Finding FTSE 100 stocks that offer the combination of growth, value, and dividends isn’t easy. Most stocks generating any meaningful growth trade at high valuations. Meanwhile, many value stocks have recently cut their dividends.

However, there are a few stocks that currently offer investors this powerful combination. Here’s a look at one such FTSE 100 stock I’d be happy to buy today.

A top FTSE 100 company

Legal & General Group (LSE: LGEN) is a FTSE 100 financial services company that operates across a broad range of areas, including insurance, investment management, and retirement solutions.

The company is the UK’s largest life insurer and is also one of Europe’s leading asset managers with assets of over £1.2trn. On the retirement solutions side of the business, Retirement Institutional (LGRI), the company helps organisations ‘de-risk’ their defined-benefit pension schemes.

Growth potential

“Legal & General remains well placed to deliver strong, attractive growth and returns in our core markets” – 16 June trading update.

What I like about Legal & General is that it has multiple growth drivers.

One is in its retirement solutions division. Last year, UK ‘bulk annuity’ deals – which take defined-benefit pension schemes off the balance sheets of corporate clients in exchange for a premium – hit a record high of £42bn, up from £25bn in 2018.

This market has plenty more room for growth. According to consultant Hymans Robertson, there’s a potential £1trn+ of defined-benefit pension liabilities looking to approach the market in the future. Early signs are we are set for a “bumper decade” for risk transfer activity.

As a key player in the bulk annuity market, Legal & General looks well-placed to benefit. Recently, the FTSE 100 company advised it’s actively quoting on a pipeline of deals worth more than £25bn.

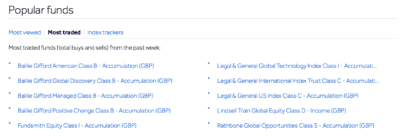

Another source of growth is its investment management business (LGIM). Legal & General was quick to launch a range of passively-managed index funds, and these have been a real hit with UK investors. Just look at this recent list of the most-traded funds on the Hargreaves Lansdown platform.

Three of the 10 funds are Legal & General funds, which is very encouraging. In 2020, LGIM achieved external net flows of £11.2bn to the end of May, which is a solid performance. As investors continue to invest for the future, and global stock markets rise over time, Legal & General should benefit.

Overall, I see plenty of potential for growth here in the medium- to long-term.

10 consecutive dividend increases

I also see plenty of potential for dividends. Legal & General has been a dividend star over the last decade, notching up 10 consecutive increases. It’s one of the few FTSE 100 companies that hasn’t suspended or cancelled its dividend this year.

Looking ahead, I expect further dividend increases (unless regulators step in and prevent insurers from paying out dividends during the coronavirus pandemic, as they did with the banks).

Currently, the trailing yield is about 8%, which is certainly attractive in the current low-interest-rate environment.

Bargain valuation

Analysts currently expect Legal & General to generate earnings per share of 29.9p for FY2020. That puts the FTSE 100 stock on a forward-looking P/E ratio of 7.4. I see that valuation as very attractive.

All things considered, there’s a lot to like about Legal & General right now, in my view. I see it as a ‘buy’ at current prices.