Barclays (LSE:BARC) is among the largest FTSE 100 banking stocks. However, it’s also the cheapest, trading at just five times earnings. To put that into context, the index average price-to-earnings is around 13.

Banks, which are cyclical, do tend to trade at lower multiples. But I believe Barclays is exceptionally cheap. And with the share price currently hovering above 150p, I think it’s an opportunity investors can’t afford to miss out on.

Let’s take a closer look at why!

Multi-billion-pound tailwind

Net interest margins have soared over the past year as central banks have pushed up interest rates. For banks, this represents a huge change. For example, the Bank of England interest rate did not exceed 1% from 2013 to 2021.

Banks are now reporting much higher interest revenue because they imperfectly pass on higher lending rates to savings customers. And in the near term, this is where Barclays will see revenues rise significantly.

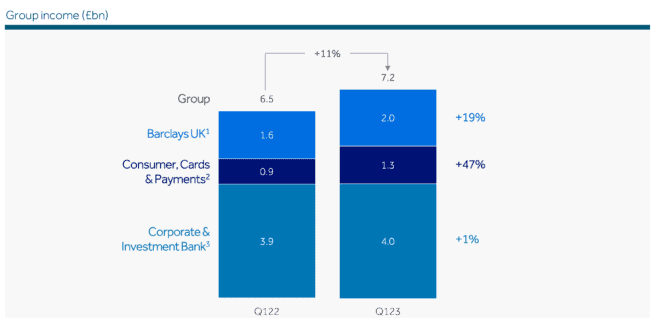

In Q1, the top performing segment was its UK division, a ringfenced consumer lender. Here, profit leapt by a third to £515m, boosted by net interest income.

Barclays is also earning more in the form of central bank holdings. This could be worth as billions of pounds a year. In fact, banking peer Lloyds could earn as much as £200m for every 25 basis point hike based on 2022 central bank holdings.

But there’s more good news

Some analysts are suggesting that this is the best it’s going to get for banks, as interest rates will push downwards in H2 and beyond. But I disagree.

Firstly, all banks have a hedging strategy. And more obviously, Barclays is currently selling fixed interest loans with higher yields and will be buying government debt with higher yields. Collectively, these factors push the interest rate tailwind into the future.

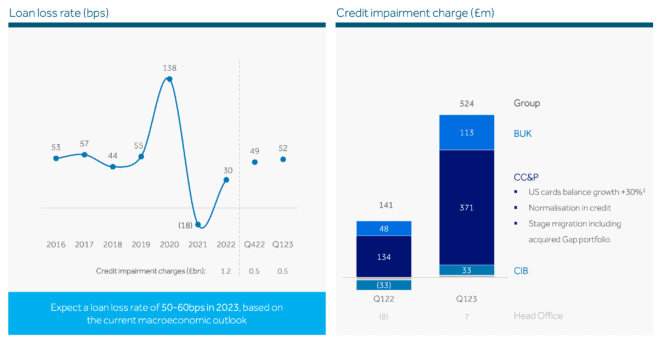

Moreover, there’s a benefit to slightly lower interest rates. When rates are very high, impairment charges on bad debt soar as customers struggle with repayments. We can see the impact of this in Q1 results — bad debt provisions increased to £524m from £141m, reflecting higher US cards balances and anticipated delinquencies.

And it’s the impairment charges that concern me the most in the near term.

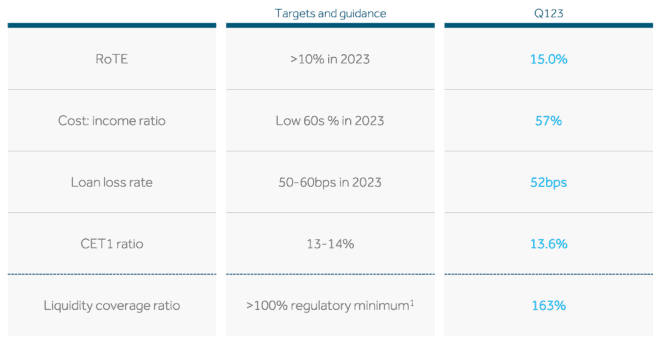

However, amid the recent US banking crisis, it is worth highlighting Barclays’ extraordinarily strong liquidity ratio — 167%. In fact, recent results demonstrated the bank’s solid position.

Buy for the medium term

In the medium term, we can expect to see rates fall to 2-3% — this would be ideal for UK banks. At these rates, we’d see lower impairment charges, but interest margins would remain elevated versus the past decade.

Falling interest rates are also good for business and loan book growth. After all, we’d all rather be on a 3% mortgage than a 5% mortgage.

So with Barclays trading at just five times earnings, I’m buying now because I’m expecting a much more positive interest rate environment for banks in the medium term.

We can also see that the economic forecast is broadly more positive during the medium term too, with more than 2% growth anticipated in 2025 — aren’t we lucky!