Bank stocks usually do well when there are high interest rates. As such, Lloyds (LSE:LLOY) shares could outperform its industry and the market this year. I’ll start a position given its potential to rise by as much as 60% from its current share price.

Interesting way to make money

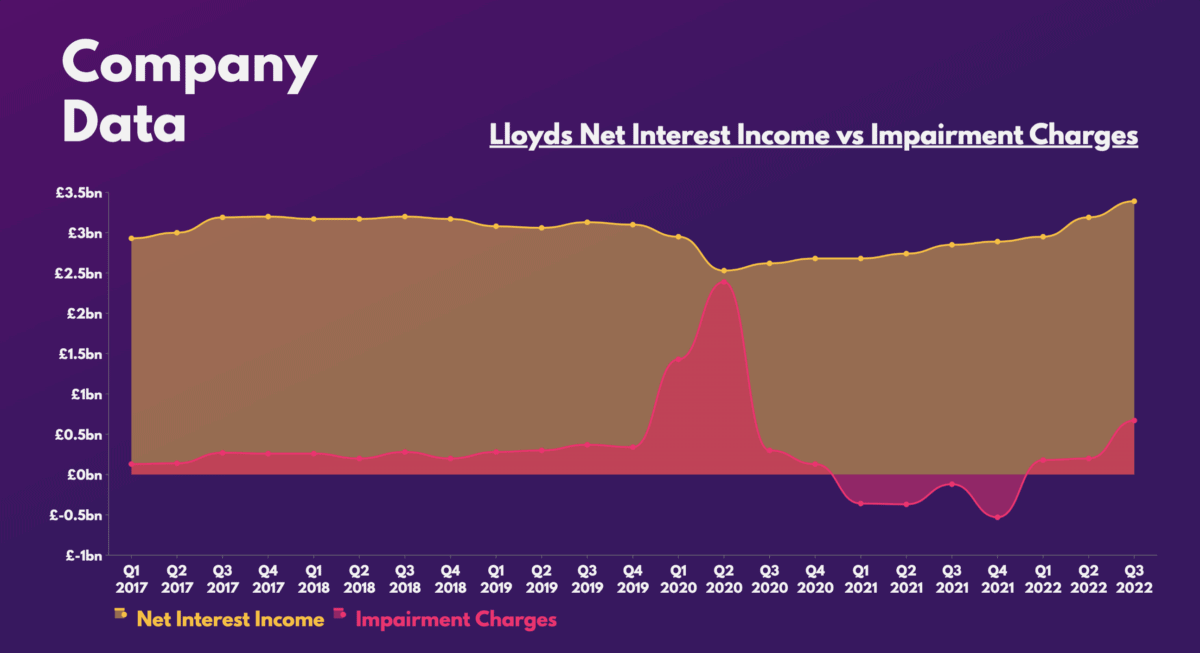

Lloyds earns the bulk of its income from the difference it receives from deposits and interest payments to customers (net interest income). It’s also the nation’s biggest mortgage provider. As such, it was a big beneficiary of interest rate hikes last year. With inflation still in double digits, further hikes are anticipated from the Bank of England this year. This would see the company’s net interest margin widen.

Nonetheless, rate rises are a double-edged sword. This is because impairments are likely to increase as more customers default on their loans, hence negatively impacting the bank’s earnings. But due to Lloyds’ large asset class, it’s been able to protect its bottom line from declining substantially.

