Growth stocks are shares of companies that are expected to expand and increase their earnings at an above-average rate compared to others in the market.

Investors are drawn to growth stocks for their potential for capital appreciation, as the companies typically reinvest their profits into further expansion rather than paying significant dividends.

So here are four growth stocks, all with attractive valuations, I’ve been keeping an eye on.

Spero Therapeutics

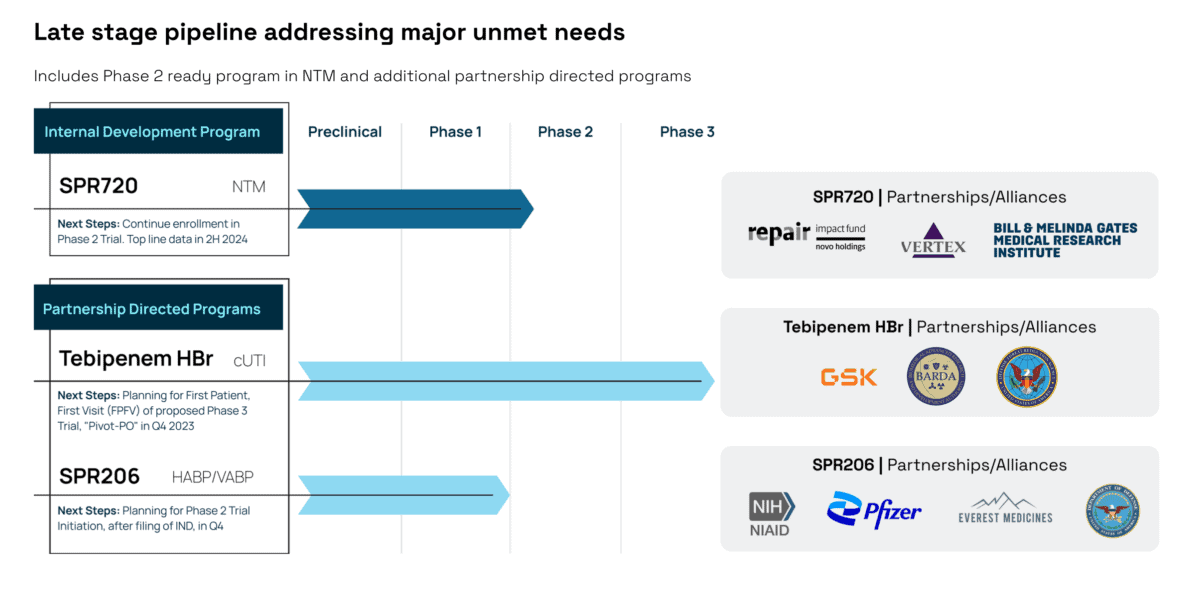

Spero Therapeutics is a biopharmaceutical company focused on developing innovative treatments for serious and life-threatening bacterial infections. It specialises in creating novel antibiotics and therapies to address antibiotic-resistant bacteria, addressing a critical need in healthcare.

With a market-cap of just $67m, the stock looks particularly attractive with a net cash position of $87m. Why? As the net cash position is greater than the market cap, it suggests the market could be missing something as it doesn’t have a positive valuation regarding the products in development.

Among several deals with pharma companies, Spero could receive up to $550m in pipeline payments from GSK. While there’s plenty of risk in this sector, (individual products might come to nothing), the pipeline is varied and offers some diversification.

