Buying Manchester United (NYSE:MANU) stock means owning a slice of one of the most popular and successful sports teams in the world. Right now, the stock price sits around $13.50, well below its all-time high (reached in August 2018) of $27.70. I think that price looks cheap, and that it might be a good time to buy Manchester United shares.

Empty stadiums

The nature of the Covid-19 crisis meant that Manchester United’s share price has been unable to recover from March’s stock market crash. Football has been played in empty stadiums, hurting matchday revenue. Also, broadcasting income took a hit due to postponement and rescheduling of fixtures. Today a quarterly loss was reported. But, the Covid-19 crisis is temporary. Fixtures are going ahead as planned now, and fans will return to stadiums.

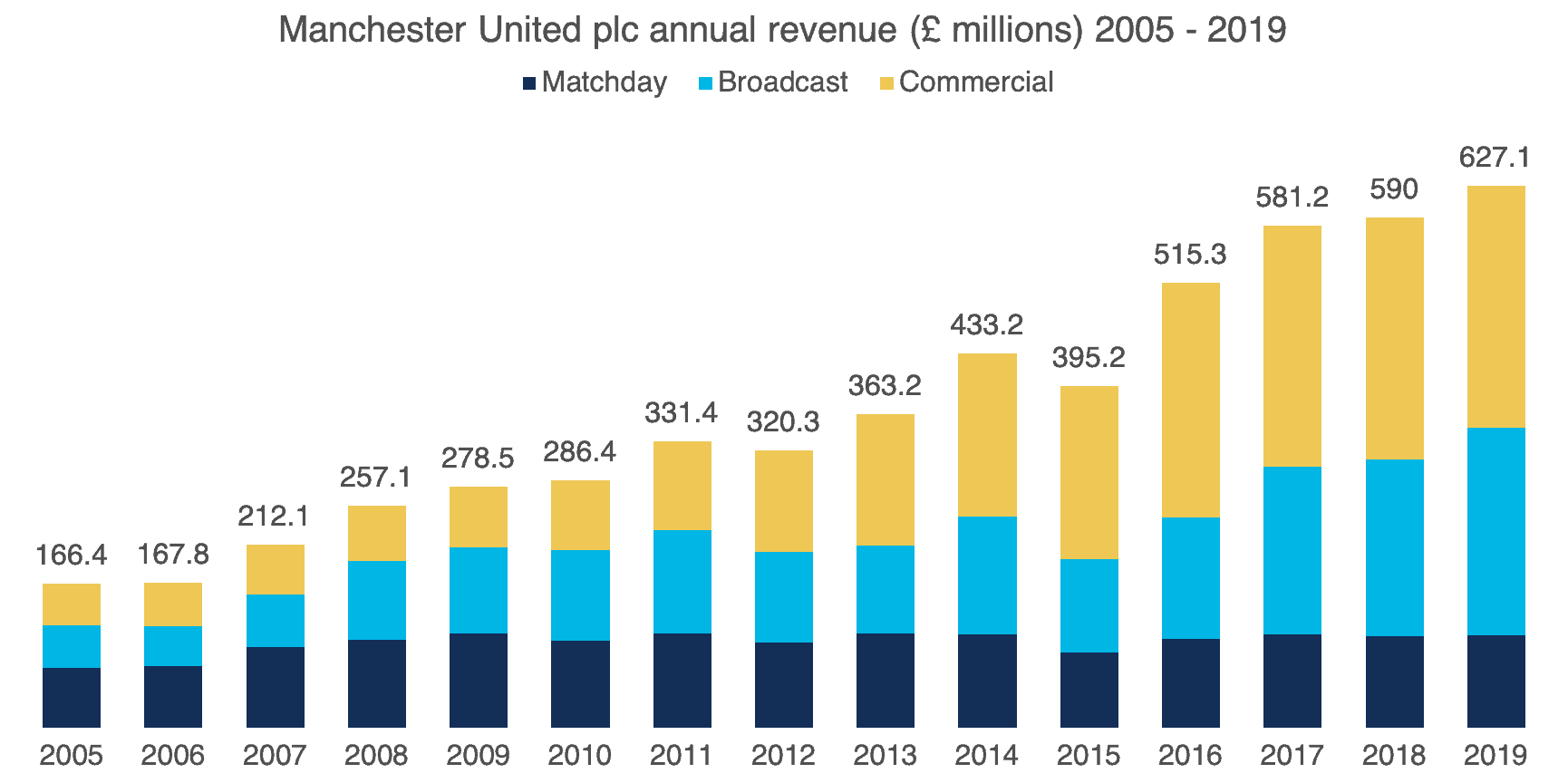

I think the Manchester United share price does not reflect its future, which should be solid, if it’s anything like the past. Manchester United grew its total revenue from £166.4m in 2005, to £627.1 in 2019: that’s a 277% increase. A lot of that gain came from the explosion in broadcasting and commercial revenue, which grew by 398% and 474% respectively, over the same period.

Source: Manchester United plc accounts

There is a limit to the size of a football stadium, and how much a club can charge for seats, pies, and pints. However, there are far fewer restrictions on a global fanbase. Manchester United has built a global following, and, as seen by the impressive commercial and broadcasting revenue growth, managed to monetize it successfully.

According to the Deloitte Football Money League, Manchester United was the richest club in world football in 2016 and 2017. Despite lacklustre (judged by historical standards) on-the-pitch performance since 2013, the club is still a commercial powerhouse. Also, its fanbase appears to be growing. The number of Instagram and Twitter followers of Manchester United has doubled over the last four years. Facebook likes have been flat. The former platforms have a younger demographic than the latter. That suggests older fans are staying loyal and younger ones are being recruited.

Manchester United stock potential

If Manchester United were to finish mid-table and never qualify for European competition again consistently, their days as a commercial force might be numbered. But I don’t think that will happen. The club has qualified for the Champions League this season, has several academy players that are developing well, and still has the financial clout and draw to sign the best players if it wants to. As stated previously, there are no signs of the fanbase shrinking. Matchday revenues will flood in again soon.

I think the increased competition and extension of broadcasting rights will boost Manchester United’s revenues higher in the future. Amazon has already broadcast Premier League matches. Netflix has a content budget of around $6bn. Football makes excellent content, being an unscripted drama, and the entry of the big tech firms into the competition for rights to broadcast it is a boon for revenue.

The potential of Manchester United’s women team – which plays in the top flight in England – cannot be overlooked. Women’s football is growing in popularity and matchday, commercial, and broadcasting revenue could all get a boost from this source.

Investors seem to be ignoring a return to normality, and the potential for growth with this stock. That’s why I think Manchester United shares look cheap.