UK shares had a great 2025 but there are still plenty of cheap stocks to explore. And with an unusual combination of an above-average dividend yield and low earnings multiple, MP Evans Group (LSE:MPE) could be one of the cheapest. Yet, I suspect very few investors have heard of the group.

Let’s take a closer look.

Who?

I think the Indonesian sustainable palm oil producer could be one of the unsung heroes of the UK stock market.

It doesn’t do anything particularly exciting and is unlikely to be impacted in a major way by the emergence of artificial intelligence. It’s as far away from a tech stock as you can possibly get. After all, making money from crop production is as old as the hills themselves. And yet shareholders have been rewarded with capital growth and a strong dividend over the past few years.

But can this continue?

Although the group’s yet to finalise its results for 2025, we know that it harvested 4% fewer fresh fruit bunches than in 2024, and produced 3% less palm oil. However, realised crude palm oil prices were 5% higher and the group was able to sell its palm kernels for 42% more.

For the 12 months to 30 June, earnings per share was 156.4p. This means the stock presently trades on a very attractive 8.4 times historic earnings. This is despite its share price rising 24% since January 2025 and nearly doubling over the past five years. To the frustration of the group’s directors, its earnings multiple’s lower than its international peers.

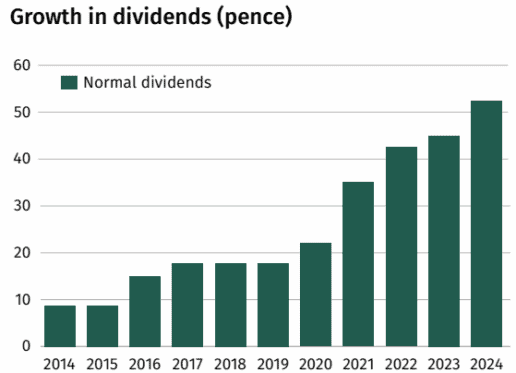

And then there’s the dividend. Based on amounts paid over the past 12 months, the stock’s yielding a very respectable 4.3%. In cash terms, its 2024 payout was 138% higher than in 2020.

An unsung hero?

However, farming’s a tough business. The group’s crop yield is heavily influenced by the weather. Indeed, one of its estates was flooded in December, although there was minimal impact on production. And there’s the twin threats of disease and pests.

Also, ethical investors have turned their backs on the sector due to the palm oil industry earning itself a reputation for causing environmental damage. This means there’s potentially a smaller pool of investors available to help push the group’s share price higher. MP Evans seeks to address these concerns by operating in a sustainable manner and working in partnership with local producers and co-ops.

Despite these challenges, the group’s shares look undervalued to me. And the three analysts covering the stock appear to agree. They have 12-month share price targets of 1,717p, 1,570p, and 1,472p, all comfortably above its current (30 January) price of 1,310p.

Demand for palm oil’s expected to rise at over 4% a year until 2035. And certified sustainable oil is a key driver of this. The group continues to plant new areas and intends to enter into more partnerships with smallholders. As a bit of a side hustle, it also has a 40% interest in a Malaysian property development company, which owns 195 hectares of land.

On balance, I think MP Evans is a stock to consider for both its growth and income potential.