Since bottoming at 94p in October, shares in International Consolidated Airlines Group (LSE:IAG) have rallied by more than 50%. With the travel sector showing no signs of cooling, I think the stock could continue its trajectory upwards in 2023.

International tailwinds

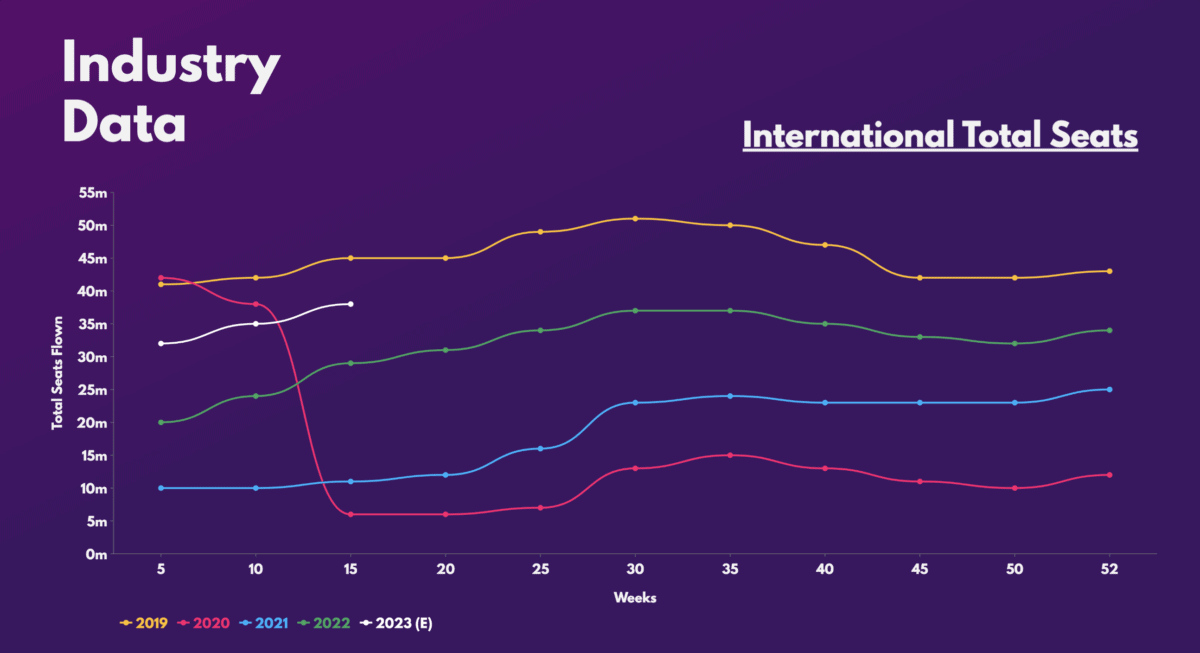

The main reason behind my bullishness for IAG shares is the industry’s strong performance. Travel demand still remains robust as consumers continue to treat themselves to holidays after years of Covid restrictions. As such, it’s no surprise that CEO Luis Gallego guided for passenger capacity to hit 95% of 2019 levels in Q1 this year.

This outlook shouldn’t be taken lightly either. Ryanair‘s most recent update continues to show such strength as sales for flight tickets are showing no signs of cooling. Consequently, the budget airline upgraded its profit outlook for the year.

Additionally, industry data estimates show that forward bookings are strongly inching back towards 2019 levels, especially for international travel. Moreover, as China continues to drop most of its Covid restrictions, this could serve to boost IAG shares.

Upgrading margins

International flights are deemed to be more profitable in most cases. Aside from operating on larger economies of scale, the group also stands to benefit from luxury travel, where First and Business Class products are sold.

Some would argue that the impending UK recession could put a dent in this recovery, but I beg to differ. Luxury goods and services tend to be more immune to economic downturns due to their more affluent customer base.

