Advertising agencies like FTSE 100-quoted WPP (LSE:WPP) could struggle to grow earnings in the event of a prolonged economic slowdown. Marketing budgets are one of the first things to be trimmed when companies feel the pinch.

Yet the industry giant may be spared from the worst of any downturn. This is thanks in part to its focus on the booming digital marketing segment.

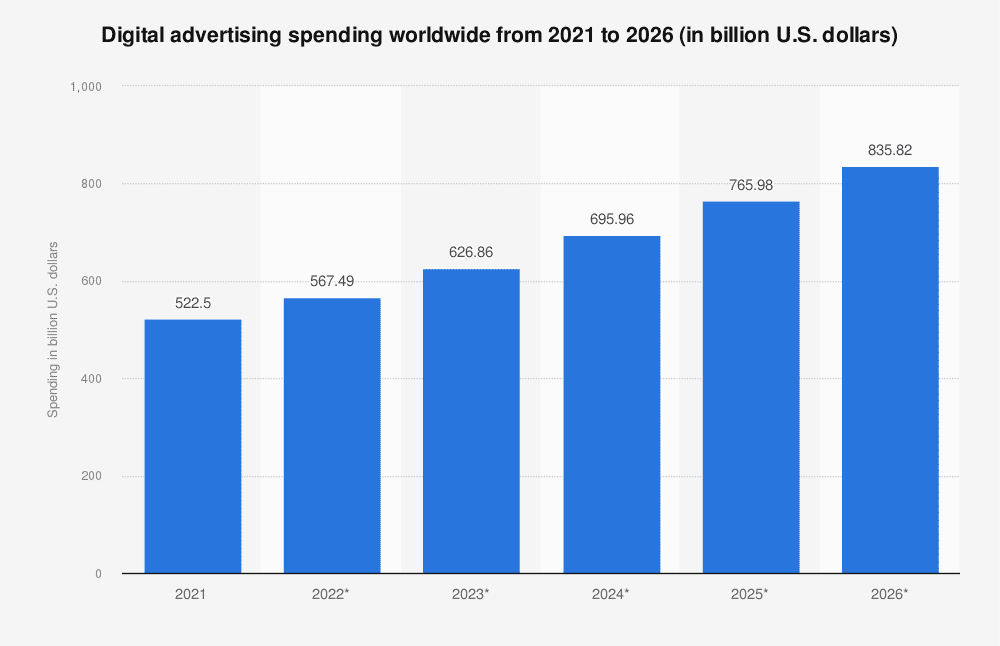

If reports are to be believed, digital could fuel profits growth at the FTSE firm for long into the future. Search engine optimisation (SEO) business Linkdaddyseo.com reckons digital advertising spending worldwide will grow 47% in the four years to 2026 alone.

Reflecting the digital boom, City analysts expect WPP’s earnings to soar 63% in 2023. Further mid-single digit rises are forecast for 2024 and 2025, too. This also means dividends are tipped to rise strongly over the period.

Global superstar

But soaring digital-related spending isn’t the only reason I’m thinking of adding the FTSE share to my portfolio. I’m also attracted by its wide geographic exposure. It has operations in a total of 100 countries.

Firstly, the company is benefiting from the outperforming US economy that is in turn driving the ad market. The States is by far WPP’s most important single market and in 2022 it generated 37% of all revenues from there.

The firm’s bright earnings outlook also reflects its large presence in fast-growing emerging regions. Advertising spending in the likes of Asia, for instance, is tipped to outstrip the global average. This is thanks to a post-coronvirus rebound in China and a booming Indian ad industry.

These markets offer substantial long-term rewards for WPP as companies seek to capitalise on soaring disposable incomes there. Recent investments by WPP include the acquisition of Brazilian e-commerce agency Corebiz last July and the opening of a new campus in Guangzhou, China back in January.

Dividend growth

The firm has huge scope to keep growing its global footprint too. This is thanks to its healthy balance sheet that should support additional investment. Its debt-to-EBITDA ratio stood at 1.46 times at the end of 2022, well below its target of 1.5 to 1.75 times.

This also means that WPP is well placed to continue paying shareholders a healthy dividend. In fact City brokers think rewards will grow strongly through the next few years at least.

| Year | Total dividend per share |

| 2022 | 39.4p |

| 2023 | 40.7p (f) |

| 2024 | 44.1p (f) |

| 2025 | 47.1p (f) |

As a result dividend yields here range between 4.7% and 5.4% for the next three years. Its my opinion that the firm will be well placed to meet these dividend forecasts too. Predicted payouts are covered around 2.5 times by anticipated earnings through to 2025. And of course the firm has that rock-solid balance sheet to fall back on.

Those huge dividend yields make WPP a highly attractive FTSE 100 stock to me. And so does its rock-bottom price-to-earnings (P/E) ratio of 8.6 times for this year. I’ll be looking to add it to my own portfolio when I have spare cash to invest.