Despite periods of volatility, the FTSE 100 and FTSE 250 are roughly at the same levels they started 2023 at. Does this mean UK shares are cheap?

The analysts over at Schroders certainly think so, and I’m inclined to agree. The asset management firm’s head of strategic research believes that neglect of UK equities has resulted in dirt-cheap valuations.

With that in mind, here’s why I’m optimistic that now could genuinely be a once-in-a-decade buying opportunity for investors like me who are looking to hoover up high-quality shares at discounted prices.

Cheap valuations relative to elsewhere

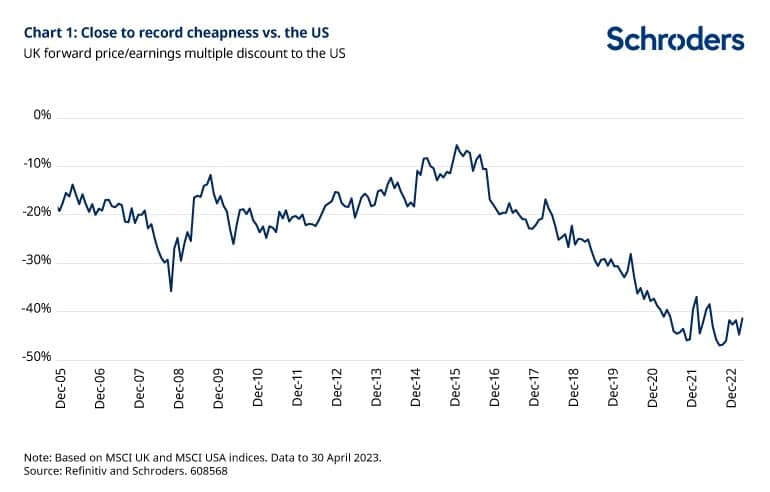

I think one of the best ways to determine whether British shares are undervalued is to compare them with international counterparts.

Doing so reveals that the UK stock market is comparatively cheaper than other markets, particularly the US. In addition, Schroders found that the UK is also trading at a wide discount relative to European equities.

It’s important to remember that there may be valid reasons for the relatively low equity valuations. An obvious one is that the FTSE 100 lacks the same level of exciting tech companies that dominate US indexes.

Beyond this, legitimate fears in regard to the UK’s future economic outlook could also be taking its toll on valuations.

Nevertheless, I think the London Stock Exchange is packed with high-quality companies. What’s more, some boast various combinations of juicy dividend yields and high growth potential.

It’s precisely these companies that represent the best buying opportunities for me.

This means I’m keeping my eye on industry titans like Unilever (dividend yield: 3.7%, P/E: 18), Legal & General (dividend yield: 8.1%, P/E: 6.2), and Glencore (dividend yield: 8.1%, P/E: 3.8).

The prospect of falling interest rates

On top of my conviction that UK shares are too cheap to ignore, I think we’re likely to see interest rates fall in the long run.

Amid the combined pressure of the world economy reopening after Covid and the ongoing Russia-Ukraine war, consumer goods and energy prices pushed inflation markedly higher.

In response, the Bank of England (BoE) has been steadily increasing interest rates. This essentially equates to putting the brakes on the economy. After all, the purpose is to deliberately slow economic activity to allow rising prices to cool.

But interest rates won’t stay elevated forever, even if more hikes are required in the short term. The good news in the long term is that most economists expect interest rates will decline.

This is backed up by the outlook of the BoE. Their experts expect inflation to fall quickly this year and then meet the 2% target by late 2024.

What’s the significance of this? Well, with inflation back under control, the central bank can pursue a more expansionary monetary policy. And that’s a notable characteristic of a bull market.

Therefore, if I had some spare cash lying around, I’d jump at the opportunity to snap up some cheap shares for my portfolio with the intention of holding them for the long run.

While the short-term outlook remains fraught with uncertainty, taking a long-term approach would position me nicely to benefit from any potential upswing.