The Glencore (LSE:GLEN) and Aviva (LSE:AV) share prices have both fallen since the start of 2023. These FTSE 100 household names are down 22% and 7%, respectively, in the year to date.

Both are lower as worries over the global economy and rising interest rates have whacked investor confidence. Investors fear that demand for Aviva’s life insurance products could be set for prolonged weakness.

Meanwhile, Glencore is down as economic headwinds have pulled prices of base metals through the floor. A fresh raft of disappointing manufacturing updates from China suggests the downturn could be a drawn-out one.

Bad news baked in?

| Forward P/E ratio | |

| Aviva | 7.5 times |

| Glencore | 6.9 times |

| FTSE 100 average | 14.5 times |

It’s my belief, though, that these factors are now baked into Aviva and Glencore’s rock-bottom share prices. Both of these FTSE 100 shares trade on forward price-to-earnings (P/E) ratios well below the UK blue-chip average.

I think this represents an opportunity for investors to make market-beating capital gains. As someone who invests for the long term I’m excited by both companies’ earnings outlooks for the rest of the decade.

Profits to soar

Why am I so bullish? Well in the case of Aviva, I expect sales of its life insurance and retirement products to rise strongly as populations in its UK, Irish and Scandinavian markets rapidly age.

The FTSE firm could also witness robust growth across its Aviva Investors unit. This demographic change is putting a growing strain on governments’ ability to pay decent State Pensions. So active investing is taking off as people try to build a financial buffer to help them in retirement.

As for Glencore, profits look set to increase sharply as the world embarks on a new commodities supercycle. Sectors like renewable energy, electric vehicles, construction and consumer electronics will all boost demand for the company’s raw materials over the next decade.

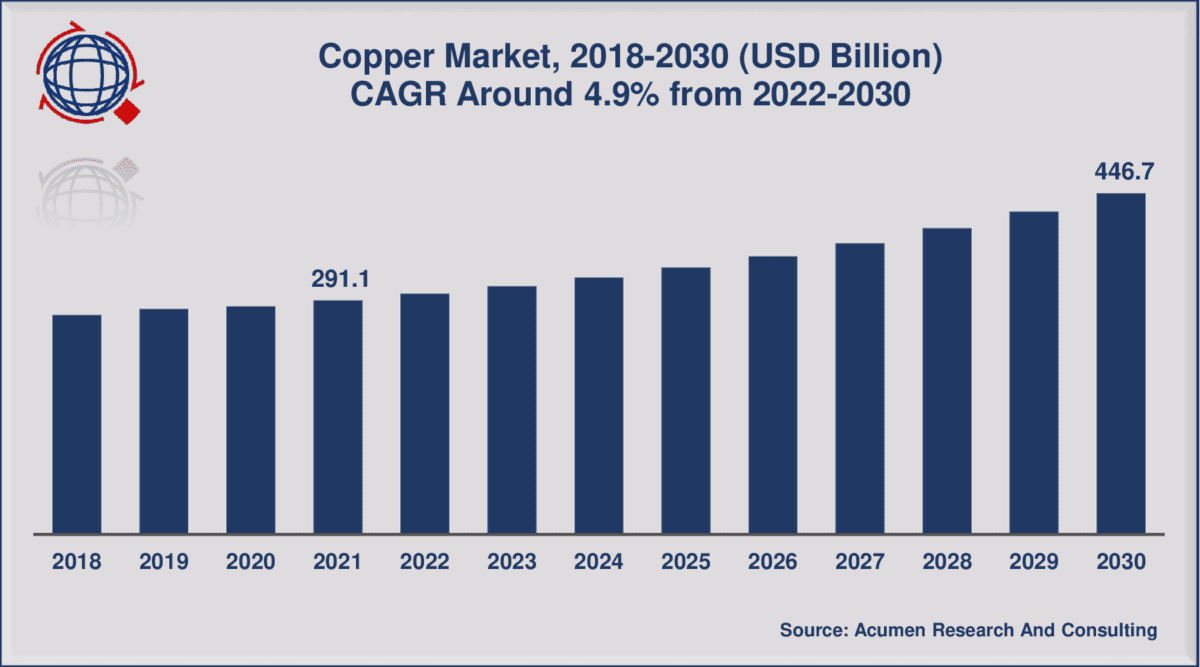

Copper alone is expected to witness stratospheric demand growth in the years ahead, as the chart above shows. And supply here (as in many commodity markets) is tipped to lag behind. Mining giant BHP thinks up to $250bn will be needed for copper mine developments through to 2030.

8%+ dividend yields

| Forward dividend yield | |

| Aviva | 8% |

| Glencore | 10.8% |

| FTSE 100 average | 3.7% |

The truth is that Aviva and Glencore shares don’t just look cheap when it comes to predicted earnings. Both companies also offer huge forward-looking dividend yields that are at least twice as large as the FTSE 100 average.

I think there’s a great chance that both businesses will meet current dividend forecasts. Rapid balance sheet improvement over the past year should give Glencore the financial headroom to pay huge dividends. Net debt fell to just £75m at the end of 2022.

Aviva, meanwhile, had an outstanding Solvency II capital ratio of 212% as of December. Its huge capital reserves even allowed it to launch a £300m share buyback programme in March.

For investors seeking all-round value, I think these FTSE shares are hard to beat.