No-one wants to pay more tax than they have to. I’m sure there are plenty of people out there, though, who feel particularly hard done by. I’m talking about buy-to-let investors of course.

The UK’s landlords are bearing the brunt of the government’s sustained failure to solve the housing crisis. Rather than rectifying disjointed homebuilding policy to boost the number of new homes, politicians are simply seeking to free up properties by forcing buy-to-let owners to sell up (or avoid the sector in the first place) by taking the scythe to investment returns.

One way in which they’ve done this is by giving the taxman plenty more punch. From hiking stamp duty on second homes, to axing wear and tear allowance and phasing out tax relief for mortgage interest, the subsequent impact on investors’ wallets has been staggering.

But there’s a way to get around this: by choosing to own and operate your property portfolio through a limited company.

Good company?

And recent data shows that more and more of us are saving a fortune in lost tax by doing just that.

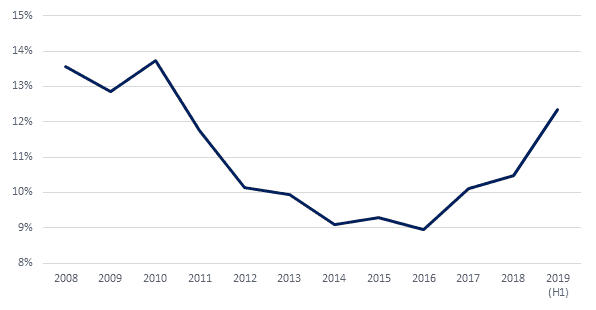

According to Hamptons International, some 12% of rental homes in Britain are let out by a company landlord, the highest level for eight years. This is also up from 9% in 2015, just before those tax changes on mortgage interest for non-company landlords were introduced a year later.

Percentage of UK homes let by company landlords

Source: Hamptons International

But is this trick really a lifeboat to rescue returns for buy-to-let investors? Not in my book. Landlords still have to pay considerably more to the taxman than they did just a few years ago, even if they choose to do their business via a company. And with a flurry of other extra costs coming in, like those associated with the Tenant Fees Act, as well as the rising amounts of new regulation associated with rental property ownership, I for one am happy to avoid this particular investment arena.

Boxing clever

Those seeking to grab a slice of the British property sector would be much better off getting exposure via the stock market, in my opinion. And one great way of doing so would be by buying Tritax Big Box (LSE: BBOX), even if it is a bit of a departure from traditional buy-to-let investing.

This FTSE 250 firm provides so-called big-box spaces from which blue-chip retailers and fast-moving consumer goods companies warehouse and distribute their products. Demand for such space is red hot right now as businesses switch increasingly to automation to drive down costs and sell increasing volumes of their wares through online shopping.

And when it comes to the latter point, Tritax Big Box certainly appears to have a lot to look forward to, certainly if a new report from Retail Economics is anything to go by. The researcher estimates that more than half of all retail sales — 53%, to be exact — will be generated online within the next decade. This compares to around a fifth at the present time.

The stage looks set, then, for trading to thrive at Tritax. It’s already delivered a total shareholder return of 82% over the past five years, and there’s clearly plenty of reason for it to continue delivering knockout gains long into the future.