AstraZeneca (LSE:AZN) isn’t your conventional growth stock. It’s the largest company listed on the FTSE 100 but it’s also a firm that has grand plans to almost double sales over the next five years.

However, the stock fell on Thursday 25 July after the company released its H1 results, despite the science-led biopharma giant raising its guidance.

Let’s explore why.

Strong results, worried market

While investors in biotech and pharma have been very keen on fat-fighting drugs in recent years, AstraZeneca is continuing to generate very impressive growth from its oncology-focused portfolio.

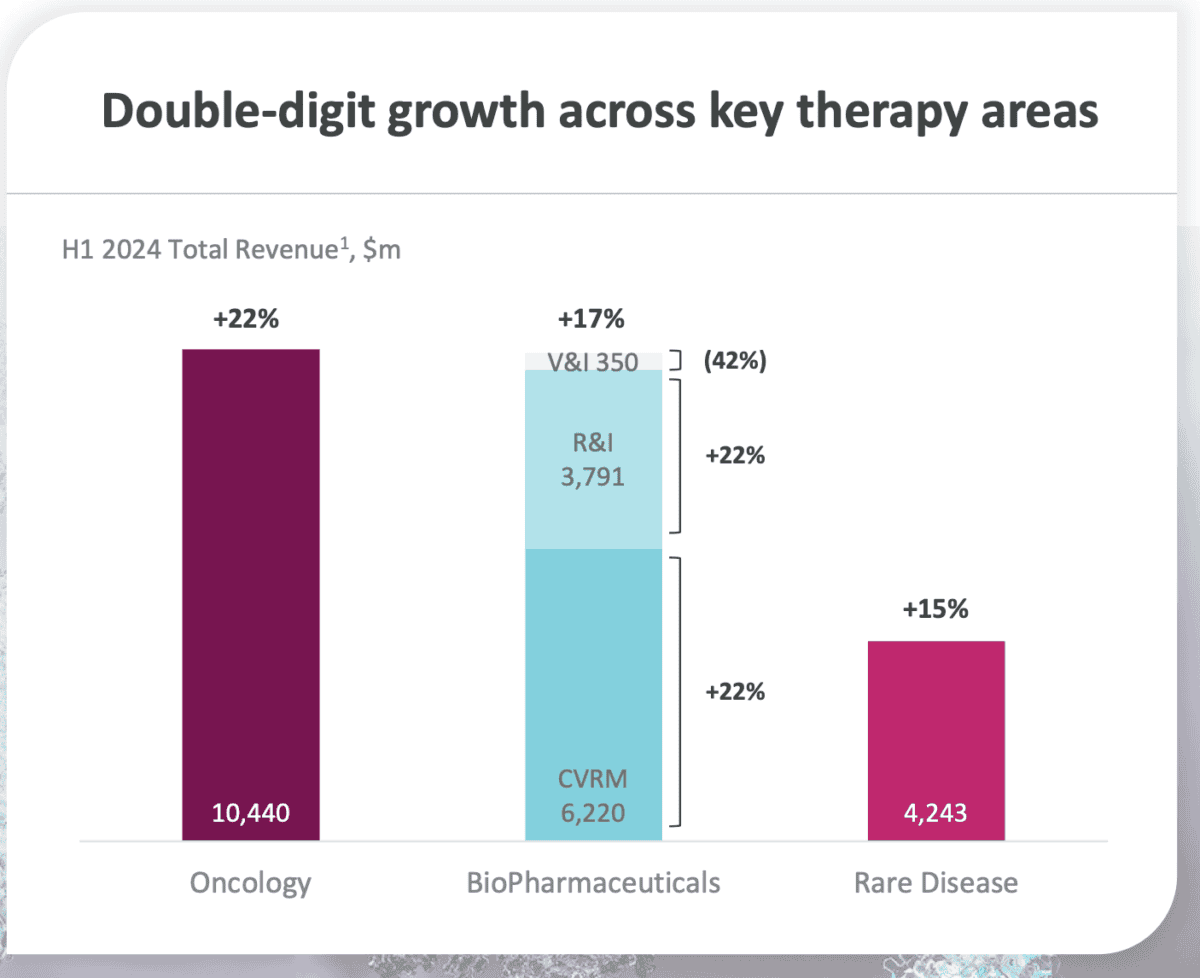

In H1, the company’s revenue rose to $24.6bn, with $12.9bn in the second quarter, driven by a 22% rise in oncology.

Biopharma, which includes CVRM (Cardiovascular, Renal and Metabolism) and R&I (Respiratory & Immunology), saw revenues increase by 17%, and sales from its rare disease unit rose 15%.

Despite the positive revenue growth, AstraZeneca’s shares fell nearly 4% on the day of the announcement.

This decline can be partially attributed to higher-than-expected costs, which led to lower net income margins that fell to 17.2% from 19% in Q1.

The market’s reaction probably also reflects the current bearish sentiment in the equities market as a whole, where even strong earnings reports are scrutinised for any signs of weakness.

Nevertheless, AstraZeneca has upgraded its full-year guidance. It’s now expecting both total revenue and core earnings per share (EPS) to increase by a mid-teens percentage at constant exchange rates.

Serious growth plans

In the H1 report, the company pointed to some of its pipeline and new commercialisation developments that are set to push revenue higher in the years to the end of the decade.

In May, the company set out its plan to achieve $80bn in revenue by 2030, a significant leap from the $45.8bn reported in 2023.

This will be driven by 20 new medicines. CEO Pascal Soriot believes each of these new drugs or new molecular entities can deliver more than $5bn annually in peak-year revenues.

What does all this mean?

AstraZeneca is among the most expensive companies on the FTSE 100. It currently trades around 28.4 times forward earnings, putting it at a significant premium to the index average — around 12 times.

However, we pay a premium for growth. And the company’s price-to-earnings (P/E) ratio falls to 23.3 times in 2025 and 20.4 times in 2026. Remember, this is based on the current price of the stock.

If AstraZeneca is able to deliver on its revenue generation targets, then this level of earnings growth is likely to continue. In short, we could be looking at one of the fastest growing stocks on the index in terms of earnings.

Investors, however, need to decide whether they’re willing to pay a premium for that growth. And with the stock getting cheaper, that decision may have become slightly easier.

I already hold AstraZeneca shares in my pension, but I’m certainly considering buying more.