Edinburgh Worldwide Investment Trust (LSE: EWI) is a FTSE 250 firm that manages a portfolio of innovative smaller companies, typically with a market-cap of less than $5bn at the time of investment.

The trust’s top holding today is Space Exploration Technologies (SpaceX), which makes up 9.3% of the portfolio.

I’m very bullish on the privately-held rocket firm led by Elon Musk. So should I buy this stock to gain exposure? Let’s discuss.

A disruptive company

SpaceX has radically lowered the cost of accessing space by flying and landing its rockets multiple times.

In 2023, it achieved 96 orbital rocket launches, as well as two test flights of its giant Starship Mars rocket. Both of them exploded but another Starship is ready and waiting for a third attempt.

Meanwhile, Starlink, its internet-from-space service, continues to progress rapidly. This was created to help the company make money while it works towards its founding mission of reaching Mars.

The network currently consists of more than 5,100 active satellites, with the latest ones capable of beaming services straight to smartphones. This promises no more internet dead zones on Earth.

As of December, Starlink had 2.3m subscribers.

SpaceX is aiming for a mega-constellation of 42,000 satellites, which would make it truly dominant. It’s already estimated to have launched 80% of all Earth payload into orbit last year. No company or government comes close to it.

That said, Starship remains critical to the company’s long-term ambitions. A catastrophe could set the firm back years from a regulatory standpoint.

Constant underperformance

Of course, there’s more to Edinburgh Worldwide than SpaceX.

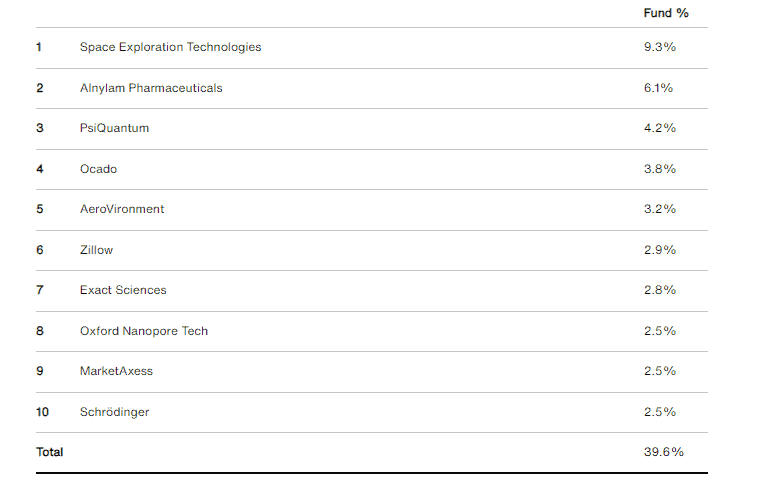

Here are the top 10 holdings, as of 30 November:

Looking further down the portfolio, I see a lot of early-stage biotechs. Indeed, the healthcare sector accounts for over a third (34.2%) of assets.

Now, I do love healthcare stocks, but I’m not sure I’d want that much weighting towards them.

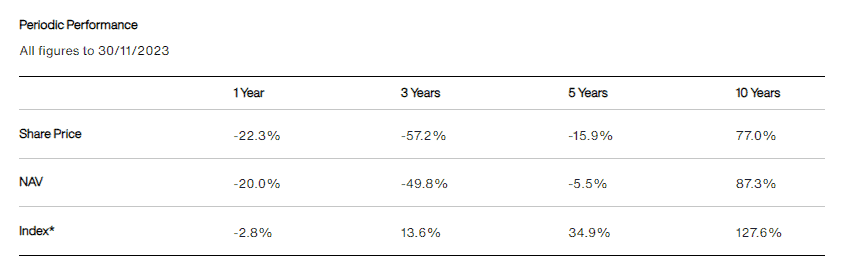

Another concern I have is underperformance. According to Baillie Gifford, the trust has multiple time periods in which it has lagged its benchmark (the S&P Global Small Cap index).

This is obviously very disappointing for shareholders. It means they would have been better off buying a low-cost index fund.

For me, I can stomach one, two, or even three years of underperformance. Markets can do strange things. But a 10-year period does worry me.

My move

Additionally, there are some stocks in the portfolio that I have specific doubts about:

- Chegg is an education firm providing online tutoring subscription services. But can’t students just use ChatGPT for homework nowadays without paying?

- Huya is a Chinese live-streaming platform. But regulators in China have just brought in strict rules to reduce spending within video games.

Of course, I could be proved wrong on these and they do collectively account for only 1% of assets. But, on balance, I’d rather keep my SpaceX exposure to Baillie Gifford stablemate Scottish Mortgage Investment Trust.

That said, I do think the Edinburgh Worldwide share price could perform strongly when interest rates start heading lower.

Plus, there’s currently a 13% discount to net asset value (NAV). In other words, I can buy £1 of assets for 87p. So it could be worth a look for growth investors wanting to nab a potential bargain.