Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Aviva

Aviva (LSE: AV) is a British multinational insurance company. It has millions of customers across its core markets. Aviva is also the UK’s largest general insurer. This week, a non-executive director purchased shares using a proportion of their net director fees.

The insurance giant has suffered a rather tumultuous week, dropping more than 10%. This is due to fears that the company’s pensions and investment management divisions could suffer greatly from the sell-off in gilts. That being said, the purchase from non-executive director Pippa Lambert could hint that insiders don’t think the overall market reaction this week will affect Aviva in the long term.

- Name: Pippa Lambert

- Position of director: Non-Executive Director

- Nature of transaction: Share Purchase Scheme (Partnership Shares)

- Date of transaction: 27 September 2022

- Amount bought: 1,288 @ £4.19

- Total value: £5,393.40

Kingfisher

Kingfisher (LSE: KGF) is an international home improvement company. The firm has over 1,500 stores and numerous household brands under its group. These include the likes of B&Q, ScrewFix, and TradePoint.

The FTSE 100 company reported that its CCO sold a rather substantial number of shares earlier this week. That being said, it’s worth noting that these shares were, in fact, sold on 21 September 2022. Still, the director dealing doesn’t help shore up investor confidence after Kingfisher posted earnings that saw profits slump by 30% on an annual basis.

- Name: Sebastien Krysiak

- Position of director: Chief Commercial Officer

- Nature of transaction: Sale of shares

- Date of transaction: 21 September 2022

- Amount sold: 20,132 @ £2.35

- Total value: £47,346.44

DS Smith

DS Smith (LSE: SMDS) is a multinational packaging business. It manufactures sustainable corrugated case materials and specialty papers. In addition to that, it also provides recycling and waste management services along with plastic packaging that is reusable and recyclable.

This week, a couple of huge director dealings were reported by the FTSE packaging company. Among this, a group finance director as well as a non-executive director opted to buy and sell shares in large volumes. It’s worth noting that the following transactions occurred in the previous week and were only reported this week.

- Name: Adrian Ross Thomas Marsh

- Position of director: Group Finance Director

- Nature of transaction: Deferred Share Bonus Plan

- Date of transaction: 23 September 2022

- Amount vested: 79,617 @ Nil

- Total value: N/A

- Name: Adrian Ross Thomas Marsh

- Position of director: Group Finance Director

- Nature of transaction: Sale of shares

- Date of transaction: 23 September 2022

- Amount sold: 38,493 @ £2.64

- Total value: £101,429.06

- Name: Alan Johnson

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 23 September 2022

- Amount sold: 12,596 @ £2.62

- Total value: £32,999.84

Types of shares

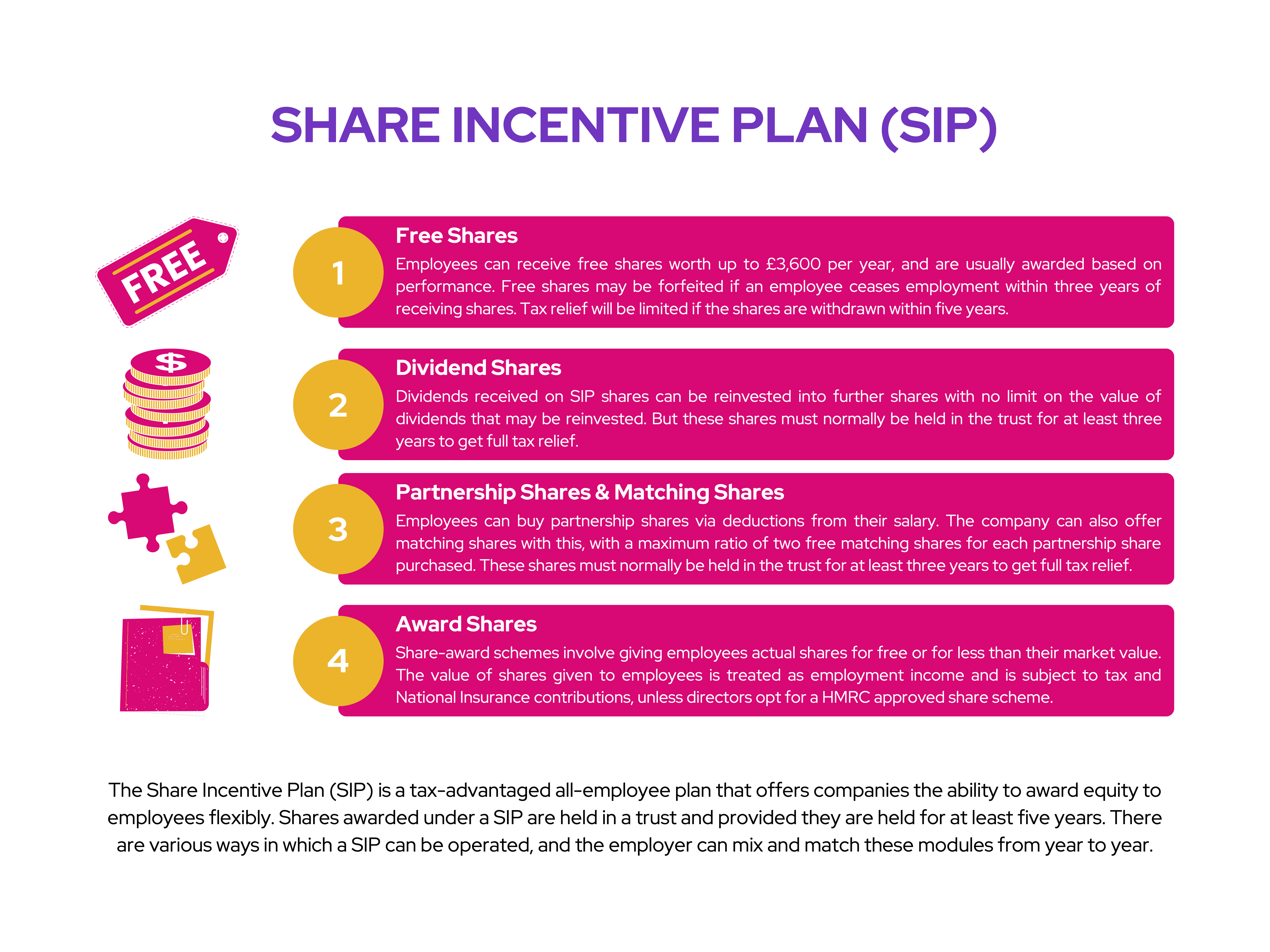

To provide context, there are a few types of shares that can be purchased by directors. Some directors opt to purchase shares via the open market. Having said that, directors also have the option to purchase and receive shares via a share incentive plan (SIP).

A SIP is an employee plan for companies within the UK to flexibly award shares to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

On this occasion of FTSE director dealings, Aviva’s Lambert purchased over a thousand Aviva shares using a proportion of her net director fees. Evidently, this is paid on a quarterly basis with the goal of acquiring Aviva shares on a continuing basis.

Meanwhile, the Kingfisher CCO opted to sell his shares after a dismal report from the company last week. DS Smith’s Group Finance Director also opted to follow in his footsteps by selling a number of his shares. This comes following the director’s decision to exercise the option to redeem almost 80,000 shares that were granted on 15 July 2019 under the company’s Deferred Share Bonus Plan. He subsequently sold approximately 38,000 of those shares. Having said that, the sale of shares conducted were for tax purposes, rather than a decline in confidence. On the other hand, Johnson decided to purchase DS Smith shares direct from his pocket.