The Rolls-Royce (LSE:RR.) share price continues to fly in early 2023 trading. At 154p per share the FTSE 100 engineer’s up a whopping 63% since the start of the year.

A spectacular recovery in the global airline industry has lifted investor demand for Rolls-Royce shares. More flight activity means better demand for the company’s maintenance services, a phenomenon that blasted revenues, profits and cash flow higher in 2022.

I’m not buying

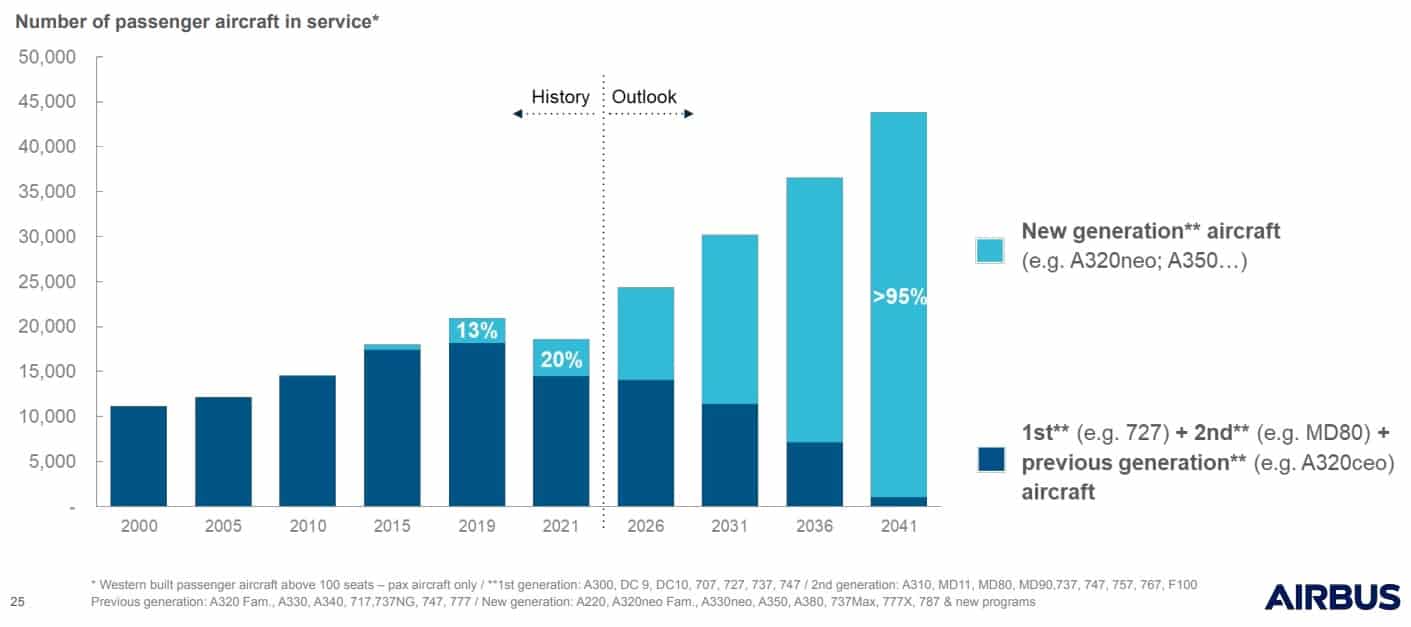

Demand for passenger aircraft is tipped to rise strongly in the coming decades, as the graph above shows. And Rolls-Royce — with its huge investment in new aerospace technologies and massive installed base — could be in great shape to exploit this opportunity.

Yet I still have reservations about buying the company’s shares today. Here are just three reasons why.

#1: Green investment fails

The engineer has been building aircraft engines since 1914 and is an important cog in the industry’s evolution. But developing new technologies always carries an element of risk and its focus on designing cleaner power systems could prove a spectacular failure.

Rolls is, for example, investing huge sums in the development of engines that run on sustainable aviation fuels (SAFs). Yet studies suggest that the commercial potential of these fresh technologies could be limited.

A report from the Royal Society suggests that “at least half of all UK agricultural land” would be needed to grow enough crops to supply all jet fuel in Britain. Pursuing doomed technologies could significantly erode value for Rolls shareholders.

#2: No nuclear funding

Rolls-Royce isn’t just about building technology for civilian and defence aircraft of course. Its plan to build 16 nuclear reactors, for example, could be a solid profits generator as Britain move towards net zero.

Yet a lack of government funding is threatening the existence of its small nuclear reactor (SMR) programme. Alastair Evans, government and corporate affairs director at Rolls-Royce SMR, told Reuters last week that the division risks running out of cash by the end of 2024.

He added that funding negotiations need to begin by the middle of the year. The £500m that Rolls has already ploughed into its nuclear reactor programme might also prove an expensive mistake.

#3: Big debts

The group’s battered balance sheet has improved of late as income and cash flows have recovered. But net debt of £3.3bn at the end of 2022 still makes for uncomfortable reading, in my opinion.

This could compromise the engineer’s ability to fund its growth programmes now and later on. It might also adversely affect its plans to start paying dividends again and future dividend growth.

Debts may remain high if the civil aviation market enters a fresh downturn. Meanwhile, persistently high cost inflation and supply chain issues might also scupper Rolls’ ability to pay this down.

It’s isan interesting recovery story. But on balance, I think there are more attractive UK shares available for me to buy right now.