Last year, Warren Buffett’s fund, Berkshire Hathaway, invested more than $4.1bn into TSMC (NYSE:TSM). The Taiwanese company’s share price had a terrible year, but here’s why I think it could be his best-performing stock for years to come.

Energised by growth

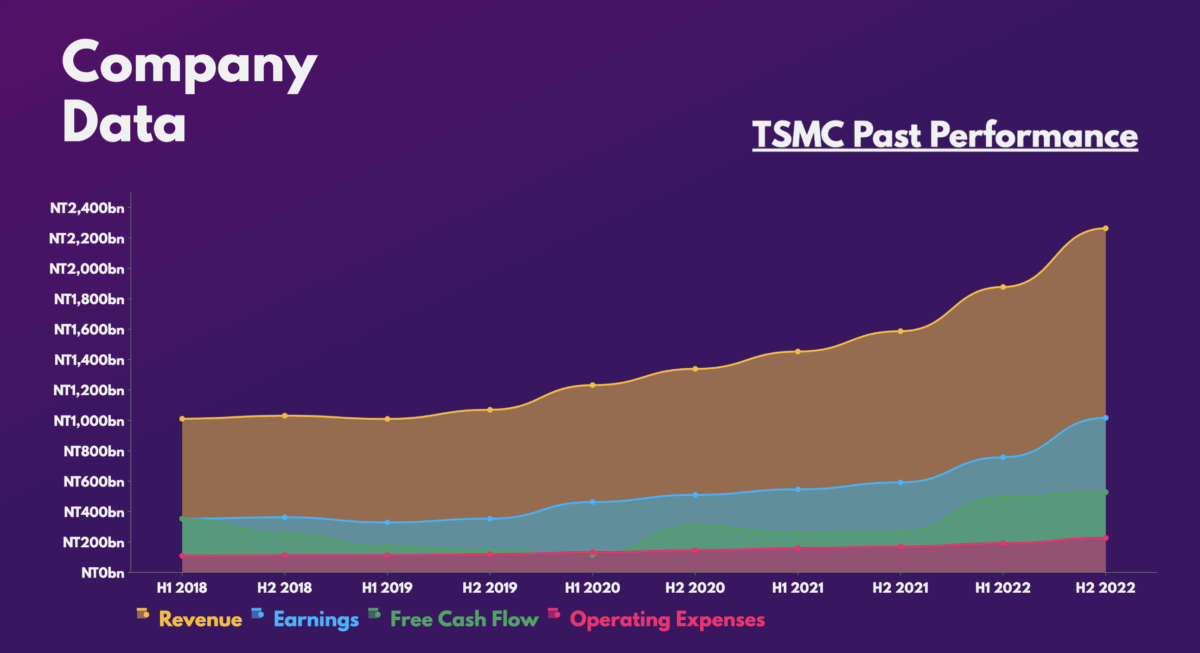

Many chip companies saw their top and bottom lines decline in 2022 due to sky-high inflation dampening demand for electronic goods. However, TSMC managed to buck this trend and post extremely strong growth instead.

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Net revenue | $75.88bn | $56.82bn | 33.5% |

| Gross margin | 59.6% | 51.6% | 8.0% |

| Diluted earnings per share (EPS) | $6.57 | $4.12 | 59.5% |

In fact, since Berkshire declared its position, TSMC stock has risen by over 20%. In contrast, none of Buffett’s other investments has generated a larger return in this short as time.

While analysts aren’t bullish on TSMC’s prospects in 2023, only guiding for single-digit growth, it’s worth noting that the stock market trades based on future cash flows. This means that 2023’s bad numbers have already been priced in. After all, CEO C.C. Wei expects the semiconductor decline to bottom in H1 of 2023 before recovering in H2.

Chipping away the competition

Like the Oracle of Omaha, I’m personally invested in the Taiwanese firm. This is for an array of reasons, but mainly that it’s in a class of its own. The group is head and shoulders above its competition and it looks to extend the gap with the introduction of denser and smaller power-efficient chips.

TSMC is expecting to pour over $32bn worth of capital expenditure (capex) into producing its groundbreaking 3nm chips. This is expected to be its golden nugget for the foreseeable future, as clients move to improve their products with better processors.

