Apple (NASDAQ: AAPL) stock could have incredible upside potential in 2023 and beyond, I feel. This same sentiment is echoed by Citi analyst Jim Suva as he’s listed five reasons why the tech company’s shares could surge this year. So, here’s what I think and whether I’ll be buying the stock.

1. Indian potential

China’s Covid lockdowns and poor working conditions pushed workers into striking last month. Consequently, iPhones were sold out in many stores as the bulk of production comes from China. This sparked urgency within management to diversify its manufacturing sites.

As such, India has now been identified by Apple as its next production site. Pair this with the lack of import tax the firm has to pay for importing iPhones from China, and I can see Apple stock benefiting from such a move.

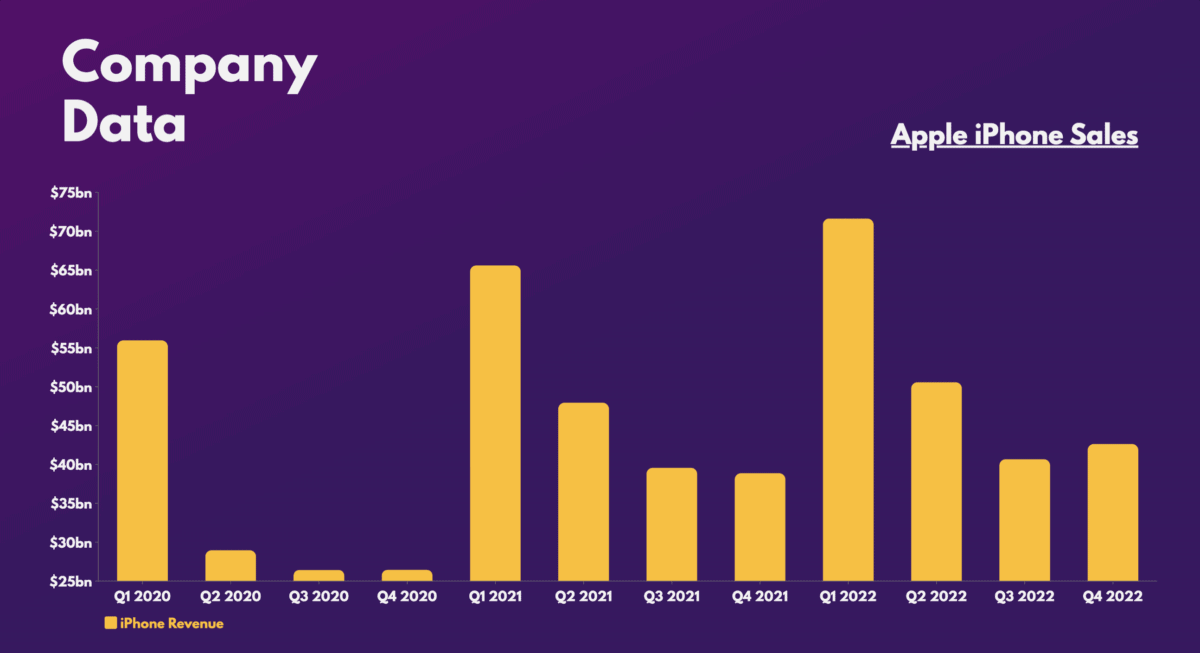

2. iPhone sales to grow

Along with that, Apple stores are also expected to open in India soon. Given that over 95% of the country uses Android phones, the total addressable market for the world’s second biggest population is tremendous.

Although household income in the Asian subcontinent remains low, it’s worth noting that India is expected to become one of the world’s fastest-growing economies over the next decade. This should see affordability and discretionary spending tick up. If iPhone sales history in China is anything to go by, India could see a repeat of this in due course. Therefore, I imagine iPhone sales soaring along with Apple stock this year.

3. AR and VR products

In addition to iPhones, Apple is expecting to unveil its own AR/VR products. Although Meta has been notorious for overspending on its Meta Quest, I believe Apple’s product will cost less to produce.

This is because its AR/VR kit was released to developers last summer. This allows programmers to build the ecosystem before the tech giant churns lots of capital into an unfinished product. Hence, better apps and a smoother interface will give a better reason for consumers to buy the product. After all, Apple stock’s return on capital employed stands at 56%, double most of its closest tech competitors.

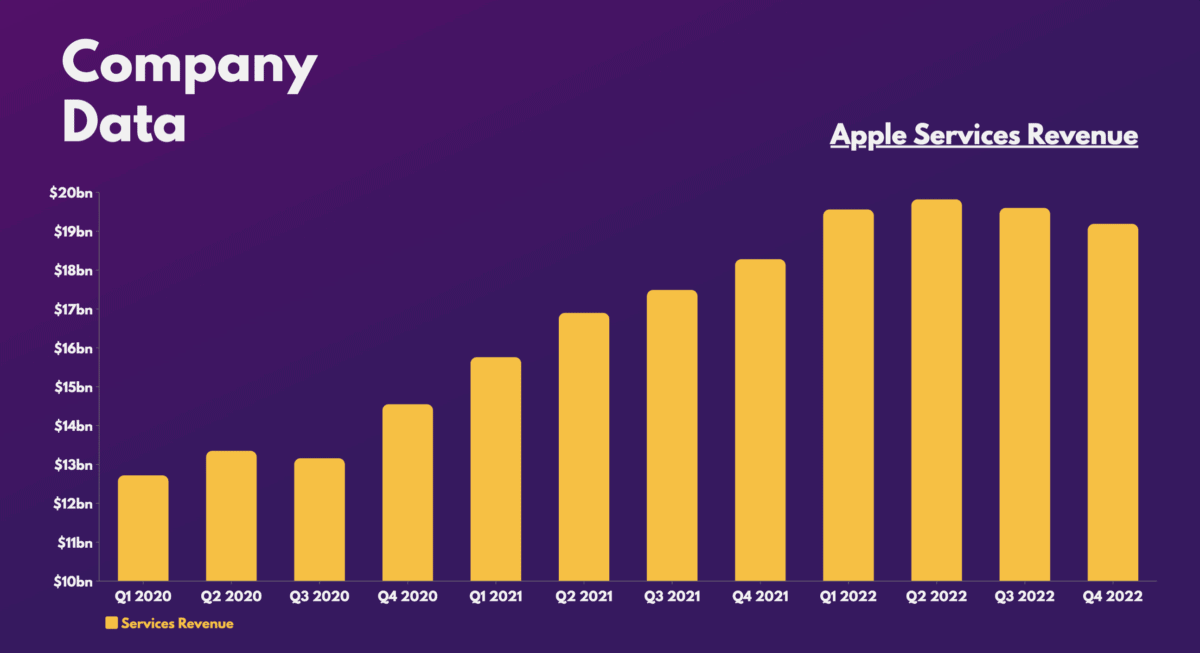

4. Higher services revenue

Aside from products, however, the group also benefits from services revenue. This is the amount of income it generates from its app store, music subscriptions, advertising, etc. With more iPhones forecast to be sold this year, services revenue should also tick up after several quarters of declines.

5. Cash returns

More importantly, the board continues to facilitate large returns to shareholders. Suva sees Apple potentially spending $110bn in stock buybacks, which is almost 5% of its outstanding shares.

It’s for those reasons that the Managing Director of Equity Research at Citi rates Apple stock a ‘buy’, with a price target of $175. Considering that this presents me with a 30% upside from current levels, I’ll be looking to buy the stock very soon.