I don’t have unlimited reserves of cash to invest in UK penny shares. But here are two I’m looking to buy in the very near future.

Michelmersh Brick Holdings

Homebuilding activity could slow sharply in 2023 as interest rates keep rising. In this scenario demand for construction products might fall off a cliff.

Fresh financials from landscaping specialist Marshalls this week has raised fears of a market meltdown. Here, like-for-like sales plummeted 14% between January and April. This was due partly to lower housebuilding rates and a subdued repair, maintenance and improvement (RMI) sector.

Yet it can be suggested that such a threat is baked into Michelmersh Brick Holdings’ (LSE:MBH) low valuation, a share I’m looking at today. Today, the penny stock trades on a forward price-to-earnings (P/E) ratio of 9.4 times.

I believe that a huge deficit in the UK brick market should help the business to absorb any temporary downturn. Just six weeks ago, Michelmersh noted that “we still have record low inventory volumes of bricks” despite a cooldown in the housing sector. This explains why the firm’s gross margin still sits at elevated levels around 40%.

Domestic brickmakers are boosting capacity to capitalise on this market imbalance. But it’s likely that Britain (which imports a third of all the bricks it needs) will continue to suffer a supply shortage if — as expected — home construction ramps up later this decade. So Michelmersh looks in good shape over the longer term.

I’m also expecting a solid RMI market to boost the company’s revenues once economic conditions improve. Britain’s housing stock is the oldest in the world and requires huge constant investment to keep it in good shape.

Savannah Resources

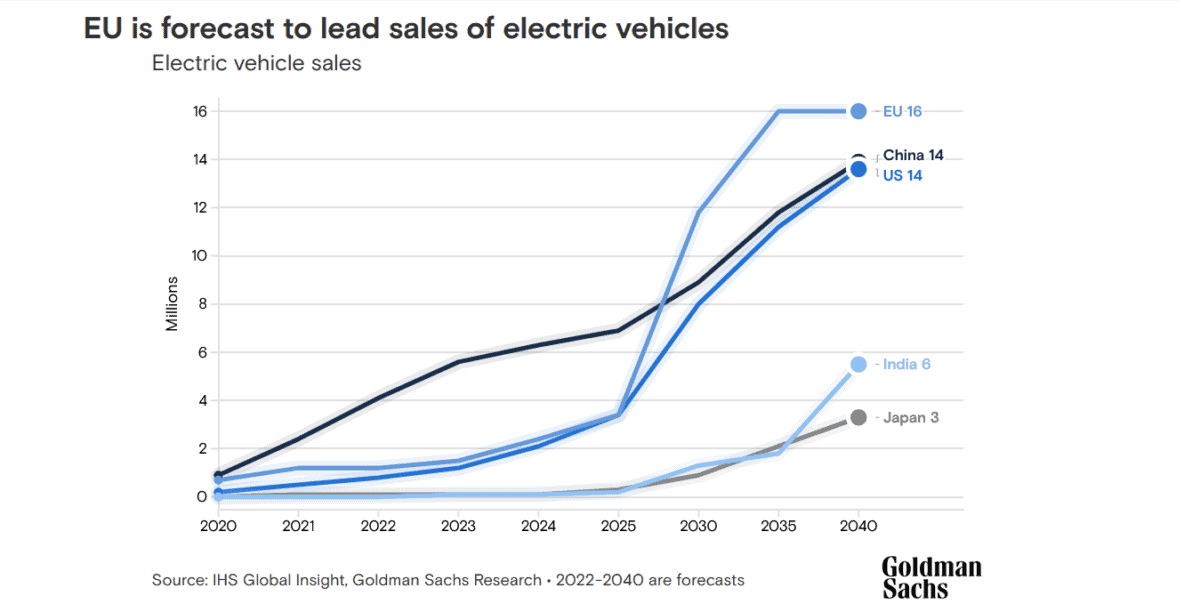

Junior miner Savannah Resources (LSE:SAV) describes its Barroso project in Portugal as “Europe’s most significant resource of hard rock spodumene lithium”. That’s no small claim and it suggests huge profits potential here as electric vehicle (EV) sales rocket.

Investing in early-stage mining companies carries extra risk. Businesses like this £65m market-cap have less financial clout than a FTSE 100 or FTSE 250 operator, for instance. This means they may have to take on debt, or sell, new shares to carry on operating.

However, the rewards can also be explosive. Assuming Savannah gets approval to start producing at Barroso, the cash could flood in as EV production heats up.

The site contains enough lithium to support annual production of 22,000-25,500 tonnes. That’s equivalent to half a million car battery packs every year. There is huge expansion potential in the area too that could supercharge earnings at the company.

Analysts at Goldman Sachs believe EVs will account for half of all global auto sales by 2035. And as the graph above shows, demand growth in Europe is expected to be especially strong. If things go to plan Savannah could deliver outstanding investor returns over the next decade.