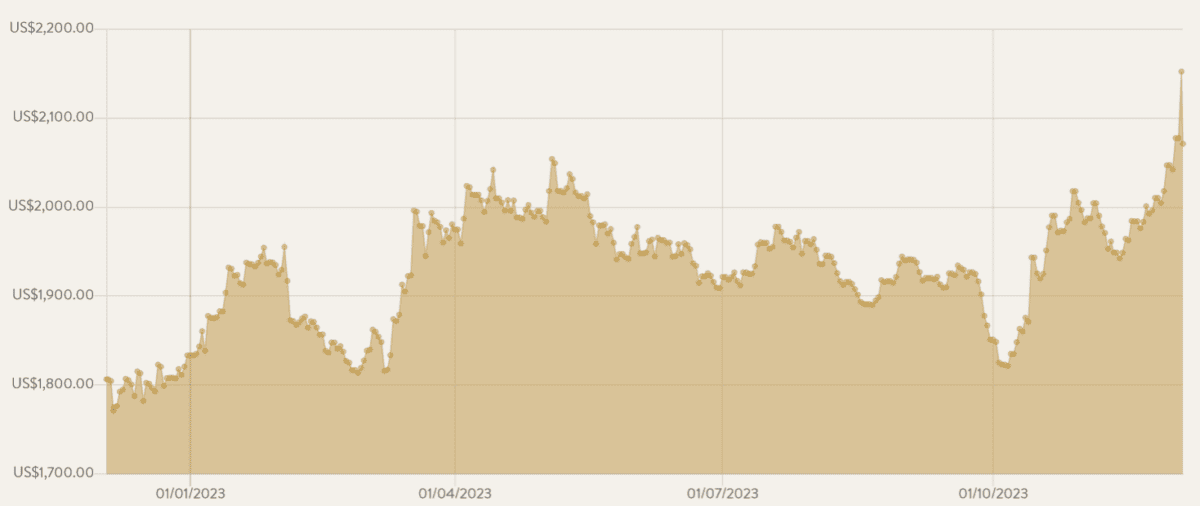

I’m building a list of the best UK gold stocks to buy as bullion prices rocket. The precious metal ripped to new peaks above $2,148 per ounce on Monday. And some analysts are tipping further price gains following the breach of key technical levels over the weekend.

Forecasters at ING Bank have predicted that “the speculative buying interest for gold is likely to continue in the near term, given the ongoing geopolitical tensions and expectations of lower interest rates in the US.”

Growing belief that the Federal Reserve will slash rates in 2024 — and potentially as early as March — have propelled gold higher. A subsequent fall in the US dollar has boosted appetite for the metal too. A declining greenback makes it cheaper to buy the dollar-denominated asset.

As ING mentioned, geopolitical chaos in the Middle East has also bolstered demand for safe-haven gold. A resumption in fighting between Israel and Hamas has reignited speculation of a full-blown conflict in the region.

Two top gold stocks

Buying gold stocks could be a great way for me to build wealth in this climate. As well as leading to some considerable share price gains, bigger profits at mining companies might also result in some fat dividends.

Conversely, buying physical gold, or an exchange-traded fund (ETF) that tracks the metal price, doesn’t pay any income at all.

What’s more, buying shares in strongly-performing companies can provide me with superior returns than if I’d simply bought gold bars or one of those ETFs. Remember though, that the reverse can be true, and that businesses suffering operational troubles can provide poor returns even when gold prices rise.

With all this in mind, here are two top gold stocks I’ll be seeking to buy at the next opportunity.

1. Centamin

FTSE 250-quoted Centamin is one of the biggest gold miners on the London Stock Exchange. In 2023 it’s on course to produce around 450,000 ounces of the precious metal. And it’s expanding its flagship Sukari mine in Egypt to produce more than 500,000 ounces per annum at low cost within the next couple of years.

The company also has a number of exciting early-stage assets in the North African country and the Côte d’Ivoire.

Centamin is one of those gold miners that’s also tipped to pay an income. Indeed, for this year and next its dividend yields sit at a healthy 3.1% and 3.5% respectively. I think its a top buy despite the constant threat of production-related issues.

2. Shanta Gold

Tanzania-focused Shanta Gold is also on my wishlist today. Its dividend yield isn’t as high as those of Centamin. But it still sits at a handy 1.6% through the next two years.

This Alternative Investment Market (AIM) company owns the ultra-low-cost New Luika and Singida gold mines where production continues to rattle along nicely. In fact, production at the latter asset beat estimates by 15% in the last quarter.

Recent takeover target Shanta also has a vast exploration asset in Kenya, which it has described as one of the “highest-grading gold projects in Africa.” Drilling work has been hugely encouraging so far. But remember that disappointing testing or development work further down the line could hit the share price.