A high dividend yield can sometimes be a sign investors are worried. In a classic trade-off between risk and reward, they might be demanding a generous payout to compensate for the increased perceived risk of owning the stock.

That’s why to try and sort the value traps from the genuine bargains, it’s important to take a closer look before investing in any high-yielding stocks.

With this in mind, I’ve been studying AEW UK REIT (LSE:AEWU). Based on amounts paid over the past 12 months, the real estate investment trust (REIT) is currently (30 January) offering an amazing yield of 7.5%. And in my opinion, I think it’s an excellent passive income opportunity to consider.

Here’s why.

A different business model

Like all REITs, to preserve certain tax advantages, AEW must return at least 90% of its relevant profit to shareholders each year by way of a dividend. And since early 2016, it’s been remarkably consistent with a payout of 2p each quarter.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

The trust has an unusual approach in that it buys commercial property leases it says are mis-priced and soon to expire. At 30 September 2025, its average weighted unexpired lease term before break clauses kick in was just 3.95 years. Buying short leases gives it an opportunity to negotiate rent increases relatively quickly after purchase.

And this approach appears to be working. Since early 2021, it’s outperformed the MSCI/AREF UK PFI Balanced Funds Quarterly Index, its chosen benchmark, by nearly 7%.

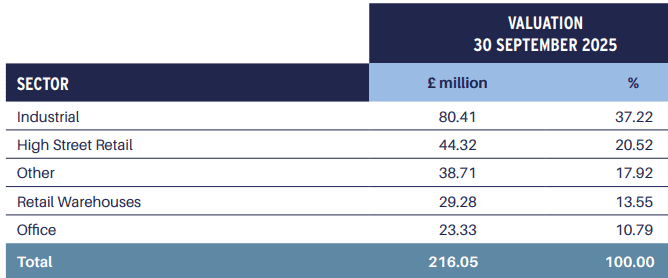

Unusually for the sector, the trust focuses on smaller commercial premises (typically less than £15m). And it has a good mix of industrial, retail, and office properties in its portfolio.

Some challenges

But there are a couple of things that could impact its future dividend. One issue that needs to be taken into account is the trust’s debt facility, which is due to be renewed in May 2027. Given its relatively low loan to gross asset value – it was 25.2% at 30 September — extending this shouldn’t be too much of a problem.

But at the moment, it’s paying fixed interest of 2.959% per annum. Given the higher interest rate environment in which we find ourselves, I suspect it will have to pay more post-renewal. For the year ended 31 March 2025, finance costs accounted for 10.5% of net rental income, so there appears to be plenty of headroom here.

Also, the trust’s focus on smaller properties means its tenants are mainly small- and medium-sized enterprises. These might not be as financially robust as the clients of other REITs who have blue-chip companies occupying their premises. The risk of bad debts is therefore higher.

My view

Despite these concerns, latest figures show that the trust enjoys a 93.68% occupancy level. In addition, its rental yield’s in excess of 8%. It also has a good track record in selling leases significantly above what it paid for them.

On balance, although dividends can never be guaranteed, I think AEW’s looks reasonably secure for now. And with a yield of 7.5%, passive income investors are likely to believe there’s an opportunity to consider here. And in my opinion, they’d be right.