IAG (LSE:IAG) shares are up 47% over the past 12 months. As such, a £10,000 investment in the British Airways owner would be worth £14,700 today. That’s an impressive return over such a short period.

However, it’s worth noting that IAG shares bottomed out around a year ago. Civil aviation’s recovery had been damaged by rising fuel prices following Russia’s invasion of Ukraine, and Liz Truss’s premiership had sent UK stocks into reverse.

Nonetheless, picking up this airline stock a year ago would have been a great idea!

Further to rally

Looking at valuation metrics, IAG shares look particularly cheap. The stock trades at just 4.74 times trailing twelve month (TTM) earnings and 4.76 times forward earnings. This makes it one of the cheapest stocks on the FTSE 100.

This highlights a distinct discount compared to industry peers like Delta, at 6.9 times forward earnings, and Ryanair at 6.1 times forward earnings. More broadly, we can observe a 76% discount versus the industrials sector average.

These factors suggest the rally, which has slowed in recent months, has further to go.

Debt

Although there was a dip in net debt over the past 12 months, moving from €8.4bn to €7.61bn, it still negatively impacts the IAG share price, especially given the current high interest rate landscape.

Nevertheless, given improving business performance, IAG’s net debt to EBITDA ratio currently stands at a reassuringly low 1.3 times. Arguably, we should be paying less attention to the company’s debt burden.

Fuel prices

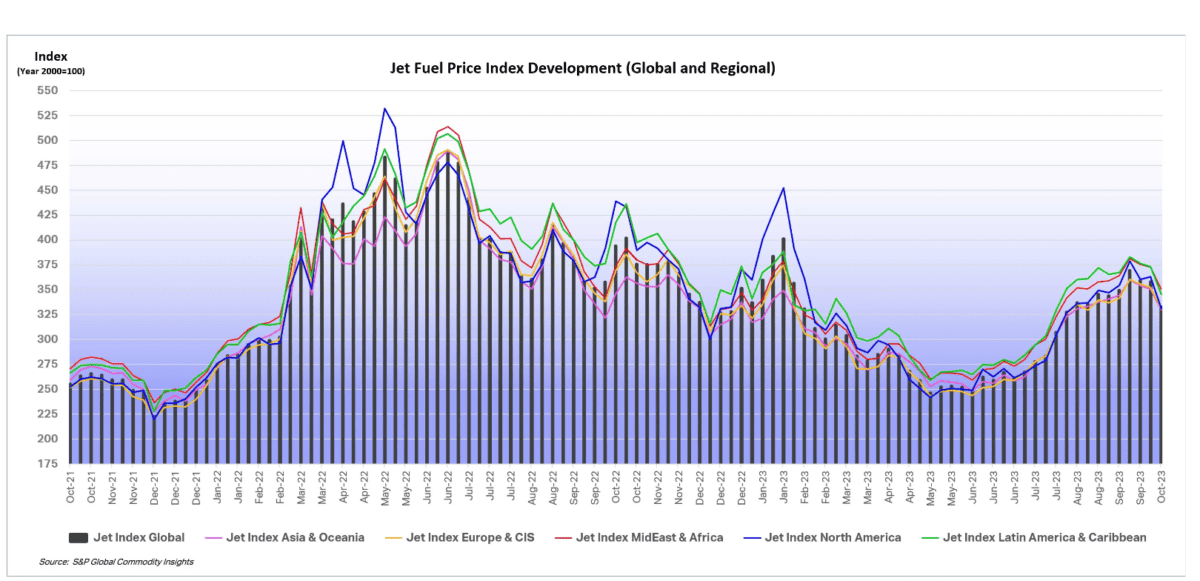

In 2022, surging fuel prices saw industry margins crippled just as the sector was starting to recover following the pandemic.

Currently, jet fuel prices remain elevated versus the past decade. And near term, we’re likely to see more upward pressure here.

Analysts have suggested the conflict between Hamas and Israel will see crude oil prices 5-10% higher than they were in September.

While a concentrated conflict would have little impact on fuel prices, a tragic escalation throughout the Middle East would have a huge effect on supply and price.

Naturally, lower fuel prices benefit airlines. But it’s also worth noting that airlines employ hedging strategies. IAG has hedged 65% in Q4 2023, 58% in Q1 2024, 49% in Q2 2024, and 39% in Q3 2024. In turn, this should provide some degree of insulation if fuel prices do surge.

In fact, an efficient hedging strategy can really benefit a company when prices go up. If IAG is more hedged than its competitors, its offer may become more price competitive.

Topping up

I’ve made the decision to top up my holding of IAG shares. Despite economic pressures in the form of the cost-of-living crisis, strike action, and potential increases in jet fuel prices, the stock remains attractive.

I believe these factors have been more than factored into the share price.