In 2021, for the sixth time in seven years, Persimmon (LSE:PSN) paid a dividend of 235p a share, reaffirming its credentials as one of the best passive income stocks around.

Two years later, the FTSE 250 housebuilder is expected to return 60p to shareholders. This dramatic reduction is due to the well-documented downturn in the UK housing market, prompted by 14 successive increases in the base rate, part of the Bank of England’s efforts to combat double-digit inflation.

Not surprisingly, shareholders like me have suffered significant paper losses. The stock is down 60% from its all-time high of February 2020. But I think the worst is behind us — the share price is now 35% above its 52-week low.

Looking backwards and forwards

In my opinion, sensible investing is all about taking a long-term view.

I’m not clever (or lucky) enough to always buy at the bottom of the market and sell at its peak. But being prepared to hold a share for, say, 10 years should help to smooth any downturns.

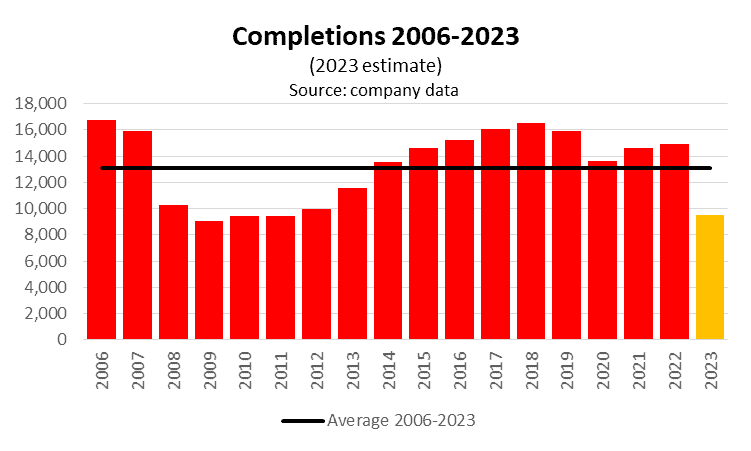

This is particularly true of a stock like Persimmon, which is exposed to the cyclical UK construction industry, as illustrated by the chart below.

If recent history is repeated, the new property market is likely to remain depressed for the next few years, but then the good times should return.

Of course, there’s no guarantee that things will pick up. But the latest yield curve from the Bank of England, which plots market expectations of future interest rates, suggests they have peaked and should start to fall in 2024.

A cash cow?

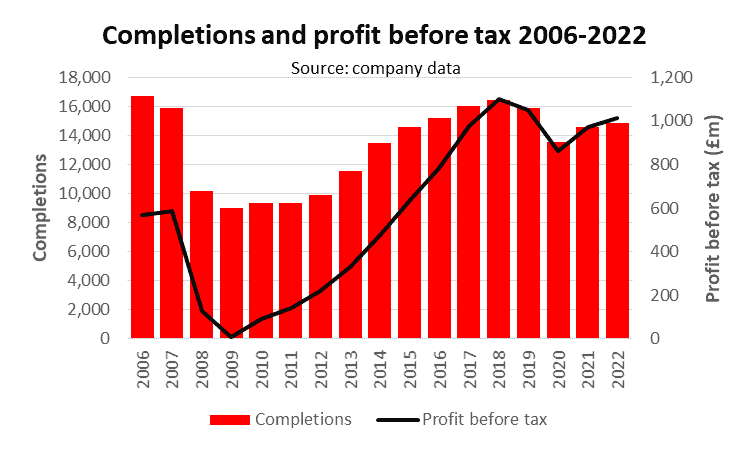

And if this analysis proves to be correct, Persimmon should become very profitable once more.

From 2017-2022, its average profit before tax was £996m.

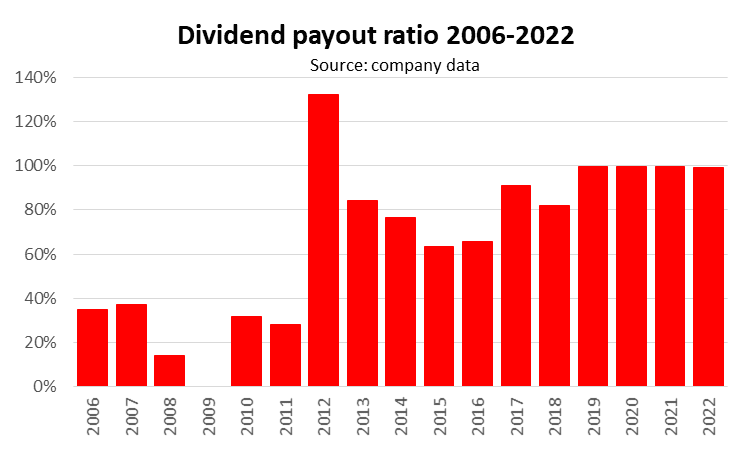

And the company has traditionally returned nearly all its earnings to shareholders.

The average dividend payout ratio from 2013-2022 was 86%.

Some analysts will claim this is far too generous, and that a well-managed business should be retaining more of its cash for future expansion.

But Persimmon is debt-free. And its only significant capital expenditure is land. That’s why it can pay such good dividends when the business is performing well.

A second income

If I didn’t already own shares in the company, I’d be happy to invest in anticipation of the dividend returning to its 2021 level.

For example, £20,000 would currently buy me 1,593 shares. Assuming a 235p dividend, I could generate £3,743 in passive income each year, or £312 a month.

I think that’s an excellent return for doing very little.

But any recovery is not going to happen overnight. It will therefore take time for the dividend to climb back to where it was.

The latest forecasts from the Office of Budget Responsibility are for the UK economy to grow by 0.7% in 2024, 1.4% in 2025, and 1.8% in 2026. Only in 2027 is GDP growth expected to return to its long-term trend rate of around 2.5%.

But ahead of the general election, the UK’s two largest political parties have both pledged to build more houses. Although there are likely to be a few bumps along the way, I remain optimistic that the market for new homes will start to grow again soon. Persimmon will then become my favourite passive income stock once more.