Investing in penny stocks is a high-risk, high-reward game. On the downside, these stocks can be very volatile. On the plus side, however, they can potentially make investors a fortune.

Here, I’m going to highlight a 6p penny stock that appears to have a lot of potential. I think it’s worth a closer look right now.

Life-saving technology

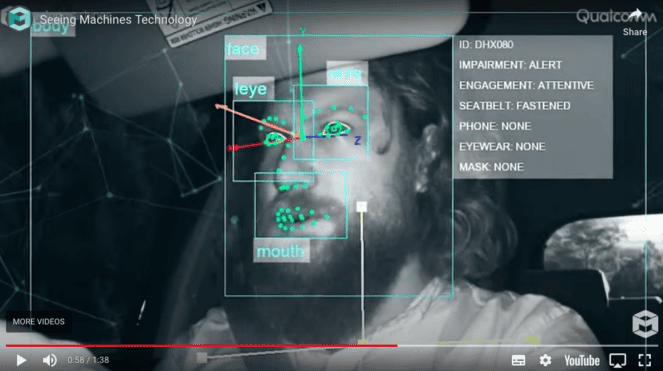

The stock I’m going to zoom in on today is Seeing Machines (LSE: SEE).

It’s an AIM-listed company that specialises in technology that helps machines (cars, planes, trucks, buses, mining equipment, etc.) see, understand, and assist human operators.

The goal of its technology – which monitors drivers’ faces and eye movements – is to reduce human fatalities to zero and make the world a safer place.

Founded in 2000, the company is headquartered in Australia. However, it operates globally, and generates a lot of its revenues in North America.

Its customers include GM, CAT, Emirates, Qantas, Transport for London, and Magna International (a large Canadian parts manufacturer for automakers). This distinguished list of customers suggests that the company has some decent technology.

At present, its market cap is around £240m.

Source: Seeing Machines, YouTube

Strong growth ahead

Seeing Machines’ most recent results were strong.

For the year ended 30 June 2023, revenue was up 48% to $57.8m (ahead of market expectations) with annual recurring revenue increasing by 27% to $13.6m.

Meanwhile, gross profit was up 65% to $28.9m.

What caught my eye, however, was the medium-term outlook.

Looking ahead, the company said that by FY26 (the year ending 30 June 2026), it expects revenue to be not less than $125m.

In other words, it reckons it can more than double its top line in the next three years.

That’s pretty exciting.

It’s worth noting that the company believes that new European safety regulations will provide a tailwind going forward.

“Our three business units are now well established, and we are expecting to see continued growth from each of them as we move closer to compliance deadlines in Europe, where every vehicle on European roads will require technology to mitigate risks associated with fatigue and distraction,” commented CEO Paul McGlone.

High risk, high reward

Now, this is a high-risk stock.

Currently, the company is not profitable.

For the year ended 30 June, it generated a loss of about $15.5m.

Companies that are not profitable are harder to value accurately. As a result, they tend to have volatile share prices.

Adding risk is the fact that the company has a relatively large amount of borrowings ($40m at 30 June) on its balance sheet.

Of course, another risk is that in a decade’s time, cars, buses, trucks, and planes may be driving themselves. So, the company’s technology could become obsolete.

All things considered, however, I think the stock looks interesting.

It’s not a penny stock I’d load up on. But I’m tempted to take a small position.