If I’d have bought shares in BAE Systems (LSE:BA.) at the end of 2021, I’d have seen 92.1% growth. That means a £1,000 investment then would be worth £1,921 today. Taking into account the relatively small dividend yield, I’d now have more than £2,000.

The defence business

The share price of BAE Systems can benefit from war, such as the Ukraine/Russia and Israel/Palestine conflicts, in a number of ways.

- Increased demand for defence products: War leads to increased near-term demand for defence products, such as fighter jets, tanks, and artillery. BAE Systems is largest defence contractor in Europe

- Increased long-term government spending on defence: War also leads to increased government spending on defence. This may see governments commit to large, long-running contractors for new military systems

- Increased investor confidence: War can also lead to increased investor confidence in BAE Systems. This is because it’s seen as a safe and reliable investment during times of conflict

It’s certainly the case that the war in Ukraine has represented more of a tailwind for BAE than Israel’s war with Hamas. Since Hamas’ attack on Israeli citizens in early October, the stock has only pushed up 3%.

Meanwhile, the stock is up around 80% since the start of the Ukraine war. It’s worth noting that even if hostilities were to cease immediately in Ukraine, BAE would still experience a positive impact.

This is because governments worldwide have already made commitments to augment their defence budgets and programmes, providing a sustained uplift for the company.

Is it still cheap?

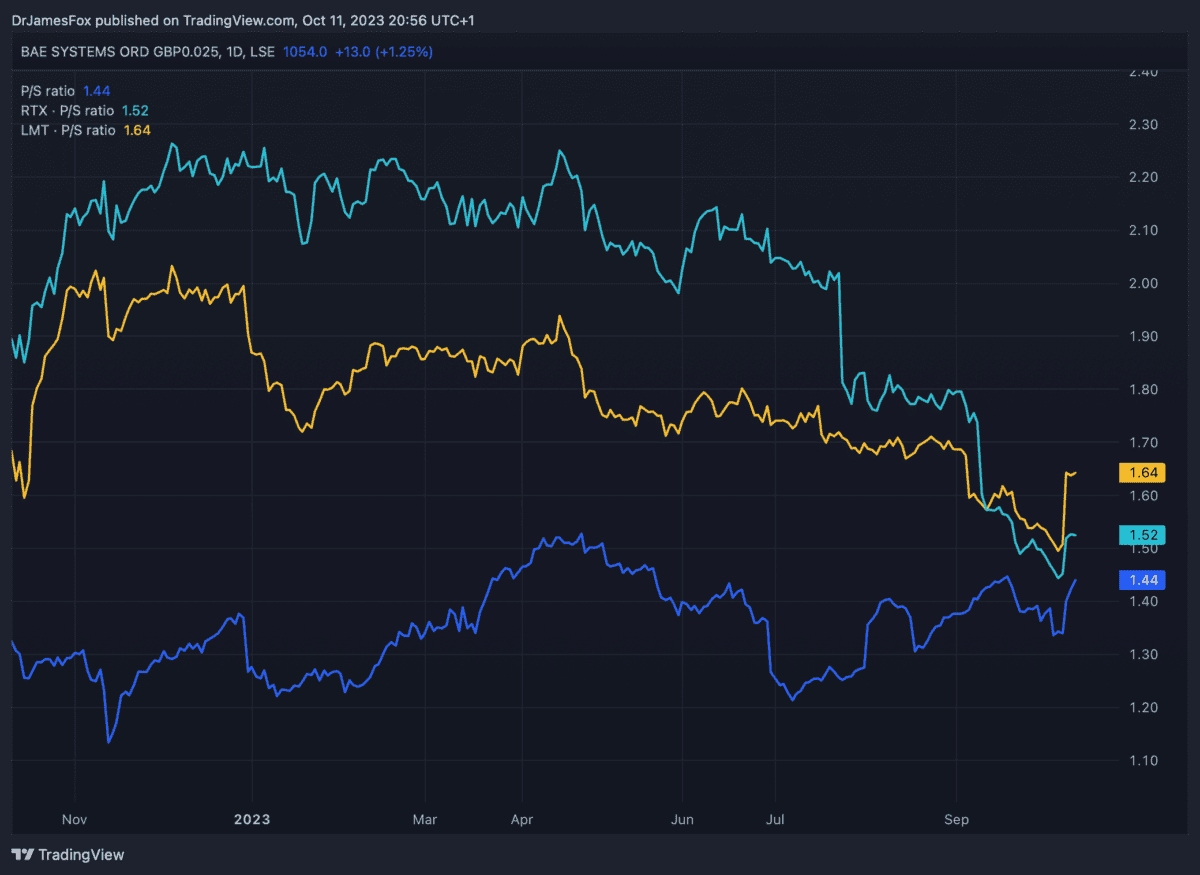

When trying to ascertain whether BAE shares are cheap, it pays to look closely at its peers. RTX Corp and Lockheed Martin are among two of BAE’s biggest international peers.

