I think these FTSE 250 shares are brilliant bargains at current prices. This is why I’d buy them if I had spare cash to invest right now.

Bank of Georgia Group

Investing for exposure to emerging markets can be a great way to achieve above-average returns. I think one effective way to pursue this strategy is to buy Bank of Georgia Group (LSE:BGEO) shares.

As the name implies, this banking business operates in the fast-growing Eurasian territory of Georgia. The economy there is tearing higher. Indeed, the Asian Development Bank recently upgraded its 2023 growth predictions to 6% from 4.5%.

Bank of Georgia is thriving due to a combination of low financial product penetration and fast growth. During the third quarter, net interest income and profit before tax and one-off items leapt 42.3% and 32.5% respectively.

Banks are highly regulated and rule changes later on could hamper growth. But on balance, I still think this share could be too cheap to miss. It trades on a forward price-to-earnings (P/E) ratio of 3.9 times and carries a 9% dividend yield.

The Renewables Infrastructure Group

I already own shares in The Renewables Infrastructure Group (LSE:TRIG). And despite the danger posed by higher-than-usual interest rates — this scenario pushes up borrowing costs and drives down asset values — I’d like to increase my stake.

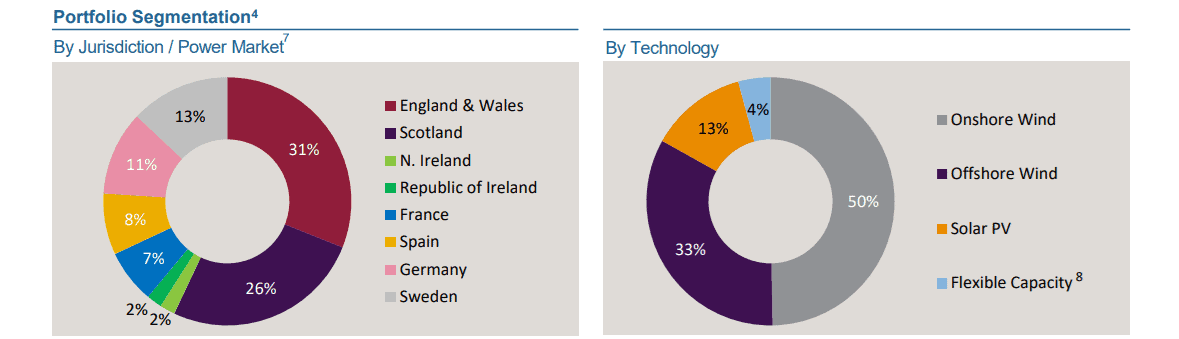

As the name implies, this FTSE 250 company owns a portfolio of green energy assets that are spread across multiple geographies, as the graphic below shows. This diversified approach helps to reduce risk created by unfavourable weather conditions in one or two territories.

I think earnings at The Renewables Infrastructure Group could soar as demand for clean energy takes off. The European Union wants wind energy capacity — which is TRIG’s main area of expertise — to rise from 205 GW today to up to 1,300 GW by 2050.

I don’t believe this growth opportunity is baked into this UK share’s low valuation. Today, it trades on a prospective P/E ratio of just 9.3 times. It also carries a 6.6% dividend yield, a reading that confirms its position as a top value stock.

ITV

Broadcaster ITV (LSE:ITV) is under pressure as economic trurbulence damages advertising income. Ad sales at the I’m A Celebrity… and Love Island maker dropped 7% during the September quarter. And more trouble could be coming as the UK economy flirts with recession.

But there’s still a lot I like about the television heavyweight today. For one, its ITV Studios division continues to expand ahead of the market (revenues here rose 9% during the third quarter). And theres plenty of room for growth here through acquisitions.

ITV’s impressive performance in the rapidly growing streaming sector is also highly encouraging. Monthly active users rose 29% between July and September, and total streaming hours increased by more than a third.

Today, the company trades on a low P/E ratio of 7.5 times. It also carries an 8.1% dividend yield. These numbers make it a very attractive value stock, in my book.