Housing worries

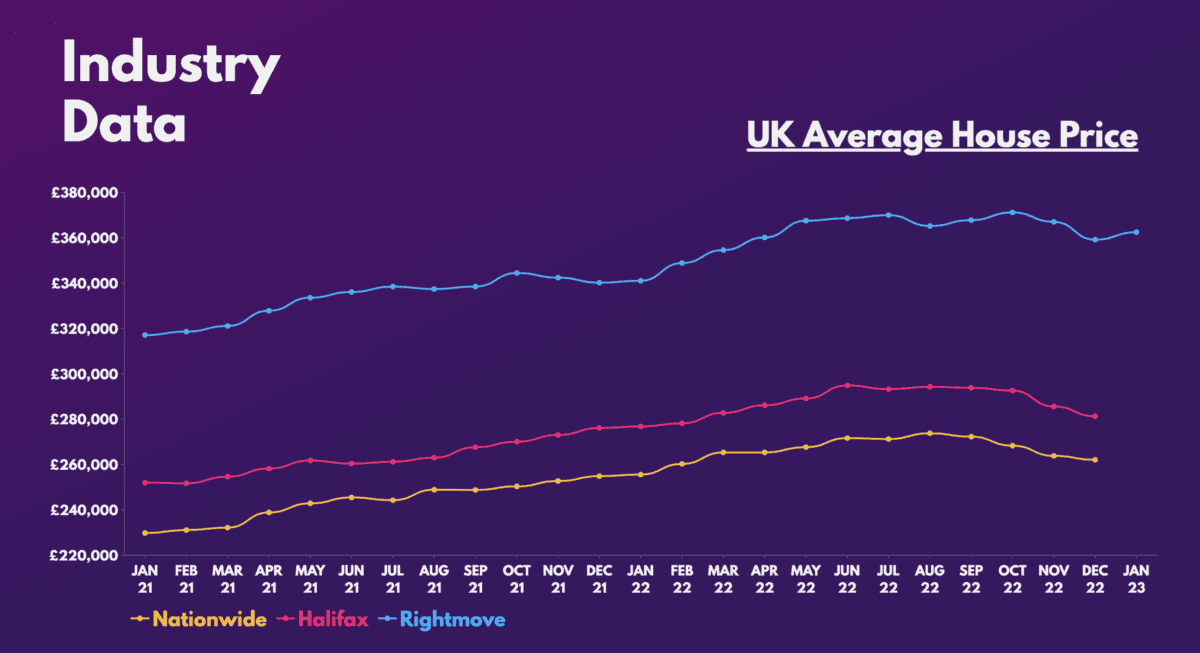

But the million pound question is: for how long can it protect its bottom line from further loan defaults? Housing associations have forecast house prices to decline as much as double digits this year, which doesn’t bode well for the Black Horse bank’s top line.

Nevertheless, the latest housing data gives investors a glimmer of hope. That’s because there’s been some disconnect in where house prices are heading. Rightmove‘s January data showed price growth, while Nationwide and Halifax’s numbers are yet to state otherwise. Either way, it’s also a positive to see mortgage rates continue their decline, which will allow affordability to catch up.

On the other hand, there are fears surrounding the commercial real estate (CRE) market as well. Recent news from Direct Line highlighted a 15% decline in CRE, which could impact UK banks. That being said, Lloyds only has small exposure to the sector (2.5%). Of that amount, over 80% of loans are in stage 1, where credit risks aren’t material. Moreover, the bank’s CRE exposure is well covered by customer profits and collateral, which should relieve any worries in that area.

Banking on its success

The most lucrative reason for me to start a position with Lloyds is that it’s got the backing of many institutions. The likes of UBS, Jefferies, Deutsche, and JP Morgan all have a ‘buy’ rating on the firm. And despite ‘hold’ ratings from Barclays and Berenberg, it’s worth noting that all their target prices are above the current share price.

It’s no surprise why. The FTSE 100 stalwart has very favourable valuation multiples currently with multiple tailwinds to move it higher.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 8.2 | 10.0 |

| Price-to-tangible-book-value (P/TBV) | 0.8 | 0.8 |

| Price-to-earnings growth (PEG) ratio | 0.1 | 0.1 |

What stands out to me most however, is that Jefferies is indicating a 50% upside for Lloyds shares from current levels. The US bank rates it as the number one UK high street bank, stating that rising net interest margins are expanding, with a recession already priced into the stock.

So, although I wasn’t a fan of Lloyds shares previously due to its cyclical nature, these factors have convinced me to change my mind. There seems to be less downside risks than there is upside potential, which is why I’ll be buying the stock in due course.