After a couple of months of market calmness, trade war-related volatility has returned with a vengeance. US President Donald Trump said on Thursday that he will impose a fresh 10% tariff on another $300bn of Chinese goods and, as a result, the FTSE 100 fell a huge 2.3% on Friday – its worst day of 2019 so far.

When the stock market gets hit like that it’s certainly frustrating. All the gains you’ve been building up over a number of months can be wiped out instantly. However, at the same time, this kind of volatility can also throw up attractive buying opportunities. With that in mind, here’s a look at one FTSE 100 stock I’m looking to buy more of while markets are focused on trade wars.

Prudential

Financial services group Prudential (LSE:PRU) seems to get hammered every time trade tariffs on China are mentioned. On Friday, its share price fell a whopping 6% and it’s down another few percent this morning. The reason? The group generated around 38% of its operating profit from Asia last year and has substantial exposure to China. Any mention of a slowdown in China and investors run for the hills.

Long-term growth story

But stop and think about the long-term story for a minute. Wealth across China (and Asia) has risen at a rapid rate in recent years and is likely to continue growing at a formidable pace in the years and decades ahead, irrespective of any trade tariffs that are placed on the country in the short term.

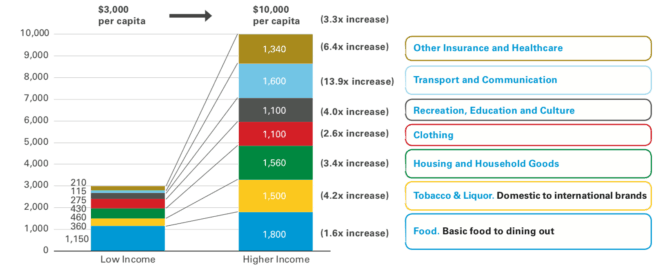

In 2000, just 0.1% of the Chinese population had an income of $10,000 or more per year. However, by 2018, that figure had climbed to around 35%. By 2030, Legal & General estimates that 60% of the population could be in this income bracket. Now, look what this could mean for consumption in China.

Chinese consumption baskets by income group

Source: Legal & General

This excellent graphic shows as an individual’s income rises, spending tends to shift from basic needs such as housing and food, towards things such as education, travel, communication, healthcare, and insurance.

What this means is as wealth across China continues to rise in the years ahead, demand for life insurance, as well as other financial products such as savings accounts and investment products, is likely to increase substantially.

That’s why I like the long-term story associated with Prudential. Given that the company has been operating in China for nearly 20 years now and is looking to expand its presence in the country, I see it as well placed to benefit from this rising income trend. Add in the group’s exposure to other fast-growing countries across Asia, such as Vietnam, the Philippines, and India, and there’s a compelling growth story.

Valuation and yield

With Prudential’s share price under the 1,600p level, I see considerable value in the stock. Analysts are currently expecting the group to generate earnings per share of 157.1p this year, which means the P/E ratio is just 10. The dividend yield also looks attractive at present. Analysts are forecasting a payout of 52.4p per share for FY2019, which equates to a prospective yield of 3.3%.

Overall, I see considerable long-term investment potential in Prudential shares. When the shares get dumped on the back of trade war-related market volatility, I see a buying opportunity.