The Lloyds Banking Group share price packs a real solid punch when it comes to value. Today, the FTSE 100 bank carries an 5.7% dividend yield for 2022. On top of this, its forward price-to-earnings (P/E) ratio sits at a modest 6 times.

But these figures are based on broker forecasts I expect to be steadily downgraded. Rising interest rates will boost the bank’s profits by spreading the rates it offers to savers and borrowers. But I still believe profits could slump as the economic downturn smacks revenues and drives up loan impairments.

So here are two dividend stocks I’d much rather buy for passive income.

The Renewables Infrastructure Group

The Renewables Infrastructure Group (LSE: TRIG) is, in fact, a UK share I already own. I bought it to capitalise on increasing long-term demand for green energy. The business has a growing portfolio of solar, wind and battery storage assets currently valued at around £3.7bn.

I also invested in TRIG because of its broad geographic footprint. Its assets can be found across the UK, Ireland, France, Germany, Spain and Sweden. This means group profits aren’t vulnerable to unfavourable weather conditions (like lack of wind) in one or two areas.

I think it could be a top stock to buy for uncertain times like these too. Electricity demand remains broadly constant at all points of the economic cycle. So, unlike Lloyds, I think profits here will remain robust over the next couple of years.

The Renewables Infrastructure Group trades on a forward P/E ratio of 6 times. It also carries a healthy 5.3% dividend yield right now.

I’m aware that changing energy price-cap legislation could hit the valuations of TRIG’s assets. However, it’s my opinion that, on balance, the potential benefits of owning the business outweigh the risks.

Urban Logistics REIT

I also think Urban Logistics REIT (LSE: SHED) has superior growth (and thus dividend potential) to Lloyds shares.

This UK share owns and operates distribution hubs and warehouses, making it a critical part of the e-commerce ecosystem. New supply of these sorts of properties remains weak, meaning that rental income continues to grow strongly.

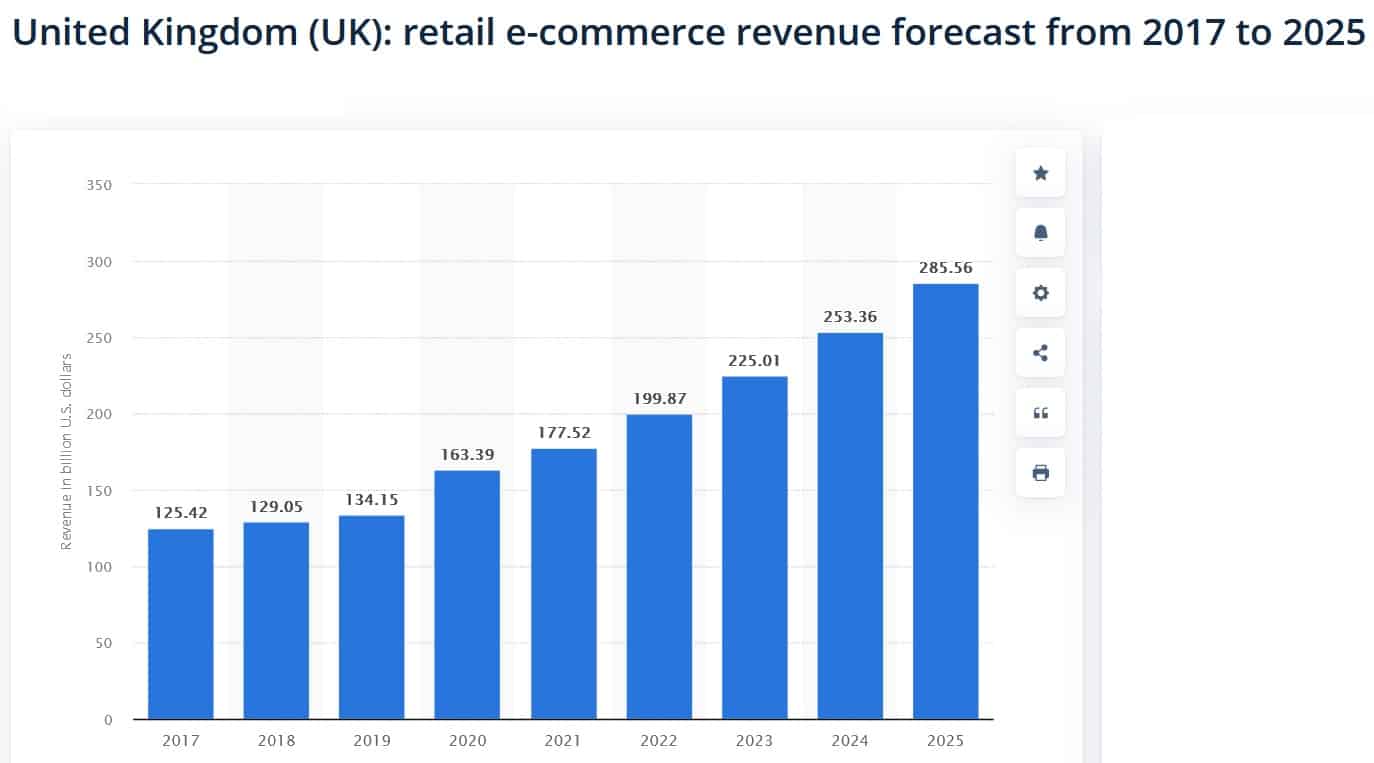

At the same time, demand is exploding as consumers increasingly migrate online to shop. Analysts at Statista expect UK internet sales to continue rising at a rapid pace too, to the mid-2020s at least.

This bodes well for future earnings and, by extension, dividends at Urban Logistics. The company’s classification as a real estate investment trust (REIT) means it’s obliged to pay at least 90% of annual profits out in the form of dividends.

Rising construction costs pose a risk to the company’s bottom line. But I still think it’s a top buy right now. And its forward dividend yield currently sits at an impressive 5.8%.