NIO (NYSE: NIO) stock surged from $10 at the beginning of July to reach $15 by the first week of August. Now it’s back down at $11. While such volatility isn’t anything new to long-term NIO shareholders, this recent share price turbulence has been pretty dramatic.

Should investors buy this latest dip? Here’s what the charts are saying.

A bucking bronco

The five-year share price chart above shows how wild NIO stock can be. In fact, beyond rival Tesla, I can’t remember a more volatile share than that of the Chinese electric vehicle (EV) manufacturer.

This can be seen visually by considering the stock’s beta. This is a concept that measures the expected move in a stock relative to movements in the overall market (the S&P 500 in this case).

Therefore, a beta greater than 1.0 suggests that the stock is more volatile than the broader market. A beta of less than 1.0 would indicate that a stock has lower levels of volatility.

Put simply, a low beta means low volatility measured against the wider market while a high beta indicates the opposite.

In the case of NIO, the beta is 1.85, which is extremely high. What this means in practice is that the stock will typically move almost twice as much as the market does.

Often, a high-beta stock will be a smaller, speculative company such as a biotech or a start-up with an unproven technology. However, NIO has a market cap of $18.6bn and delivered 122,486 vehicles in 2022.

So this isn’t your run-of-the-mill growth stock, and it’s certainly not for the faint of heart.

Falling valuation and squeezed margins

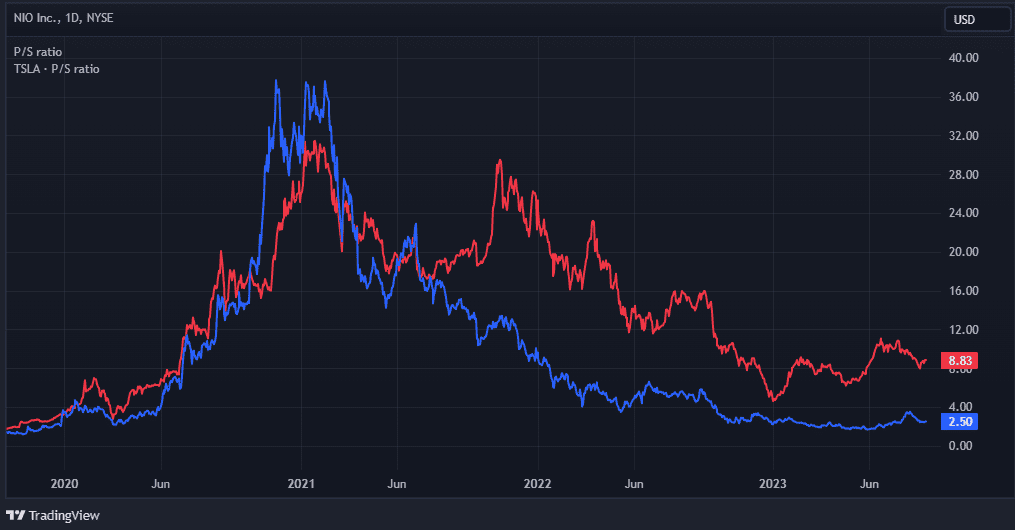

I can’t value the stock using a P/E ratio because NIO still isn’t profitable. But it can be assessed on a price-to-sales (P/S) multiple. This is the share price of a company divided by its sales per share. And on a P/S basis, the shares are ‘cheap’, at least by historical standards.

Above, we see that they’re trading at 2.5 times sales versus Tesla at 8.8 times. Seen from this perspective, the stock looks good value.

However, the P/S ratio started to diverge from Tesla’s in 2021 as investors became less convinced about NIO’s path towards profitability. And looking at the company’s deteriorating gross margin, it’s easy to see why.

NIO’s margins have contracted due to rampant inflation and supply chain issues. But things aren’t expected to improve any time soon, with the firm recently cutting prices on its vehicles while ramping up production of new models. And with increasing competition, margins are likely to stay under pressure.

Big questions remain

Today, on 29 August, the company is due to report its second-quarter earnings. Historically, investors have mainly focused on its top-line growth and bottom-line losses. However, there are now multiple issues to consider, including competition, demand for its vehicles after price cuts, and overall concerns about the state of the Chinese economy.

Additionally, NIO still seems some way from its 250,000 vehicle delivery target for 2023. If the firm turns in a weaker-than-expected quarter, I fear the share price could get hit quite badly.

So, while the stock looks cheap, I think there are better and certainly less volatile growth shares to buy right now.