktrace will be one of them.

My worry is that the stock is valued like it will be. We’re looking at a steep price-to-earnings (P/E) ratio of 47 and a price-to-sales (P/S) ratio of 5.5. I think this valuation presents risk were the firm to hit a growth speed bump (or worse).

Currently, I also hold the L&G Cyber Security UCITS ETF in my portfolio, which is a thematic exchange-traded fund (ETF) containing multiple such stocks (including Darktrace). This gives me broad-based exposure to this rapidly-evolving industry.

As things stand, I’m satisfied with that and CrowdStrike for my exposure to cybersecurity. But I’ll keep tabs on Darktrace.