One key investment principle of Warren Buffett is only to invest in companies within one’s “circle of competence”. That’s why I’m always researching. In so doing, not only am I increasing my knowledge base but also improving my prospects of identifying opportunities for investments to add to my Stocks and Shares ISA.

Outside of artificial intelligence, I’m particularly excited by two mega trends that have the potential to unlock an array of investment ideas.

Energy transition

The transition of the global economy from fossil fuels to renewable sources of energy represents the biggest investment opportunity of a generation, I feel. Indeed, it’s also one that Maven Capital Partners has identified as part of a range of sectors that could be worthy of consideration for the potential of long-term high returns.

However, a lot of investors apply a very narrow lens when deploying capital in this space. Although they’re key industries, renewables is a lot more than simply wind and solar.

Hydrogen is one market that I’m actively looking into. In the UK alone, the government has committed to deliver 10GW of low carbon hydrogen production by 2030.

Technologies in this space are at an early stage and therefore most investment would be via private equity putting money into start-ups. That said, a critical enabler of the hydrogen ecosystem relates to transport and storage infrastructure.

Given the long development lead times and high capital requirements, infrastructure projects are more suited to established players such as National Grid. Oil majors BP and Shell are active too.

Electrification metals

One key industry I predict will boom as a result of the green revolution is mining. Collectively, electrification metals including copper, cobalt, zinc, nickel and silver are a key constituent of an array of low carbon technologies.

As demand for these metals grows exponentially over the coming decades, shortages are inevitable. Long lead times in discovering and bringing online new reserves of these metals will exacerbate the situation.

I particularly like Glencore and Anglo American. Both are established players, paying healthy dividends and to me are cheap relative to their prospects.

Cybersecurity

I think another sector likely to experience explosive growth this decade is cybersecurity — another that Maven Capital Partners has touted. The Department for Science, Innovation and Technology 2023 survey data estimate that there were 2.4m instances of cyber crime in the last 12 months.

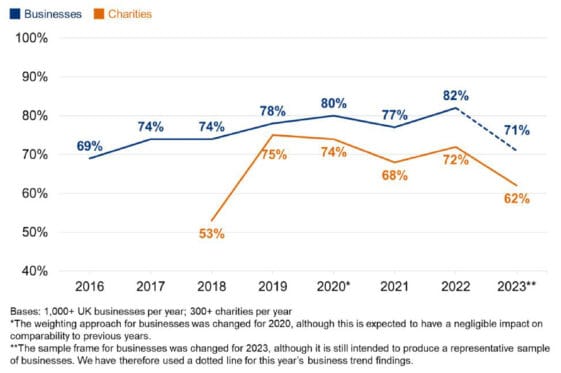

In the short term, cyber budgets could well come under pressure. As highlighted in the following chart, cyber security has dropped down the agenda for many businesses. Interview data suggests that high inflation and general economic uncertainty are to blame.

Source: Department for Science, Innovation and Technology

However, as the frequency and severity of breaches grow, businesses of all sizes will be forced to confront this challenge.

Research by Fortune Business Insights estimates that the global cyber security market is predicted to grow at compound annual rate of 13.8% out to 2030. Consequently, I’m actively seeking to improve my expertise in this area and to identify companies with long-term potential.

Given the number and diversity of organisations operating in the space, I don’t feel confident enough to invest in individual companies. Therefore, I’m more interested in picking a sector-specific exchange-traded fund (ETF). Two ETFs that I feel match my risk tolerance are the iShares Digital Security UCITS and Legal & General Cyber Security UCITS. I expect to add both to my portfolio when funds permit in the coming months.