The FTSE 100 still remains home to many of the UK’s highest dividend payers. That said, its medium-cap cousin, the FTSE 250, still has a number of decent names. One particular share that stands out to me is Dunelm (LSE:DNLM), which has a forward dividend yield of 6.8%.

Furnishing good results

Having hit multiple record highs over the pandemic, Dunelm shares dropped by as much as 50% last year. That’s because as the cost-of-living crisis loomed, investors were worried that demand would drop catastrophically. Thankfully, such fears were overdone, and the FTSE 250 stock has now recovered almost all of its losses, and is up 80% from its bottom.

In fact, Dunelm shares have continued their upward momentum this year with a further 25% gain. This is on the back of a better-than-expected set of half-year results, as the company practiced “tight commercial discipline and operational grip”.

| Metrics | H1 2023 | H1 2022 | Growth |

|---|---|---|---|

| Revenue | £835m | £796m | 5% |

| Gross margin | 51% | 53% | -2% |

| Profit before tax (PBT) | £117m | £141m | -17% |

| Free cash flow (FCF) | £102m | £106m | -4% |

| Diluted earnings per share (EPS) | 45.8p | 55.4p | -17% |

Paying dividends

Despite not being a shareholder currently, it’s always a pleasure to see the FTSE 250 firm do well. This is especially the case after I made numerous bullish calls last year, citing the retailer’s strong proposition in delivering value during a cost-of-living crisis, all while growing its market share.

Nonetheless, I regrettably sold my stake back then as the stock had hit my price target. Had I stuck it out, I would’ve earned a handsome gain of 60%. That said, I’m planning to reinvest in Dunelm as it continues to impress on all fronts and, more lucratively, for its special dividends.

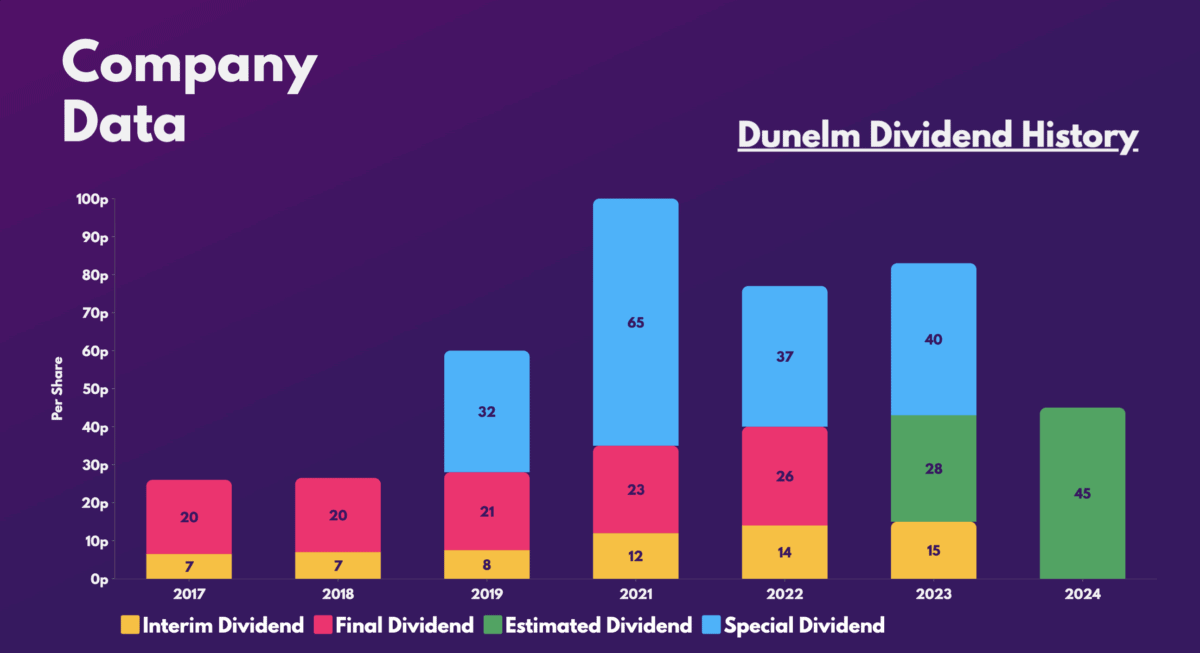

In its half-year report, the group announced a special dividend of 40p per share. Considering a forecast of 28p for its final dividend later this year, and 16p for next year’s interim dividend, this presents a solid 6.8% yield if I were to buy Dunelm shares today.

