Having started the year on the front foot, Rolls-Royce (LSE:RR) shares have risen even higher after the company reported a stellar set of full-year numbers. As new CEO Tufan Erginbilgic attempts to turn the firm’s fortunes around, there may not be another opportunity to buy the stock at these levels.

Clear for take-off

Former CEO Warren East may have left, but he definitely left in style as the engineer posted a blowout set of full-year results. Not only did Rolls meet its own guidance, it also beat analysts’ estimates while expanding its margins. In fact, the group topped expectations by such a huge amount, that the current Rolls-Royce share price has surpassed my target price, according to my DCF model.

| Metrics | Consensus | 2022 | 2021 | Growth |

|---|---|---|---|---|

| Underlying revenue | £11.61bn | £12.69bn | £10.95bn | 16% |

| Underlying operating profit | £430m | £652m | £414m | 57% |

| Free cash flow | £64m | £505m | -£1.49bn | 134% |

| Underlying diluted earnings per share (EPS) | 0.3p | 1.95p | 0.11p | 1,672% |

Rolls-Royce was also happy to share that its divisions were firing on all cylinders. Its Civil Aerospace division continues to see a strong recovery in large-engine flying hours, as it reaps the benefits of higher-margin contracts. Meanwhile, Power Systems continues to grow substantially with an order book now worth £4.3bn. Additionally, Defence supported overall cash flow with an increase of 13% in free cash flow.

Time for a turnaround

With Erginbilgic now at the helm, he’s been provided with the perfect stepping stone to continue turning things around, and to bring Rolls-Royce shares back to their pre-pandemic levels. He’s already looking for ways to cut costs and expand margins.

Our transformation programme is already underway and is moving at pace. It will include a strategic review so that we can prioritise our investment towards the most profitable opportunities.

CEO Tufan Erginbilgic

For those reasons, the board is expecting profits to continue growing in 2023. They’re anticipating operating profits of £0.8bn to £1bn, and free cash flow of £0.6bn to £0.8bn. The upbeat guidance is based on the assumption that large-engine flying hours continue to grow and hit 80% to 90% of 2019 levels.

In for the long haul

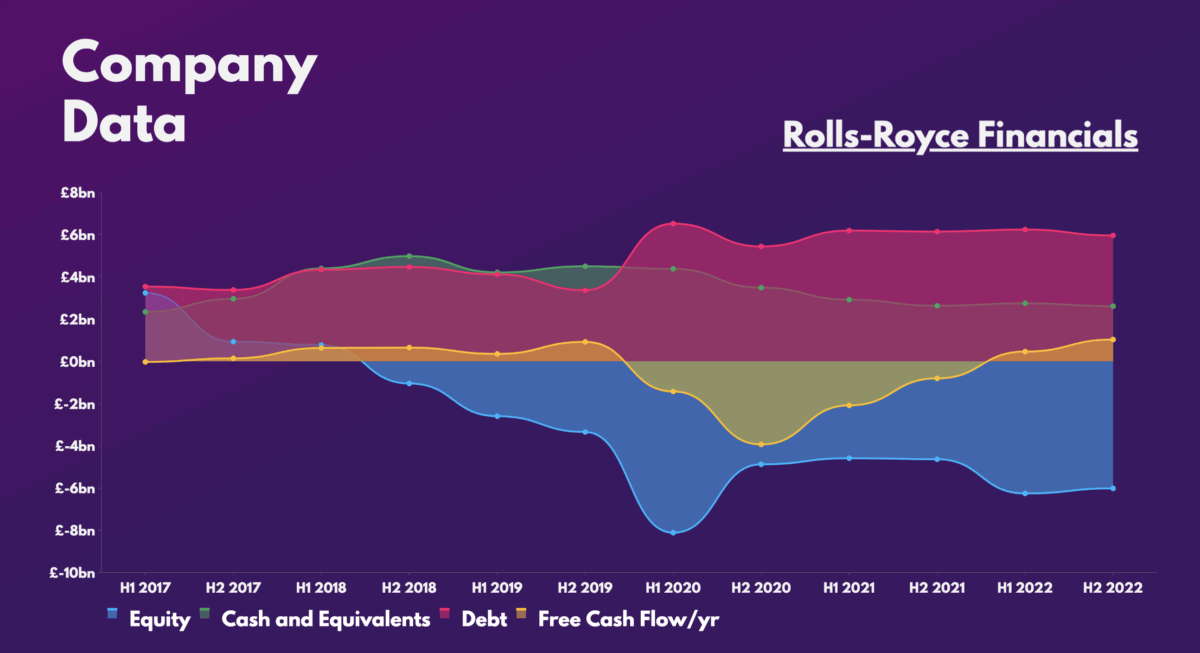

Are Rolls-Royce shares a buy on that basis then? Well, despite its terrible balance sheet, it’s certainly a positive to see the business improving. Its massive debt pile remains a worry, but it’s a relief to see the conglomerate reduce its net debt from £5.2bn to £3.3bn. What’s more, free cash flow is slowly but surely taking off, which could mean the possibility of a return to dividends in the medium term.

And although the Rolls-Royce share price has jumped 30% already this year, its forward valuation multiples still indicate a possible bargain. Analysts are yet to revise their price targets for the stock, but given the blowout results, I’m confident that upgrades will come flooding in soon. For those reasons, I’m planning to buy a little more of the FTSE 100 stalwart’s stock as it continues to recover.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-sales (P/S) ratio | 0.8 | 1.4 |

| Forward price-to-sales (P/S) ratio | 0.9 | 1.3 |

| Forward price-to-earnings (P/E) ratio | 38.9 | 29.8 |