Rolls-Royce (LSE:RR) shares have been one of the biggest success stories of the year. The stock has risen from a nadir of 64p, and now trades at £2.20. Over 12 months, it’s a phenomenal 195% gain. It’s hugely outperformed the FTSE 100.

So the big question is, with Rolls having made a serious turnaround, does the stock still offer good value? Let’s take a look.

More to go?

UBS has held a positive view on Rolls-Royce for a while now and, so far, its outlook has proven accurate. The company has surpassed expectations twice this year, leading to a notable increase in its share price.

However, UBS now thinks the engineering giant could go further. In its upside scenario, it anticipates that Rolls-Royce’s stock could reach £6. But in a more cautious scenario, it foresees it potentially declining to £1.

UBS also expressed confidence in the company’s 2023 guidance, believing it to be conservative. It also projects that Rolls-Royce might achieve £2bn in free cash flow (FCF) as early as 2024, and £2.8bn of underlying FCF by 2026.

Despite acknowledging potential macroeconomic risks due to the company’s exposure to China, UBS’s analysis of trends in the first half of the year suggests a likely increase in flying hours in the second half.

Valuation

Banks and brokers often get it wrong. So it helps to get a broad array of perspectives on stocks and do plenty of research.

The current share price reflects a multiple of 42 times forward earnings, which seems pricey at first glance. However, this metric isn’t overly useful because the company remains in transition, and its expected performance over the medium term differs significantly from the trends seen in the past three years.

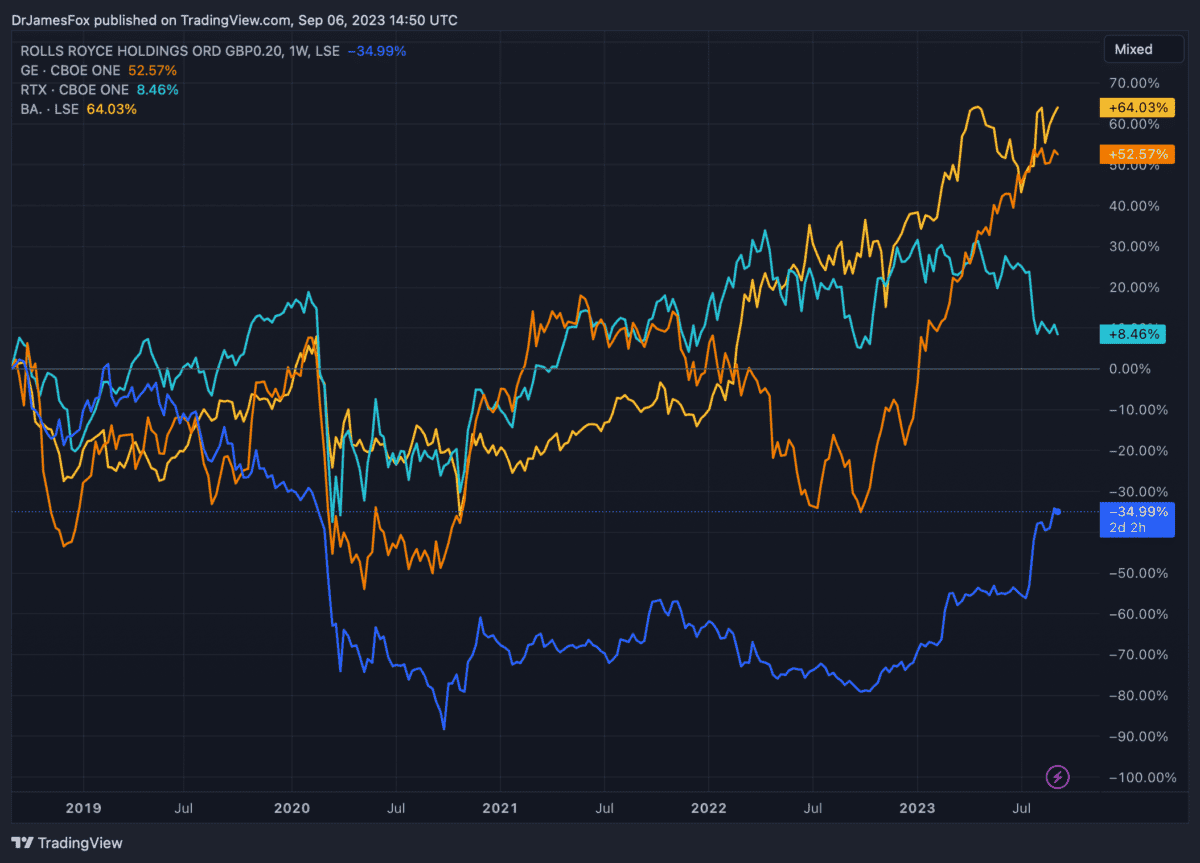

Therefore, a more effective metric for comparison is the price-to-sales ratio. Rolls-Royce currently trades at a ratio of 1.17 times sales which, even after the recent increase, positions it as a more affordable option compared to its peers, including General Electric, Raytheon, and the defence giant BAE Systems.

The chart below shows the relative performances of these defence and aerospace stocks over the past five years. As we can see, despite Rolls’ uptick over the past year, the stock has underperformed over five years, primarily due to its larger exposure to commercial aviation.

Long-run tailwind

Rolls-Royce anticipates significant tailwinds in the coming two decades as global population and income levels continue to rise. With around 200m people joining the global middle class annually, a substantial increase in air travel demand is forecast.

This upsurge in demand primarily centres around single-aisle jets, with a significant portion of growth originating from China and rapidly growing economies in Southeast Asia.

Currently, Rolls-Royce’s jet engines are predominantly utilised in long-haul or double-aisle aircraft, suggesting a potential need for strategic adjustments to fully capitalise on this emerging trend.

Rolls does appear to be undervalued compared to its peers but, personally, I believe there’s better or more obvious value elsewhere on the FTSE 100. I’ve been reallocating funds towards stocks such as Barclays and Hargreaves Lansdown.