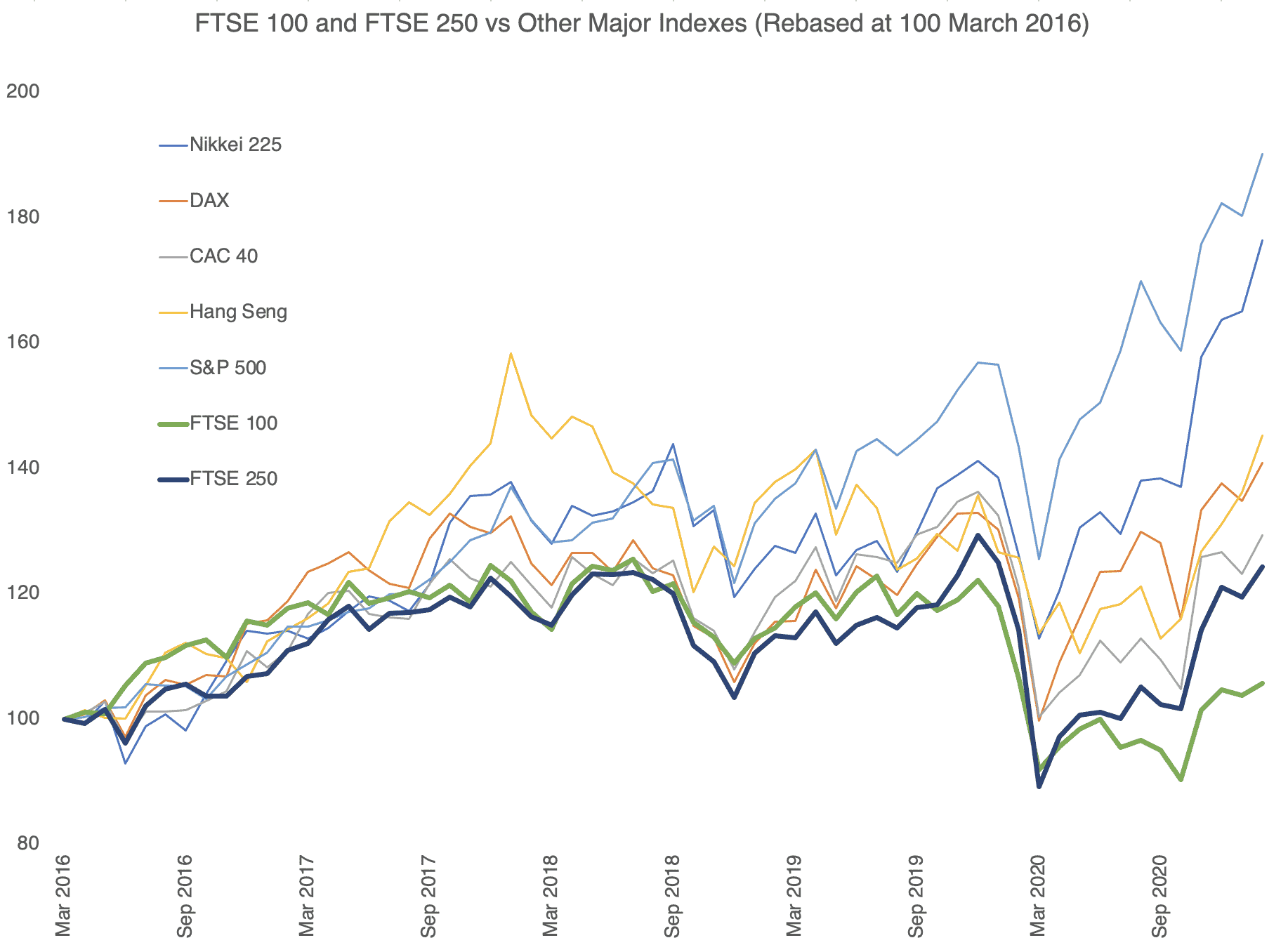

There are good reasons to think that UK stocks might be cheap right now. First, the referendum of 2016 set Brexit in motion. The nature of the UK’s relationship with its biggest trading partner was uncertain from that point forward. Markets do not like uncertainty. Second, the coronavirus pandemic crashed markets around the world, including the UK ones, last year. The FTSE 250 is almost back to its pre-crash highs, but the FTSE 100 is still nearly a 1,000 points away.

Sources: Yahoo Finance and author’s own calculations

The UK has now left the EU with a trade deal. Some details still need to be worked out, particularly for the financial sector, but uncertainty has diminished. The UK is doing an excellent job at vaccinating its population, and a route out of the pandemic is opening up. Yet, the FTSE 100 is below where it was in March 2016. Indexes like the French CAC 40, the German DAX, and the Japanese Nikkei 225 sit higher now than five years ago.

Growth and value

Compared to other indexes, the FTSE 100 looks cheap and potentially primed to recover strongly as the UK transitions back to something approaching normality. And normality is what the FTSE 100 needs. Financial, travel, and oil stocks make up a good chunk of the FTSE 100’s total market capitalisation.

Oil prices collapsed last year, and although they have recovered, climate change concerns still weigh heavily on the share prices of oil majors, like BP and Shell. Financial stocks, like banks and insurers, have been dealing with low-interest rates and squeezed margins for some time. Moreover, insurance claims and default on loans spiked during the crisis, putting pressure on financial stock prices. Travel and tourism collapsed last year, leaving planes grounded and rooms empty, which rocked the prices of airline and hotel stocks.

The S&P 500, compared to the FTSE 100, is dominated by tech and Internet stocks. These saw benefits from people getting more things done online, and people could no longer freely meet or move around. The CAC 40 and the DAX also suffered compared to the US index because they have similar shortcomings as the FTSE 100. Growth stocks have had a wild run since March 2020, taking the S&P 500 to new heights. Value stocks, on the other hand, have suffered and acted like anchors on the price of the CAC 40, DAX, and in particular the FTSE 100.

Cheap British stocks

UK stocks certainly look cheap when compared to other indexes. The FTSE 100 appears to have been trading at a discount to other major indexes since the middle of 2017. The FTSE 250 started underperforming on a relative basis before its larger counterpart, reflecting its greater exposure to a potentially messy Brexit. FTSE 250 companies derive a larger share of their revenue domestically, and a no-deal Brexit would have hit them harder. For the FTSE 250, a positive Brexit result should be positive, as would the UK coming out of lockdown permanently. FTSE 100 companies tend to get the bulk of their revenues internationally. An end to the global pandemic should be a boon for these stocks.

What the UK markets need is a shift away from growth stocks and towards value ones. This will require a change in sentiment, which in turn requires the world economy to heat up.