Cheap stock?

Aside from its dividend, though, there are also plenty of other reasons why I’m keen on investing in the retailer. For one, Dunelm’s growing market share in homewares and furniture shows conviction, as it shows the conglomerate’s drive in growing its business efficiently. This is backed by a growing number of active customers (+5.7%) and higher shopping frequencies (+4.8%).

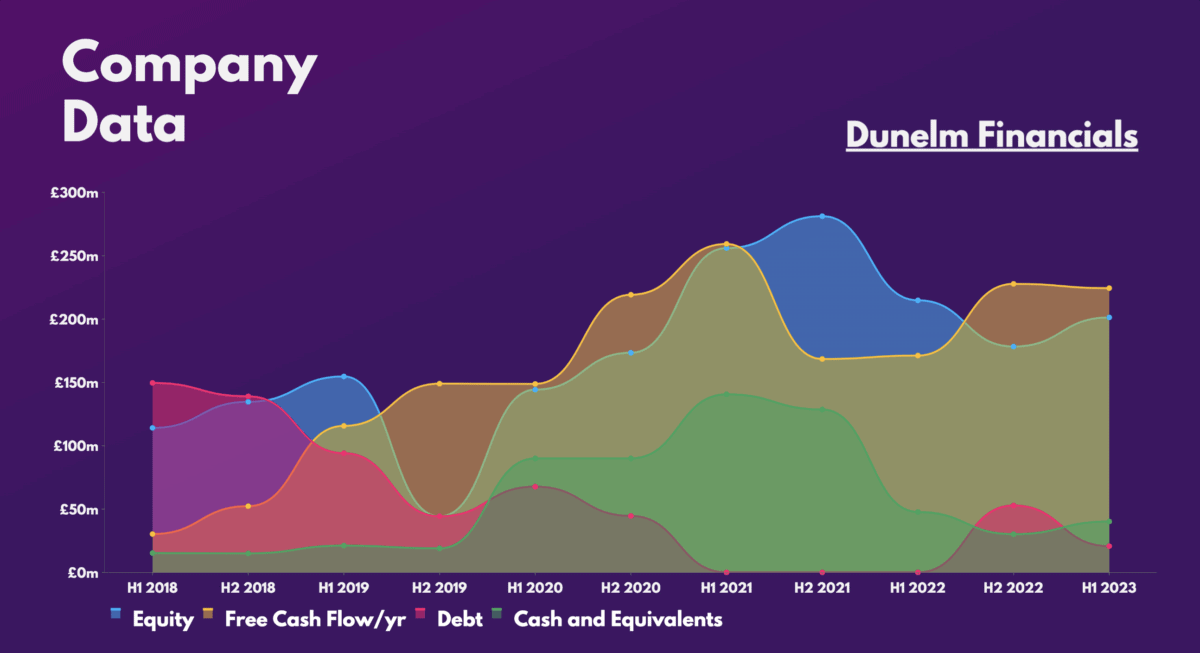

I’m also a huge fan of its robust balance sheet, which boasts a healthy debt-to-equity ratio of 10%. Pair that with a rapidly growing free cash flow and it’s no wonder the furnisher is paying special dividends. What’s more, the initial headwinds that plagued the FTSE 250 constituent are now starting to fade. Inflation is beginning to taper off, and the Bank of England is expecting a softer recession.

Nevertheless, I have my reservations too. The main one being that both its current and future valuation multiples aren’t exactly the cheapest. As such, it’s no surprise to see the shares with an average price target of £12.90, presenting a minimal 5% upside from today’s price.

| Metrics | Dunelm | Industry Average |

|---|---|---|

| Price-to-sales (P/S) ratio | 1.5 | 0.7 |

| Price-to-earnings (P/E) ratio | 16.4 | 11.4 |

| Forward price-to-sales (FP/S) ratio | 1.5 | 0.7 |

| Forward price-to-earnings (FP/E) ratio | 17.2 | 13.9 |

Even so, I believe these estimates haven’t considered a potential rebound of the housing market, which could see higher sales over the medium-to-long term. The stock is certainly on the pricier end, but I believe it’s still fairly valued given its upside potential, free cash flow generation, and strong shareholder returns, hence why I’ll be investing. After all, Warren Buffett once said, “Price is what you pay, value is what you get”.