The Rolls-Royce (LSE:RR) share price has already surged 156% over the past 12 months. But UBS thinks it could go further. The Swiss bank recently upgraded its price target on the engineering giant to 350p from 200p and reiterated a ‘buy’ rating.

According to the bank’s modelling, Rolls-Royce shares could extend as high as 600p. That’s almost triple the current share price. Let’s take a closer look.

UBS notes

UBS has been bullish on Rolls-Royce for some time. And to date, it’s been right. The stock outperformed expectations twice this year, leading to the surge in the share price.

In the bank’s upside scenario, Rolls-Royce stock could hit 600p, and in its downside scenario, UBS sees the stock falling to 100p.

“We believe that 2023 guidance looks conservative, that Rolls Royce could achieve £2 billion of FCF as soon as 2024 and £2.8 billion of underlying FCF in 2026”, UBS said.

“Whilst we recognise the macro economic risks given the company’s China exposure, our review of aircraft utilisation patterns over H1 suggests upside risk to flying hours in H2“, it added.

Value

Rolls-Royce shares have been riding a wave of momentum since their nadir during the Liz Truss premiership. But how has this surge impacted valuation metrics?

Presently, the shares are trading at a multiple of 103 times earnings (2022 earnings). This is primarily because the company remains in transition/recovery. In other words, the projected performance for the coming years diverges significantly from the patterns witnessed in the preceding three years.

Hence, the price-to-sales ratio is a more effective metric. The stock has a price-to-sales ratio of 1.09 on a trailing-12-month basis. In turn, this makes it appear more affordable than peers including General Electric, Raytheon, and BAE Systems.

Moving forward

Forecasting tends to revolve around the civil aviation sector. After all, this is where most of Rolls’ income is derived from, despite a booming defence and power systems business.

UBS is bullish on Rolls and sees 16.5m engine flying hours in 2024. That’s 8.5% ahead of consensus. The bank has also doubled its free cash flow estimates for 2024-26, with smaller increases thereafter.

Looking further ahead, the long-term forecast of civil aviation is very positive, albeit less measurable. With billions set to join the global middle class over the next two decades, demand for air travel is expected to rocket.

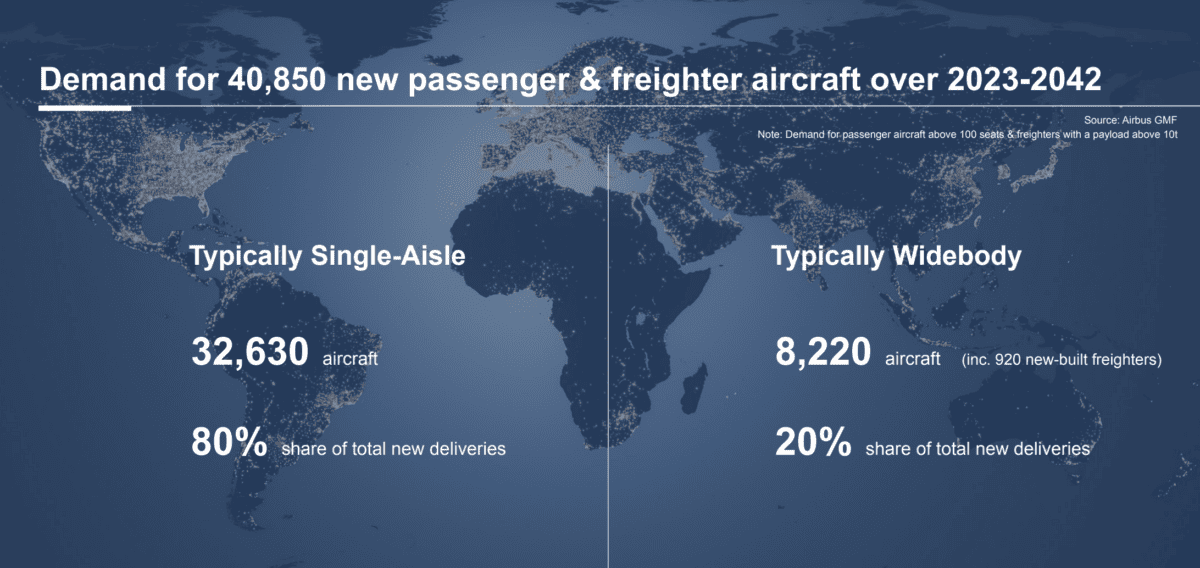

The challenge, as the above infographic highlights, is that there’s much more demand in the single-aisle market than the widebody market. Rolls’ engines are normally used in widebody aircraft.

In response, the company’s German subsidiary, Project HEAVEN, is researching into the prospects of adapting the new UltraFan engine for single-aisle jets. This could open up a huge new market.

Debt is falling, the company is beating consensus again and again, so it certainly looks like an enticing investment opportunity. Although it’s certainly worth noting that another reduced demand shock, possibly from China, could present challenges.

However, while the best-case scenario in UBS’s forecast is very exciting, it may not happen and investors may think they can find more obvious value plays elsewhere on the FTSE 100.