The UK is most likely headed for a recession this year. Nonetheless, it doesn’t necessarily mean that its leading index will follow suit. In fact, several analysts are forecasting for the FTSE 100 to hit an all-time high in 2023. So, here’s why I think it may be able to do just that.

Profits to hit a high

It’s no secret that the UK’s main index has gotten its fair share of bad press this year. It’s failed to attract more new flotations, and even lost its status as Europe’s largest stock market index to France. Having said that, analysts are bullish about the FTSE 100’s prospects in 2023.

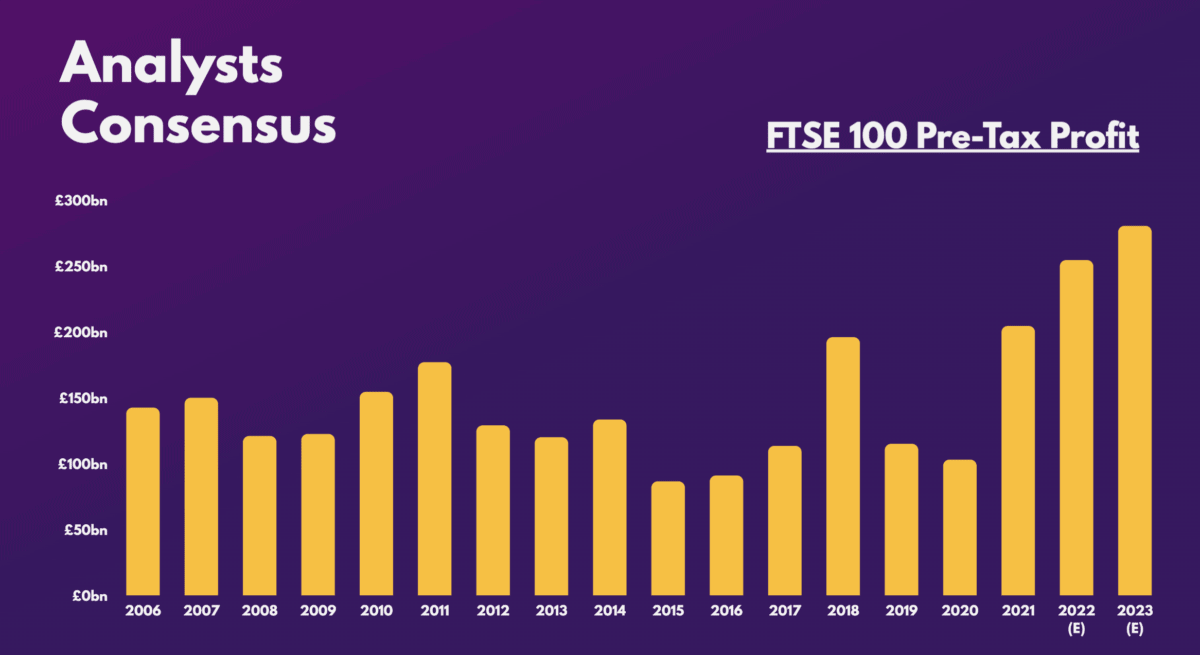

Why’s that the case then? Well, constituents of the index derive the bulk of their profits from outside the UK. As such, a local recession shouldn’t hinder those profits too much. Consequently, analysts are predicting aggregate pre-tax income to hit approximately £280bn.

