Only a few years ago, Prudential (LSE: PRU) was the FTSE 100 insurance stock everyone wanted to own. Given its exposure to Asia – where demand for financial services products, such as insurance and savings accounts, is on the rise – investors were more than happy to pay a premium for the stock.

Recently, however, investor sentiment towards Prudential has deteriorated significantly. With growth in Asia slowing due to the ongoing US-China trade war and political protests continuing in Hong Kong (a major insurance hub), investors have dumped the stock, leaving it trading at a rock-bottom valuation.

Near-term challenges

As a long-term investor who doesn’t mind going against the herd, this shift in sentiment towards Prudential has got me interested. Sure, the insurer faces some challenges in the near term. While the trade war continues and demonstrations continue in Hong Kong, profit growth could be muted. Yet from a long-term perspective, the growth story here remains very attractive, in my view.

Long-term growth story

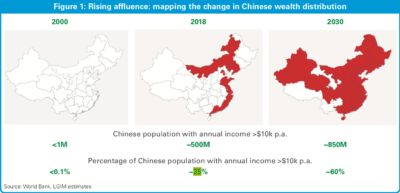

You see, over the next decade, wealth across China and other countries in Asia is predicted to rise significantly. According to research from Legal & General, the percentage of China’s population with an income of $10,000 or more per year is set to rise to 60% by 2030, up from 35% in 2018, and less than 0.1% in 2000. What this means is that we could be looking at another 350m people or so earning this level of income over the next decade. To put that number in perspective, the population of the US last year was 327m.

Source: Legal & General

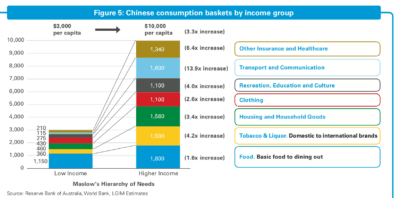

Now look what happens to consumption when income rises to $10,000 per year. As the graphic below shows, spending on insurance and healthcare soars as income increases to that level.

Source: Legal & General

This suggests the growth potential for Prudential – which has been operating in China for more than 20 years and is looking to expand its presence in the country – over the next decade, is substantial.

Rock-bottom valuation

For the year ending 31 December 2020, City analysts expect Prudential to generate earnings per share of 162.8p. This means that at the current share price of 1313p, the forward-looking P/E ratio is just 8.1. For a company with so much growth potential, I see that valuation as an absolute steal. It’s worth noting that two years ago, the forward P/E was near 14.

I’ll also point out that with the shares out of favour, there’s a healthy dividend yield on offer. For the year ending 31 December, analysts expect a payout of 42p per share, which equates to a prospective yield of 3.2% (up from around 2.5% when the shares were in demand).

Looking at these metrics, I believe Prudential shares offer a lot of value right now. As such, I’ve just bought more of them for my ISA. I think in 10 years’ time, trade wars and Hong Kong protests will be a distant memory.