The Lloyds (LSE:LLOY) share price is currently trading at just 4% above the its 52-week low of 39.6p. This may surprise some investors as the company’s performance has remained strong throughout the year. Although net interest margins has peaked, they remain higher than we’ve seen for more than a decade.

So just how cheap is Lloyds? And is it cheap for a reason?

Near-term valuation

Lloyds is among the cheapest stocks using valuation metrics. Starting with the price-to-earnings ratio — with compares the share price against earnings per share — we can see that Lloyds trades at a discount the majority of its peers.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

| P/E TTM | P/E Forward | |

| Barclays | 4.1 | 6.1 |

| Goldman Sachs | 15.8 | 13.9 |

| HSBC | 5.3 | 5.8 |

| JP Morgan | 8.7 | 8.8 |

| Lloyds | 4.2 | 5.8 |

| NatWest | 4 | 4.7 |

| Standard Chartered | 12 | 13.9 |

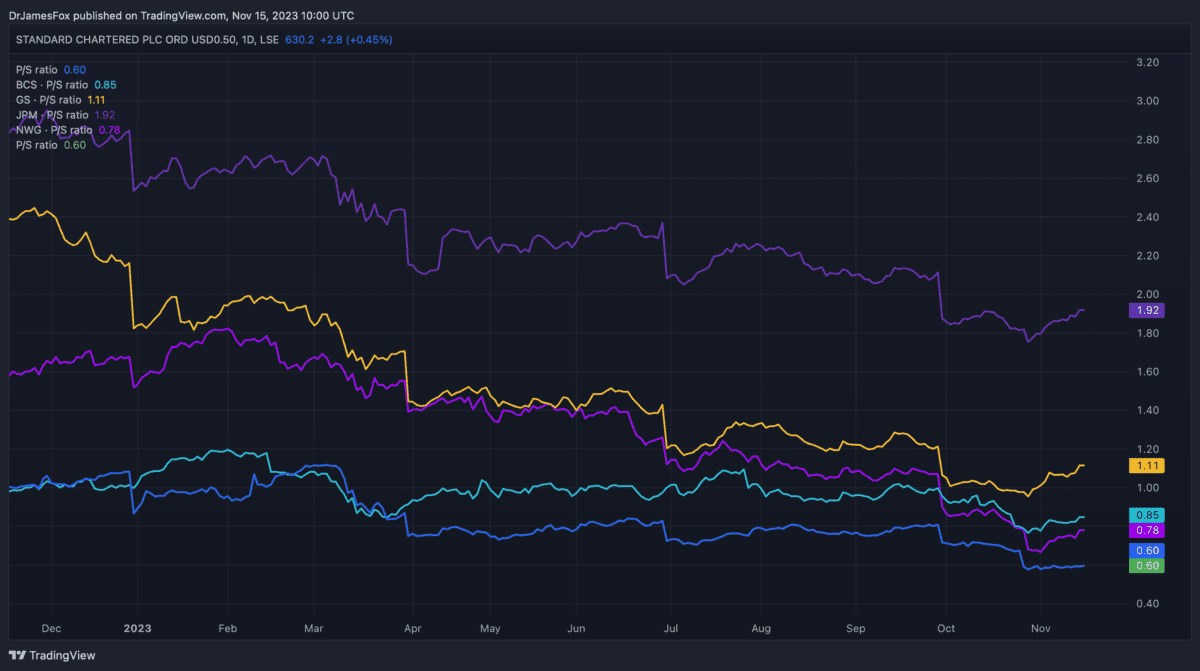

This discount is less apparent, however, when looking at the price-to-sales ratio. Although, this may reflect the fact that Lloyds doesn’t have an investment arm.

