Shares in British Telecom (LSE: BT.A) haven’t had the rosiest time this year, dropping approximately 35%. Consequently, the firm’s valuation multiples indicate that its shares could be cheap. Pair this with an expected dividend yield of 6.6% and BT shares are certainly worth exploring.

Reaching out

BT earns its money through different segments — Consumer, Enterprise/Global (BT Business), and Openreach. But it’s Openreach that gets me excited regarding its growth potential. The arm constitutes almost a quarter of its revenue and is responsible for connecting homes, small businesses, and other telecommunication networks.

The FTSE 100 firm is building Britain’s biggest fibre-to-the-premises network. And it’s offering internet service providers (ISPs) the opportunity to use its fibre lines. However, due to its status as a monopoly, the company is being investigated amid competition concerns.

Last week, Openreach announced a new set of prices for its competitors, which regulators will now assess. Provided they’re approved, the telecoms stock could benefit over the long term, given the tailwinds associated with increased fibre optic adoption.

Business boosters

Aside from that, there are a couple of other reasons for me to get excited about BT. For one, it’s finally planning to merge its Global and Enterprise divisions. CEO Philip Jansen predicts that the move will allow the group to save an additional £100m on top of a £2.5bn-£3bn in cost savings by FY25.

Additionally, the merger will allow it to develop and deliver better products and services for its business customers, while strengthening its dominant position in the industry.

To complement this, the conglomerate also expanded its partnership with Nokia. The deal will allow BT to use its AVA Analytics software for another five years. This will provide Britain’s largest telco firm with more AI tools to improve its services.

For instance, the software allows call centre agents to assess in-home issues at a quicker and more accurate pace. These perks should not only serve to improve the company’s reputation, but also its top and bottom lines in the long run.

Planning for passive income?

Having said all that, do I view the stock as a potential buy and solid passive income generator? Well, there’s certainly a case to be made. Its current dividend payout of 7.7p per share is forecast to remain steady this year. That would mean it continuing its current yield of 6.6%. And despite lagging revenue growth, the firm can cover its dividend up to 2.6 times, making it very secure.

Moreover, BT shares are trading at rather cheap valuations. Its current price-to-earnings (P/E) ratio is close to a five-year low of 6. Its others ratios remain relatively low too, as this table shows.

| Metrics | Valuation Multiples |

|---|---|

| Price-to-earnings-growth (PEG) ratio | 0.6 |

| Price-to-book (P/B) ratio | 0.8 |

| Price-to-sales (P/S) ratio | 0.5 |

| Enterprise-value-to-EBITDA ratio | 3.3 |

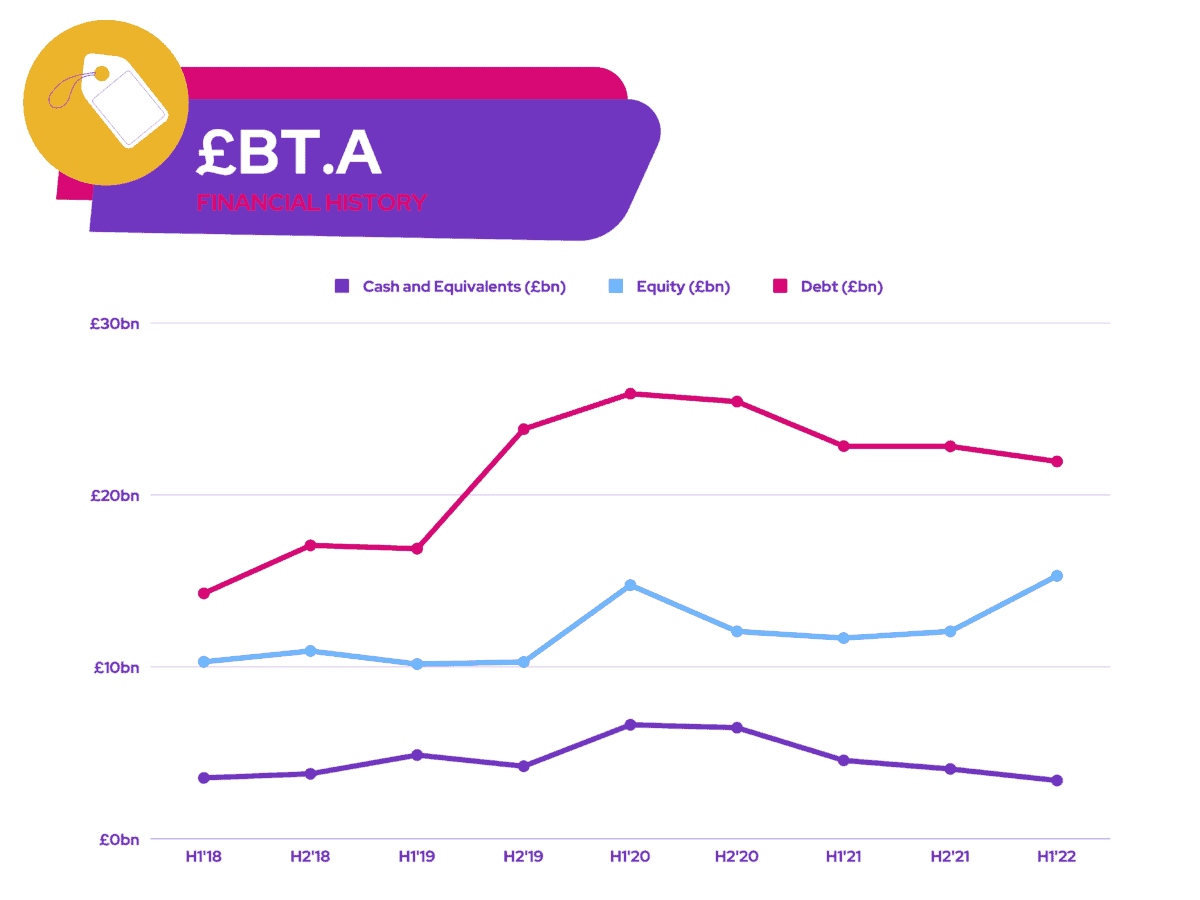

That being said, as an investor, I don’t just look for dividends, I also look for growth. While I anticipate BT’s cost structure improving over time, I’m not so convinced about its earnings potential. It’s got a mountain of debt to address, and plenty of regulatory red tape to get through.

Barclays may have an overweight rating on the stock, but that’s very dependent on regulators approving its Openreach prices and finding no fault in its mid-contract price increases for customers. Therefore, given the uncertainty surrounding these developments, I won’t be investing in BT shares for the time being.