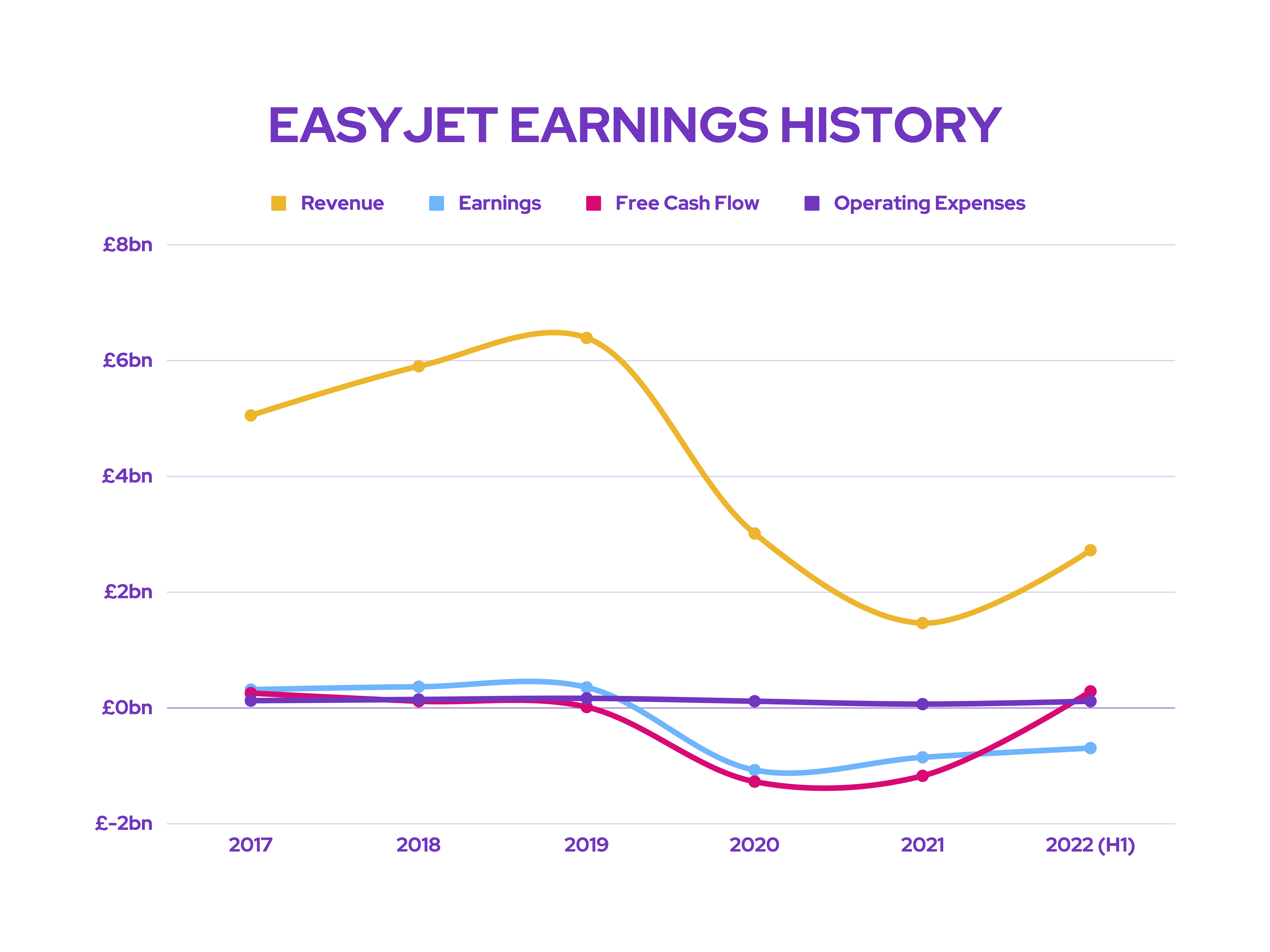

Airline shares haven’t had the best time this year, and easyJet (LSE: EZJ) has been no exception. Its shares are down over 50% and the company has got plenty of headwinds to deal with. Having said that, these factors may have already been priced in. Could now be a good time for me to buy its stock then?

Recovery isn’t easy

When easyJet released its latest trading update, its shares didn’t pop as expected. Its Q4 numbers were generally positive as the company flew 26.3m seats and operated at 88% of its pre-Covid levels. However, despite a strong performance, the airline still expects its full-year profit before tax to come in negative at -£183m.

| Metrics | FY 2022 | FY 2021 | FY 2020 | FY 2019 |

|---|---|---|---|---|

| Total revenue | c.£2,515m | £1,458 | £3,009m | £6,385m |

| Headline EBITDAR | c.£570m | -£551m | -£273m | £970m |

| Profit before tax | c.-£183m | -£1,136m | -£835m | £427m |

| Passengers carried | 69.8m | 20.4m | 48.1m | 96.1m |

| Passenger load factor | 85% | 72.5% | 87.2% | 91.5% |

| Seats flown | 81.5m | 28.2m | 55.1m | 105.0m |

From these figures, it’s easy to understand the lack of enthusiasm surrounding easyJet shares now. The budget airline still lags behind its pre-pandemic numbers by quite some distance, and a return to profitability still looks quite some way off.

No turbulence?

Nevertheless, there are a couple of things investors can cheer for. For one, easyJet expects to fly around 20m seats in Q1, which is a 30% increase on an annualised basis. More importantly, however, load factors are reported to be currently ahead of the same point in 2019, thus showing that the company is successfully battling through strong headwinds of a potential recession.

“Our 2023 summer season went on sale last week and we were filling the equivalent of more than four A320 aircraft a minute in the opening hours, demonstrating the continued demand.”

CEO Johan Lundgren

The second thing would be the company’s hedging strategy going into FY23, as it battles high fuel costs and a strong US dollar (USD). easyJet has increased its share in fuel and the greenback hedges, with around 56% and 62% hedged respectively. Moreover, the firm has been able to hedge these commodities at significantly better rates than the overall market.

| Metrics | Jet Fuel (H1 2023) | Jet Fuel (H2 2023) | USD (H1 2023) | USD (H2 2023) |

|---|---|---|---|---|

| Hedged position | 69% | 44% | 78% | 47% |

| Average hedged rate | $802/MT | $897/MT | $1.29/GBP | $1.26/GBP |

| Current spot rate (12/10/2022) | $1,100/MT | $1,100/MT | $1.11/GBP | $1.11/GBP |

Although these rates should allow easyJet to protect its bottom line, hedges are also a double-edged sword. That’s because a sudden decline in fuel prices and/or USD strength could further eat into the company’s profits. That being said, analysts are still expecting unhedged parts to impact the firm’s bottom line.

Up and away?

Taking everything into account, has the easyJet share price bottomed? Well, there’s no way of telling given the current geopolitical and economic climate. Even so, its outlook remains promising despite challenging times, as competitor IAG also released a bullish trading update yesterday.

Furthermore, easyJet’s balance sheet is well equipped to weather another slow down in travel demand. Management reported that the company finished its financial year with cash levels of around £3.6bn with net debt of approximately £0.7bn.

After all, Peel Hunt reiterated its ‘buy’ rating with a price target of £2.93 for the stock. What’s most lucrative, though, is the average price target among analysts, at £5.71. This means that I can almost double my money if I decide to invest at current levels, provided analysts get their estimates right.

Despite that, I’m not a fan of the company’s business model as it produces low profit margins. Hence, I won’t be investing in easyJet shares. I still think the company has plenty of potential and I wish them and their shareholders the very best.