The stock market downturn has made the last 12 months painful for many investors, including me. The damage has been particularly acute for those with big positions in growth stocks like Darktrace (LSE: DARK). So, what return would I have made if I’d invested in Darktrace shares a year ago and do I think they’d be a bargain buy for me today?

Let’s explore.

One-year return

The rapid growth and subsequent decline in the Darktrace share price is a remarkable story.

A year ago, the FTSE 250 stock was trading near its all-time high at £9.12 per share after making a stock market debut less than six months earlier. The Cambridge-based company was buoyed by excitement surrounding its AI technology designed to protect critical national infrastructure and global corporations from cyber-attacks.

It’s since plummeted 63% to £3.38 today. The fall was driven by multiple factors including broker downgrades, a recent collapse in takeover discussions with US private equity firm Thoma Bravo Advantage, and fraud accusations levelled against the company’s former adviser Mike Lynch.

To illustrate the point, in October 2021 I’d have been able to buy 109 Darktrace shares for a total of £994.08. Today, my shareholdings would have shrunk in value to £368.42, with no dividends to soften the blow.

By contrast, £5.92 in leftover cash from my initial £1,000 investment would still be enough to buy a pint of beer!

Investing lessons

Two lessons from this saga stand out to me.

The first is understanding stock market volatility. Fluctuations in share prices are often more pronounced in growth stocks, such as Darktrace. While there are sometimes great bargains to be found when equities are oversold, positive returns are far from guaranteed.

This leads me to the next valuable lesson — the Foolish investing approach. In my view, adopting a long-term investing horizon spanning many years (ideally decades) is the best way for me to ride out volatility and maximise my chances of making money.

Where next for Darktrace shares?

Today, Darktrace is in a very different position than it was a year ago. The stock’s currently hovering above the £3.30 level where it finished its first day of trading in April 2021.

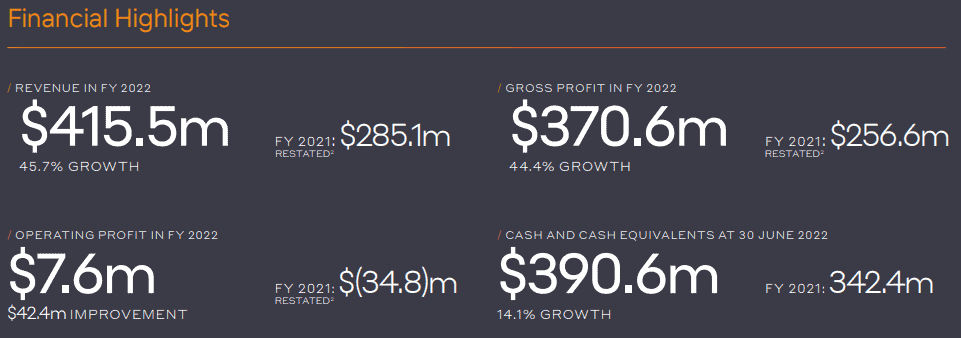

On the face of it, the current valuation improves the risk/reward profile for me. I can find several reasons to be bullish. The FY22 results showed strength across a number of financial metrics. Other key highlights included a 28.7% uptick in employee headcount to breach the 2,000 barrier. The business also achieved impressive 290% growth in its free cash flow, which is now just below $100m.

Nonetheless, unresolved legal troubles engulfing Mike Lynch complicate the picture and add uncertainty to the outlook for Darktrace shares. The company also isn’t immune to broader economic headwinds. It acknowledges spiralling inflation affects “recruitment and retention of staff” due to “pressures on salaries and costs within the business”.

Would I buy?

At today’s price, I’m tempted to enter a position. However, in this febrile investing environment, I’d prefer to invest in companies with established track records of surviving recessions. After all, Darktrace is less than a decade old. I won’t be buying today.