Shares in delivery giant Deliveroo (LSE:ROO) have started the year on the front foot. Its share price may only be up 5%, but there could be plenty of room for it to grow, according to Jefferies, which has a price target of £1.55. Given an upside of 65%, I may buy the growth stock after its positive Q4 update.

Delivering value despite tough times

With food inflation at 18%, many investors were expecting Deliveroo to post a poor set of numbers for 2022, but the opposite happened. Inflation benefited the food delivery company instead, with both its Q4 and full-year figures beating analysts’ estimates.

| Metrics | Q4 2022 | Q4 2021 | FY22 | FY21 |

|---|---|---|---|---|

| Gross transaction value (GTV) | £1.82bn | £1.73bn | £7.08bn | £6.63bn |

| Total orders | 76.3m | 80.8m | 309.9m | 300.6m |

| GTV per order | £23.90 | £21.40 | £22.90 | £22.10 |

Despite total orders and monthly active customers seeing declines, this was offset by the impact of higher prices of items, as Deliveroo’s more affluent customers showed their willingness to spend. This pushed its more important metrics (GTV and GTV per order) up.

Consequently, the FTSE stalwart surpassed its original outlook, ending the year with a -1% margin on an EBITDA basis. This was thanks to a strong H2 performance that saw the firm hit EBITDA breakeven. As a result, management is forecasting to become EBITDA profitable in 2023.

Taking the right routes

How’s that going to happen? Well, Deliveroo has been taking all the right steps to improve its bottom line. The first came with its exits from Australia and the Netherlands. While that initially soured investor sentiment, it proved to be the right call given the poor market share and operating landscape in those regions. In fact, the exit will now provide at least a £20m tailwind to the group’s profits.

Deliveroo has instead decided to plough its resources into entering and maturing its base in more affluent markets such as Qatar, Hong Kong, and the UAE, where it’s seen more success. Pair this with an increase in restaurants (+8k), grocery stores (+2k), and rider satisfaction (+3%) over the past quarter, and I can see a promising investment case forming.

Additionally, the board will continue optimising its growth avenues in advertising while improving their cost structure this year. And as mentioned, CFO David Hancock even said on the earnings call that Deliveroo could hit EBITDA profitability with flat GTV growth this year.

Riding upwards

Nonetheless, that doesn’t remove the significant short-term headwinds of rampant inflation and the cost-of-living crisis. But it shouldn’t detract away from the unicorn’s long-term potential either. The food delivery industry is still young as penetration remains low with a large total addressable market across many countries. This is especially the case in an increasingly digitalised society.

And although the likes of Barclays and JP Morgan rate Deliveroo shares a ‘hold’ with an average price target of £0.96, I’m more inclined to side with Jefferies and Berenberg that have ‘buy’ ratings on the stock with an average price target of £1.45.

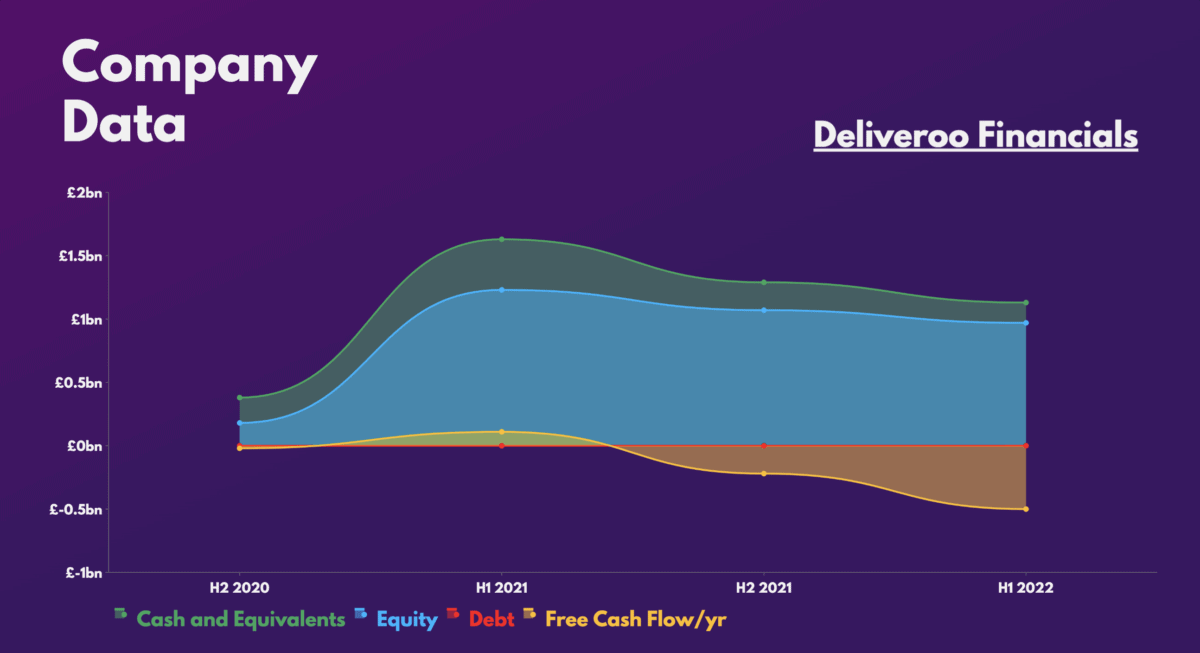

Considering Deliveroo’s strong balance sheet, declining cash burn, and profitability approaching, I feel confident in CEO Will Shu’s ability to navigate his service into generating positive free cash flow soon.

Moreover, having seen its valuation multiples, I think its current share price is reasonable. I believe sufficient downside risks have been priced in with a lack of long-term upside potential being accounted for. Therefore, I’ll be starting a small position in Deliveroo shares very soon.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-sales (P/S) ratio | 0.8 | 2.0 |

| Enterprise value-to-revenues (EV/R) | 0.3 | 2.1 |

| Price-to-book (P/B) ratio | 1.7 | 1.0 |