Having said that, the vast amount of capex could potentially weigh on EPS and see it grow negatively this year. Nevertheless, I’m confident that TSMC will be able to navigate through this given its history of spending less than initially guided. For example, TSMC guided for capex spend of $42bn last year, but ended up only spending $36.3bn instead. As a result, it wouldn’t be surprising to see it spend less than the $32bn to $36bn it’s guiding for this year.

Smaller chips, bigger margins

As Warren Buffett said, “look for companies with high profit margins”. And there’s no better example than TSMC, which has seen its margins grow exponentially. The chip producer has managed its business very well over the years — keeping operating costs steady while growing free cash flow and earnings substantially.

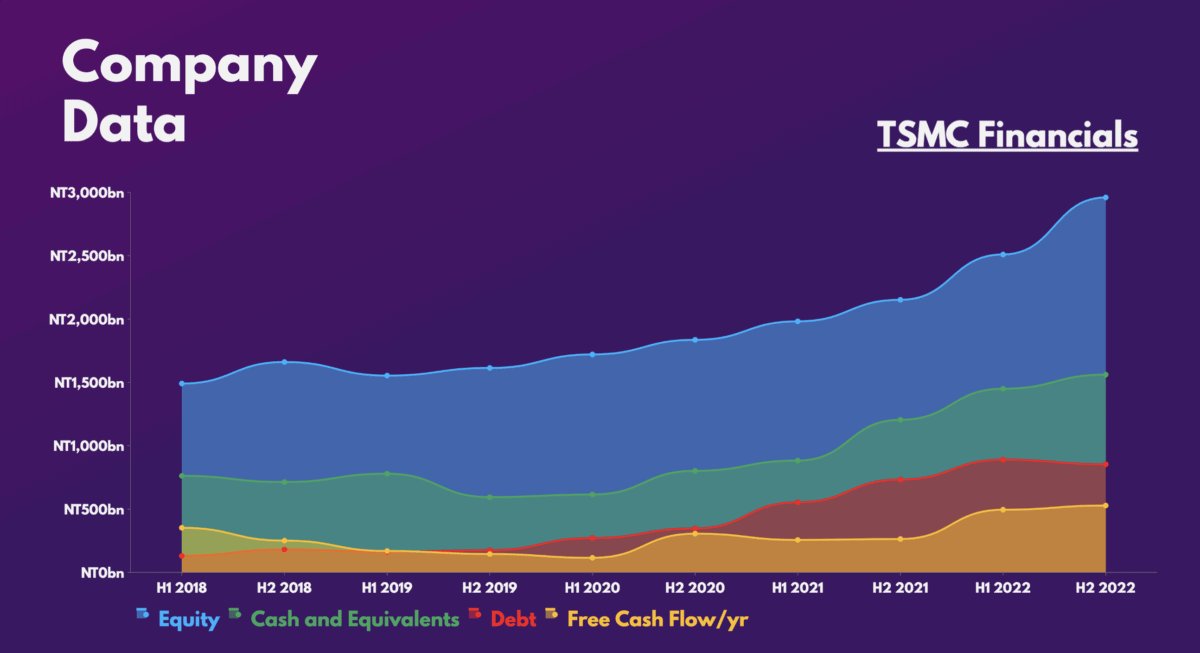

Consequently, this has allowed it to build an extremely robust balance sheet, which Warren Buffett and I are huge fans of. With such a strong debt-to-equity ratio, I’m confident in TSMC’s ability to navigate a prolonged downturn in demand.

All that being said, it’s worth noting that TSMC stock only has an average price target of $104. This indicates only a 15% upside from its current share price, which isn’t ideal for a growth stock. But given my intention to invest beyond a one-year time horizon, the smaller price targets aren’t concerning. The long-term upside potential from TSMC’s current share price is large, especially when taking a global economic rebound in 2024 into consideration.

More lucratively, its forward valuation multiples indicate a cheap bargain for its tremendous growth potential. Thus, I’ll be buying more shares in due course.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Forward price-to-earnings (P/E) ratio | 15.5 | 28.0 |

| Forward price-to-sales (P/S) ratio | 6.0 | 5.5 |

| Price-to-earnings growth (PEG) ratio | 0.2 | 1.2 |