Banking on bigger dividends

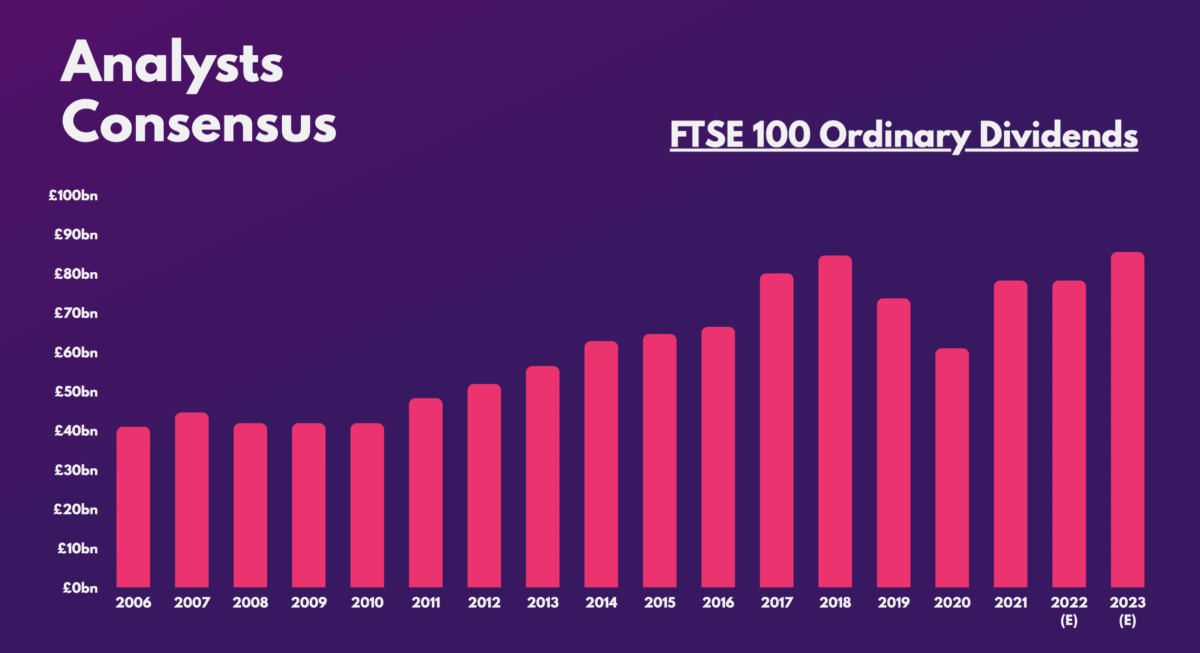

The UK’s top 100 companies have also been enriching value for shareholders, as £55.2bn worth of share buybacks were conducted in 2022 alone. Along with £2.8bn in special dividends paid out, analysts are now expecting £79.1bn worth of dividend payments for the year. In total, that would bring the FTSE 100’s cash yield to 6.6% for 2022.

Such big payouts aren’t guaranteed this year. But it’s worth noting that analysts are still projecting for ordinary dividends to hit an all-time high. That’s because the average company’s financial health is at its highest point since 2012, hence allowing them to cover their promising dividend yields rather comfortably.

Solid commodity prices

Commodity prices have largely been trading in tandem with Chinese economic activity. Therefore, the gradual reopening of the world’s second largest economy could provide some support for the majority of miners like Rio Tinto.

Additionally, financial institutions such as Lloyds should continue to benefit while the Bank of England keeps interest rates relatively high. This should allow for bottom line and dividend growth. Overall, these should serve as catalysts to bring the FTSE 100 above its closing high of 7,877 back in 2018.

| Sector | Pre-tax profit growth | Dividend growth |

|---|---|---|

| Oil & Gas | 24% | 23% |

| Financials | 23% | 18% |

| Mining | 16% | 16% |

| Consumer staples | 12% | 12% |

| Industrials | 7% | 8% |

| Healthcare | 6% | 8% |

| Consumer discretionary | 5% | 6% |

| Utilities | 3% | 4% |

| Telecoms | 2% | 4% |

| Real estate | 1% | 1% |

| Technology | 0% | 1% |

Having said all that, it’s important to note that these are just predictions, and a lot can happen over the next 365 days. More than ever, geopolitical and economic uncertainty remain at elevated levels, and the past year only serves to show how such events can greatly impact the stock market.

Nevertheless, I’m one to agree with the above consensus. With an expected dividend yield of 4.1%, and with a forward price-to-earnings ratio of 11, such valuation multiples definitely catch my eye. Earnings growth of 9% isn’t the most exciting, but given estimates for an earnings declines in the US, the FTSE 100 definitely seems like a safe bet.

The index could very well decline in 2023, but I’m a huge believer in Foolish investing — that is, investing for the long term. Thus, I’ll be buying the UK’s top shares in 2023 and will continue to pound-cost average even if it declines.