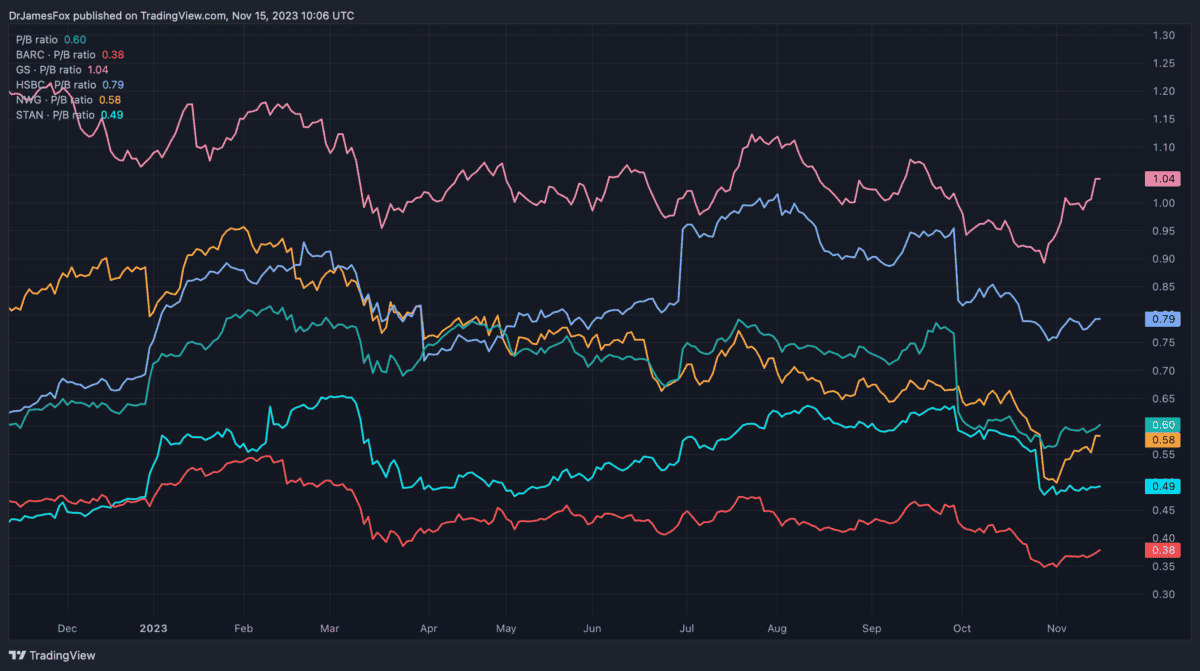

Using the price-to-book ratio, Lloyds appears to trade towards the lower end of the range. Interestingly, Lloyds’s discount to its net asset value is 40%.

Growth valuation

However, one of the most important valuations is the PEG ratio. This provides us with an earnings valuation that takes into account expected growth.

| Forward PEG | |

| Barclays | 1.22 |

| Goldman Sachs | 1.72 |

| HSBC | 0.29 |

| JP Morgan | 1.76 |

| Lloyds | 0.48 |

| NatWest | 0.47 |

| Standard Chartered | 0.83 |

Once again, Lloyds is trading towards the lower end of the PEG ranges above. Only NatWest and HSBC appear cheaper on a forward PEG basis.

Risk vs reward

Of course, no investment is risk-free, even if the valuation metrics are attractive. One reason Lloyds shares has been pushing down is default concerns relating to elevated interest rates and slowing economic growth.

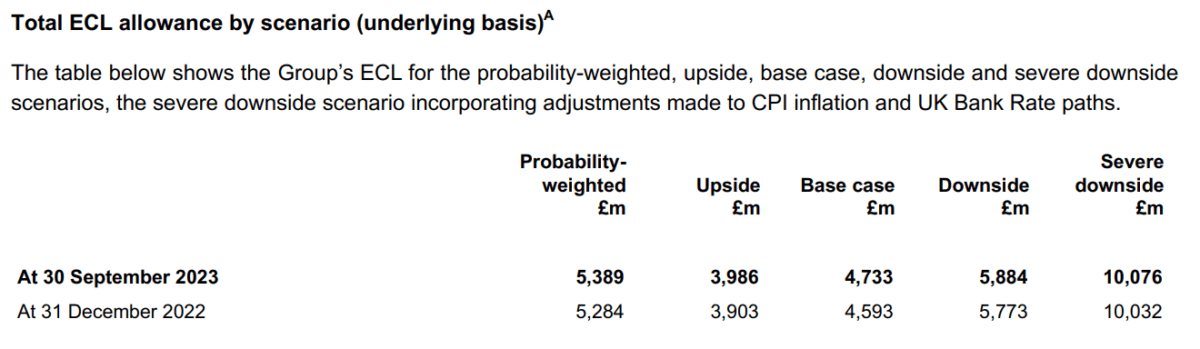

I was actually surprised to see Lloyds increase its expected credit losses (ECL) under all of its scenario forecasts in its Q3 report. The probability-weighted ECL was £5.1bn as of 30 June. That’s now £5.4bn — as shown below.

The reason that surprises me is because the same report highlighted that its underlying impairment charge fell to £187m in Q3 from £668m a year before. It’s also the case that the average Lloyds mortgage customer earns £75,000, shielding the bank from the impact of the cost-of-living crisis.

There’s also some tailwinds. One of which is hedging. As interest rates fall — and they’re expected to fall by around 75-85 basis points in 2024 — banks hedging policies start to pay dividend.

This is because banks buy fixed income assets, like bonds, with higher yields. As interest rates fall, these bonds and debt assets continue paying the higher rate. This extends the tailwind of higher interest rates as real rates fall.

For me, Lloyds is among the most attractive stocks on the FTSE 100. This is highlighted by the above ratios and improving economic conditions — inflation hit a two year low on Wednesday 15 November. This is why it’s a major part of my portfolio.