Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Rolls-Royce

Rolls-Royce (LSE: RR) a British multinational aerospace and defence holdings company. It is one of the world’s largest maker of aircraft engines, and operates in four different segments. These include civil aerospace, power systems, defence, and new markets. This week, four director dealings were carried out, albeit in small volumes.

- Name: Lee Hsien Yang

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares (Share purchase plan)

- Date of transaction: 7 July 2022

- Amount bought: 1,184 @ £0.83

- Total value: £950.59

- Name: Wendy Mars

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares (Share purchase plan)

- Date of transaction: 7 July 2022

- Amount bought: 2,198 @ £0.83

- Total value: £1,820.38

- Name: Sarah Armstrong

- Position of director: Chief People Officer

- Nature of transaction: Purchase of shares (Share purchase plan)

- Date of transaction: 7 July 2022

- Amount bought: 147 @ £1.02

- Total value: £149.91

- Name: Rob Watson

- Position of director: President (Rolls-Royce Electrical)

- Nature of transaction: Purchase of shares (Share purchase plan)

- Date of transaction: 7 July 2022

- Amount bought: 147 @ £1.02

- Total value: £149.91

Lloyds

Lloyds (LSE: LLOY) is one of Britain’s biggest financial institutions. Its brands include Lloyds itself, Halifax, and Bank of Scotland. It earns the bulk of its revenue from mortgage loans. A large number of director dealings occurred with Lloyds shares this week.

- Name: Joanna Harris

- Position of director: Interim Group Director

- Nature of transaction: Partnership shares and matching shares

- Date of transaction: 11 July 2022

- Amount bought: 296 @ £0.42

- Amount received: 106 @ nil

- Total value: £124.91

- Name: Antonio Lorenzo

- Position of director: Chief Executive Officer (Scottish Widows)

- Nature of transaction: Partnership shares and matching shares

- Date of transaction: 11 July 2022

- Amount bought: 355 @ £0.42

- Amount received: 106 @ nil

- Total value: £149.81

- Name: Janet Pope

- Position of director: Chief of Staff and Group Director of Sustainable Business

- Nature of transaction: Partnership shares and matching shares

- Date of transaction: 11 July 2022

- Amount bought: 296 @ £0.42

- Amount received: 106 @ nil

- Total value: £124.91

- Name: Stephen Shelley

- Position of director: Chief Risk Officer

- Nature of transaction: Partnership shares and matching shares

- Date of transaction: 11 July 2022

- Amount bought: 355 @ £0.42

- Amount received: 106 @ nil

- Total value: £149.81

- Name: Andrew Walton

- Position of director: Group Corporate Affairs Director

- Nature of transaction: Partnership shares and matching shares

- Date of transaction: 11 July 2022

- Amount bought: 71 @ £0.42

- Amount received: 105 @ nil

- Total value: £29.96

Vodafone

Vodafone (LSE: VOD) is is a British multinational telecommunications company. It predominantly operates services in Asia, Africa, Europe, and Oceania. A significant director exercised their options to purchase Vodafone shares this week.

- Name: Nick Read

- Position of director: Chief Executive Officer

- Nature of transaction: Purchase of shares (Vodafone Sharesave Plan)

- Date of transaction: 11 July 2022

- Amount bought: 22,352 @ £1.01

- Total value: £22,499.52

Types of shares in a SIP

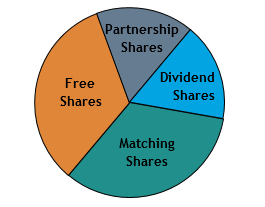

To provide context, there are a few types of shares within a company’s share incentive plan (SIP). A SIP is an employee plan for companies within the UK to flexibly award equity to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this week’s dealings, directors at Rolls-Royce opted to purchase shares under a share purchase plan. This is a form of capital raising by Rolls-Royce which offers shareholders the opportunity to apply for new, additional shares.

As for Lloyds, the director dealings occurred with partnership shares and matching shares. Partnership shares give employees the opportunity to buy shares via deductions from their salary, before tax deductions. But where partnership shares are offered, the company can also offer matching shares, as was the case. This can range up to a maximum ratio of two free matching shares per partnership share purchased. Nonetheless, it’s important to note that matching shares must normally be held in a trust for at least three years, and held for five years in order to receive a full tax relief. However, these shares may be forfeited if an employee withdraws their partnership shares from the trust.

Finally, in the case of Nick Read, the CEO exercised his options to purchase shares under the Vodafone Share Save Plan. These options are exercisable five years from the savings contract start date, provided that the required monthly savings were made.