Many young investors dream of having £100k in a Stocks and Shares ISA. This figure could be the platform for even more wealth building, or it could be used to generate passive income.

In the current market, such a figure could easily generate £500 a month in tax-free passive income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Efficient earnings

Undoubtedly, the Stocks and Shares ISA is the most efficient method for generating investment-derived income and wealth. This notable advantage stems from one enticing attribute, wherein any income or capital gains generated within the ISA remain entirely exempt from taxation.

I have the option to open an ISA account through most prominent UK brokerage platforms. The account then enables me to contribute up to £20,000 annually. In theory, with ample resources at hand, I could potentially amass £100k in just five years.

However, most of us are not that fortunate. Realistically, the path involves gradually saving, allowing us to incrementally nurture our portfolios and work towards our financial aspirations.

This measured approach aligns with the practicalities of most individuals, enabling investors to progressively build a robust investment foundation.

Opportunity beacons

A number of the most renowned investors in contemporary history, such as Warren Buffett and John W Rogers Jr, have significantly bolstered their fortunes through strategic investments during market downturns.

A noteworthy example is Buffett, who is often quoted on his sage advice: “Bad news is an investor’s best friend.” This perspective underscores the wisdom of capitalising on market contractions, a strategy that has been pivotal in shaping the success stories of these notable financial figures.

During a recent conversation with David Rubenstein, Rogers recounted his actions during the financial crises of the early 1990s and late 2000s. He shared that he proactively reached out to investors, requesting additional funds. He contended the downturns in the marker presented a rare opportunity to acquire quality stocks.

What about now?

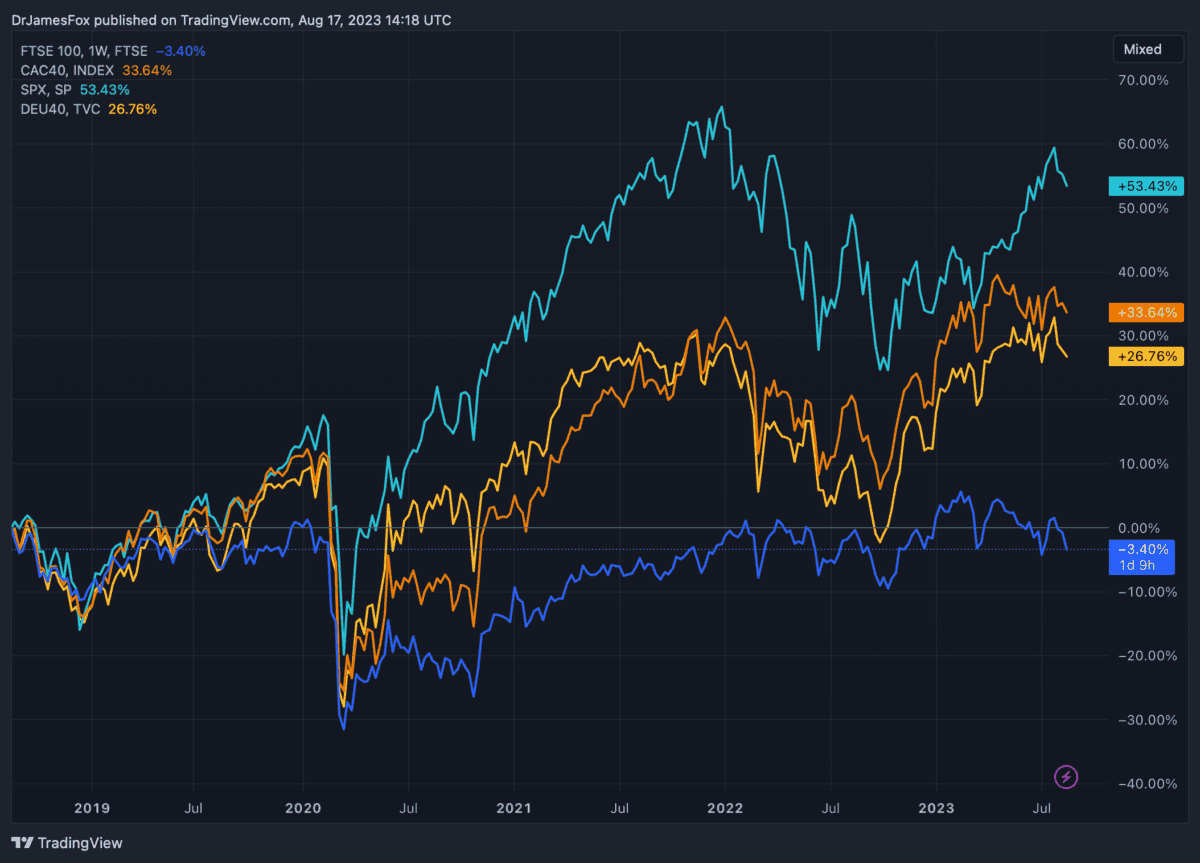

While we haven’t witnessed a crash, it’s evident that the FTSE 100 has experienced a 3% decline over the course of five years, while the FTSE 250 has faced a more substantial 10% drop.

UK-listed stocks haven’t achieved the growth potential that could have materialised post-Brexit. Interestingly, this trend isn’t predominantly attributable to earnings performance, but rather to the prevailing negative investor sentiment.

In stark contrast, the S&P 500 has surged by an impressive 53% over the same five-year period. Personally, I hold the belief that there’s a significant amount of concealed value within the FTSE 100. The pivotal question revolves around the catalyst that will propel its upward trajectory.

This is precisely where the opportunity resides, waiting to be harnessed. Sometimes it takes a while for stocks to actualise their intrinsic value. But by investing in UK stocks today, towards the bottom of their cycle, I could propel my investments moving forward.

Just think about this. If, and it’s a big if, the FTSE 100 were to grow in the next five years as fast as the S&P 500 did in the previous five years, I could turn £10,000 starting capital, and £1,000 a month, into £100k in half a decade.

Of course, that still involves some hefty contributions. But, even with smaller sums of money, investors stand to gain if they pick wisely in fallen markets. However, it’s important to acknowledge that poor investment decisions have the potential to result in financial losses.