Furthermore, oil prices are continuing to plummet with more refineries coming back online. This should allow jet fuel prices to decline too. Therefore, all these factors should serve as additional tailwinds to increase IAG’s revenue passenger kilometres (RPK) and expand its margins beyond the likes of easyJet and Jet2.

Rising cash flow

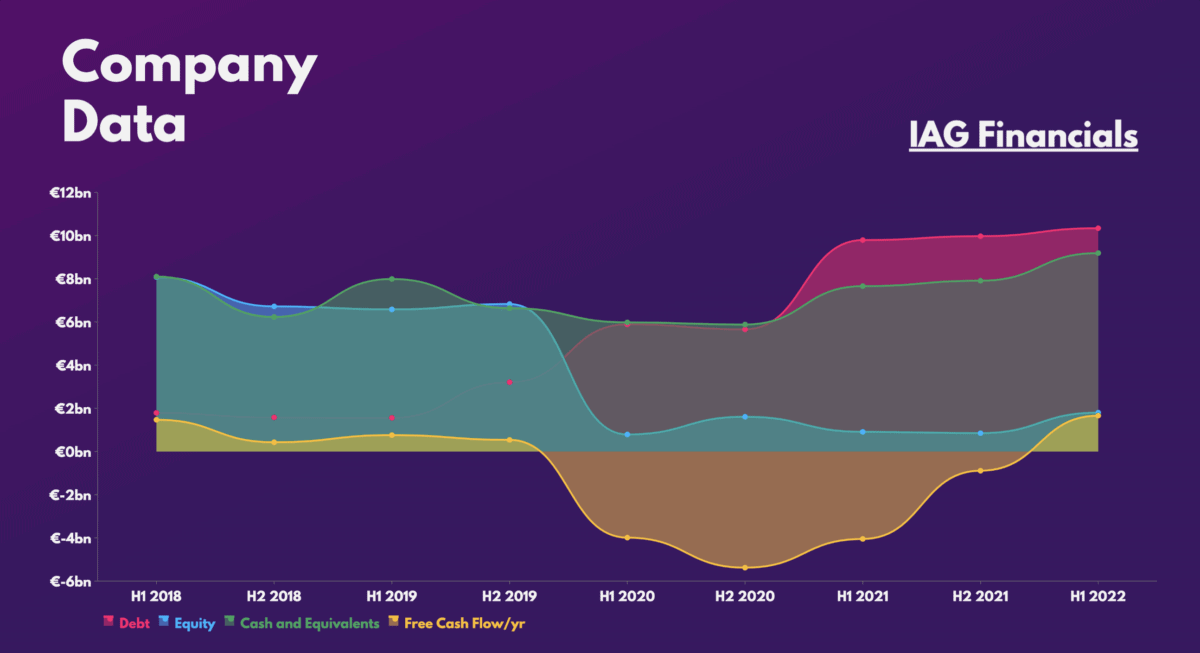

Most crucially, however, investors alike will be expecting this all to translate into strong and positive free cash flow. The most recent quarter saw the conglomerate becoming profitable again. However, investors will need to see an improvement to its balance sheet before pushing the IAG share price further upwards.

Provided debt levels continue to decline, and free cash flow continues to improve, the FTSE 100 stalwart could offer shareholder returns in the form of dividends as soon as 2024. This would invariably attract the attention of many dividend investors. This is because IAG shares could serve to be a lucrative passive income stock.

Having said that, Deutsche and JP Morgan still have the stock on ‘hold’ with an average price target of £1.40. This doesn’t provide much upside from its current share price. In fact, one could argue to sell at these levels! Nonetheless, it’s worth noting that these ratings were given in October, when the IAG share price was at a one-year low.

Given the drastic improvement and recovery in its financial situation, along with a strong travel sector, I’m expecting these investment banks to be fishing out price target upgrades in due course. What’s more, a price-to-sales (P/S) ratio of 0.5 indicates a bargain at these levels. Thus, I’ll be looking to buy IAG stock once my preferred broker launches UK shares on its platform.