Voyager Therapeutics

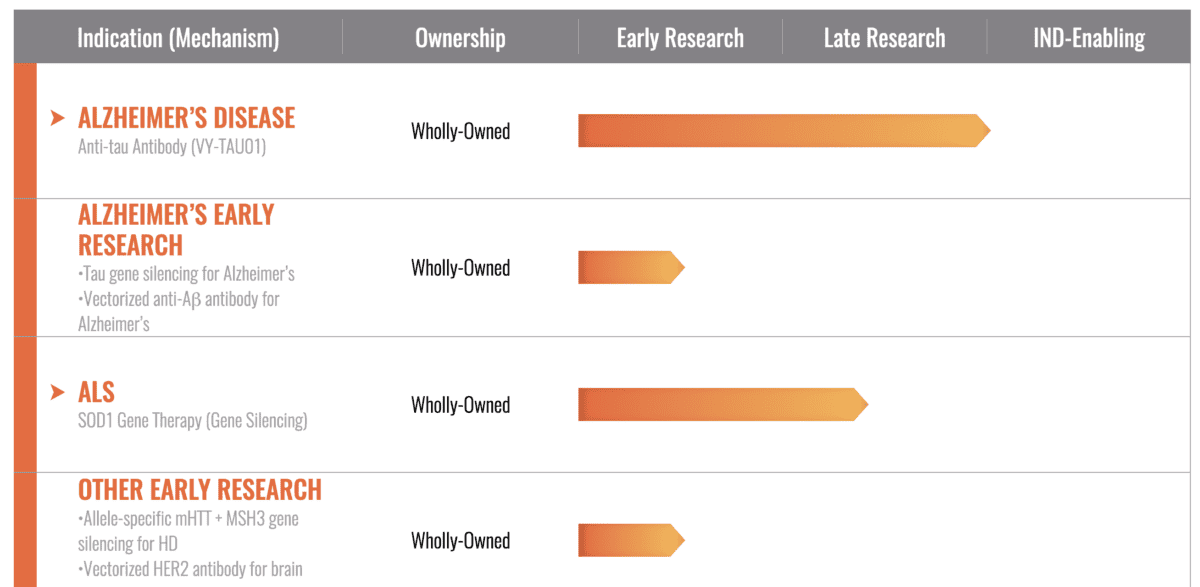

Voyager Therapeutics is a clinical-stage gene therapy company that focuses on developing transformative treatments for severe neurological diseases.

It specialises in using adeno-associated virus (AAV) technology to deliver gene therapies to address conditions such as Parkinson’s disease and amyotrophic lateral sclerosis (ALS).

The company saw significant growth in Q1 following partnerships with Novartis and Neurocrine Biosciences, but the share price has since dipped.

Pre-stage trials highlighted favourable biophysical characteristics and strong activity in mouse models, however investors may have to wait a couple years before hard clinical data gives us a better idea of the company’s prospects.

With a market-cap of $337m, pipeline payments suggest considerable upside.

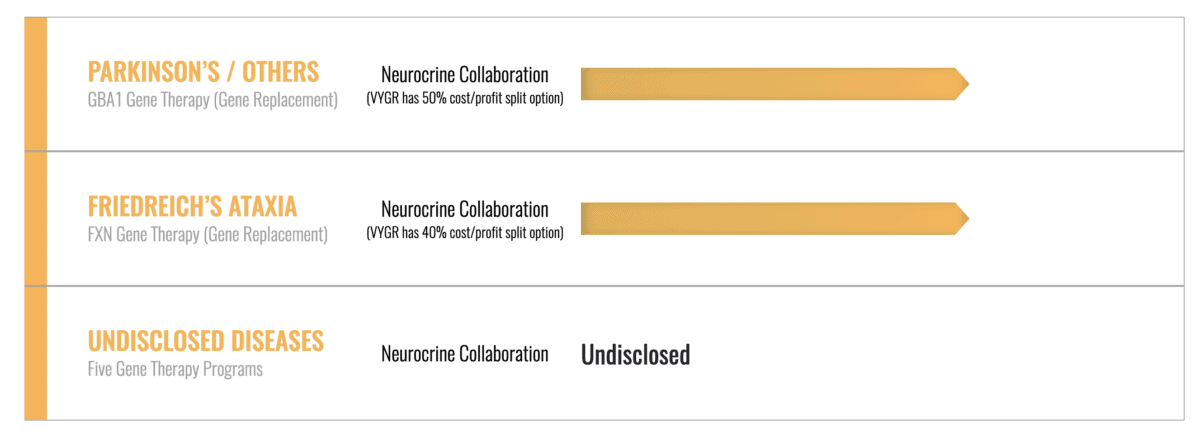

Immueering Corporation

Immuneering Corporation is a biotechnology company that specialises in data-driven drug discovery and development. It utilises computational biology and data analysis to identify potential drug candidates and targets for various diseases, with a focus on oncology and immunology.

It recently produced positive Phase 1 data from lead asset IMM-1-104 against mutant solid tumours relating to RAS gene mutations. In fact, it recently put its neurological programmes on hold to focus on oncology.

The stock has a market-cap of $224m and $105m in cash, inferring an enterprise value around $119m. It’s operating in a risky market, but one with huge potential. At the current price — down 36% year on year — its worth consideration.

Yalla

Yalla is an entertainment and communications company I’ve been watching for a while. Its share price has pushed upwards in recent months, but now trades at just 2.8 times EV-to-earnings. Yalla looks phenomenally cheap compared with peers like Meta. It’s been profitable since its IPO, and currently sits on $510m of cash.

The firm has embarked on a move into the mid-hardcore gaming space in an effort to speed up revenue growth which has slowed following the pandemic. This introduces an element of risk, but one that is well covered by its net cash position.