The two American companies are around three times bigger than the British contractor, but remain excellent points for comparison.

Firstly, looking at the price-to-sales ratio, we can see that BAE trades at a discount versus RTX and Lockheed. All three companies have seen a jump in their valuations in October, following the outbreak of war in Israel.

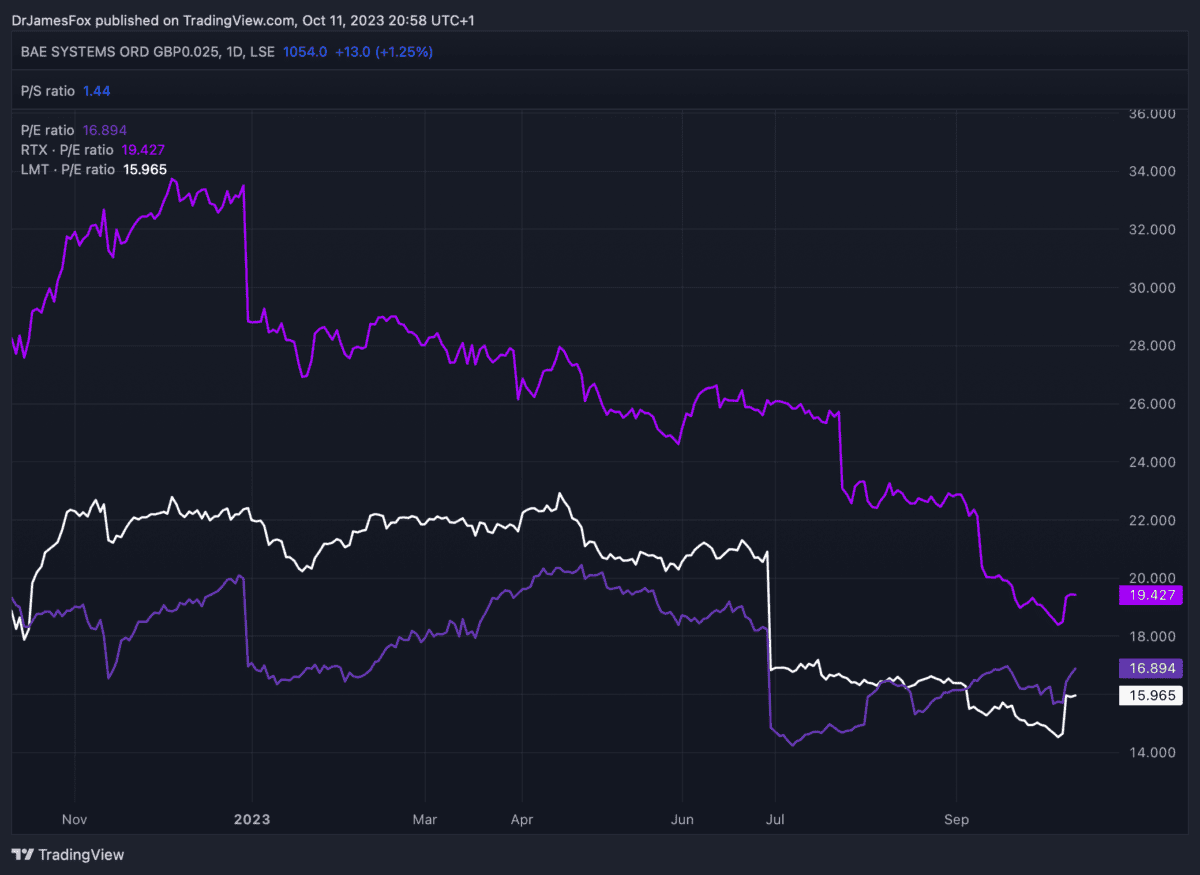

Now looking at the price-to-earnings ratio, it’s apparent BAE is slightly more expensive than Lockheed Martin, but less expensive than RTX. This infers that Lockheed is more efficient at turning revenue into profit.

With the company trading at 16.8 times earnings, investors will need to feel that BAE has the capacity to continue growing. That’s because the defence contractor is trading at a premium to the FTSE 100 average — around 13.5 times.

Given the tailwinds being experienced in defence, and the fact that many new government procurement programmes won’t result in improved cash flows until delivery, BAE doesn’t appear expensive. It’s also the case that an expansion of the AUKUS (the trilateral security pact between Australia, the UK, and the US) programme may represents a further tailwind.

The BAE share price could certainly push higher, but geopolitical events may need to align for that to happen. As it stands, I think BAE isn’t trading far from its fair value.