The FTSE 100 is a market capitalisation weighted index of the UK’s largest 100 (ish) companies. To determine whether or not the FTSE 100 index is worth investing in, I might look at its average return. The FTSE 100 return reported in the media tells an investor what they might have earned from investing in all the stocks in the index in the correct proportions (as determined by their market caps) over whatever the period of interest is.

I would not be happy making an investment decision based solely on a single return measure. Of course, past performance is not a guarantee of future performance. For example, a good return over the last three months should not be assumed to hold for the next three years. But also, the FTSE 100 index return on its own obscures a lot about what it is.

FTSE 100 industries

The FTSE 100 is made up of a hundred or so stocks. Each one can be categorised into a different industry. About 20% of those companies are financials. Consumer discretionary and industrials account for 19% each. So, almost 60% of the stocks in the index are from just three sectors. Consumer staples and basic materials companies make up another 10% each. Therefore, almost 80% of all FTSE 100 companies come from just five sectors.

Stocks in the FTSE 100 broken down into industry membership

| Industry | Number of stocks |

| Basic Materials | 10 |

| Construction and Materials | 1 |

| Consumer Discretionary | 19 |

| Consumer Staples | 10 |

| Energy | 2 |

| Financials | 20 |

| Health Care | 4 |

| Industrials | 19 |

| Real Estate | 4 |

| Technology | 4 |

| Telecommunications | 2 |

| Utilities | 4 |

Source: London Stock Exchange

I think I’m getting somewhere now. If I were to say that the FTSE 100 was worth investing in, as a whole, then I must be pretty confident about the prospects of companies in the basic materials, consumer discretionary, consumer staples, financials, and industrial sectors.

Industry returns

I find that looking at averages for the sectors’ return over various time periods and comparing them to the average for the index is illuminating. The FTSE 100 is a market capitalisation weighted index. Average returns in this article are found by taking a simple arithmetic average of individual returns. The returns approximate the results of buying one share in each company.

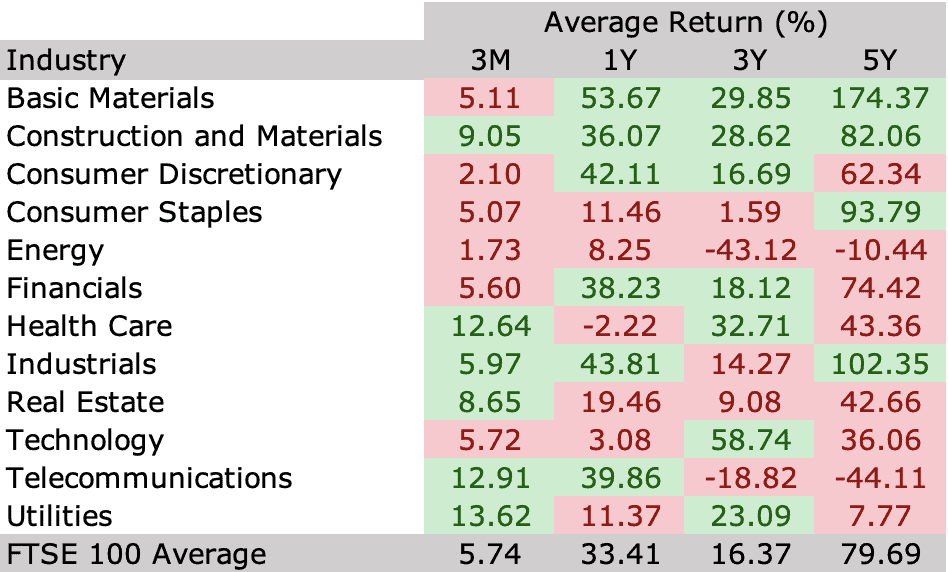

Average returns of FTSE 100 sectors over various time periods – green shading represents better than average returns, red shading represents worsethan average returns.

Source: London Stock Exchange

Breaking down returns by industry reveals the energy industry has underperformed the index as a whole over the past three months, one year, and three and five years. In contrast, the construction and materials industry has consistently outperformed. But, it’s worth mentioning there are two energy stocks in the FTSE 100 and just one constructions and materials stock.

All industries have positive average returns over the last three months, including the five industries that account for almost 80% of the stocks in the index. Now, I know that past returns do not guarantee future returns. But, I can consider whether the economic environment that produced those returns is likely to persist in the long term, particularly for the five big industries.

That’s a better way to answer the question of whether the FTSE 100 is worth investing in, rather than looking at a single return measure.